Inflation components such as shelter and insurance continue to decline at a very slow pace. GDP forecasts are far from weak and financial conditions have loosened to 2022 levels, removing the urgency to ease.

In the U.S., softer inflation print in April confirmed that while the disinflation trend was disrupted in 1Q, it was not derailed. Meanwhile, there are early signs that the labor market is cooling. If incoming economic data continues to point to a similar moderation, the earliest the Fed can cut rates would be September. However, market expectations of a September cut on the back of April’s inflation data could risk being too optimistic. This is because inflation components such as shelter and insurance continue to decline at a very slow pace. GDP forecasts are far from weak and financial conditions have loosened to 2022 levels, removing the urgency to ease. The recent softening in growth data (e.g. retail sales, industrial production) offer some good news, as it points to a potential weakening of inflationary pressure. But while the next move is most likely a cut and not a hike, the risk remains that the rate cut cycle will be shallower and slower than markets currently expect.

Europe and the UK have made significant progress, quelling headline inflation as supply-side shocks eased. European economies are more sensitive to rates than the U.S., facilitating earlier cuts for the ECB and Bank of England (BoE). The ECB has already delivered the first cut in June, and the BoE will likely cut 1-2 times in the second half of this year. Sticky inflation in the euro-area meant that the ECB is not ready to commit to a set rate path in the months ahead. The BoE, on the other hand, will likely remain relatively hawkish until services inflation and wage growth decline more meaningfully. While a divergence from the Fed might pressure domestic currencies, the impact on core inflation is small enough to allow central banks to remain focused on domestic conditions.

On the contrary, the BoJ’s decisions are more conditioned on the Fed, as the unfavorable rate differential has had a significant impact on the JPY. The BoJ will have to delicately balance policy to minimize the domestic growth impact from higher rates or a weaker JPY. We expect the BoJ to continue hiking amid further evidence of sustained inflation, but the pace will likely be gradual.

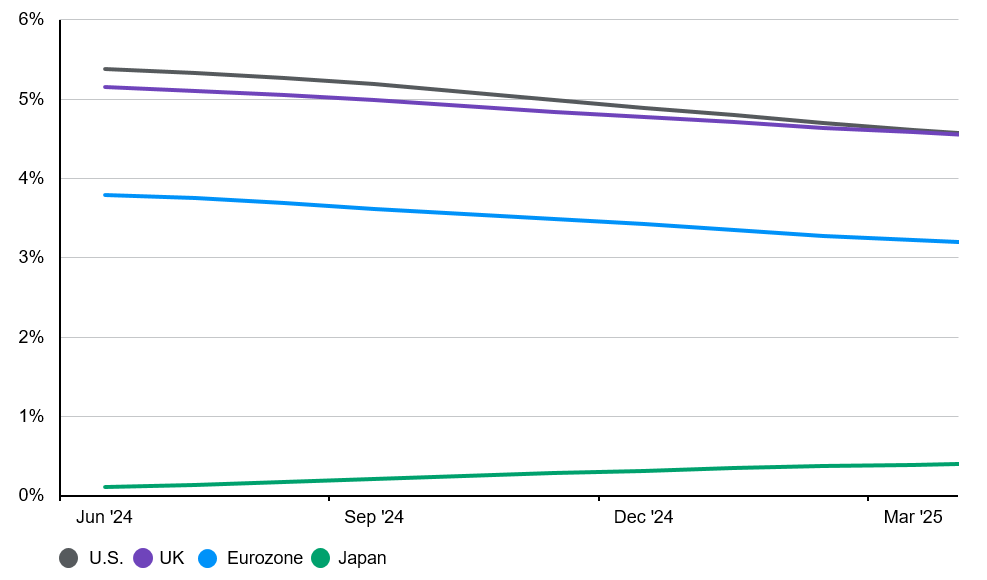

Due to stronger growth and stickier inflation, the Fed will likely start cutting later than the ECB and BoE

Exhibit 3: Market expectations* for central bank policy rates

Source: Bank of England, Bank of Japan, European Central Bank, U.S. Federal Reserve, J.P. Morgan Asset Management; (Right) Bloomberg L.P. *Expectations are based on overnight index swap rates. Past performance is not a reliable indicator of current and future results.

Guide to the Markets – Asia. Data reflect most recently available as of 06/06/24.