Investors might consider diversifying their portfolios with companies or products that would be less impacted by protectionist measures from the U.S. or Europe.

In our 2024 Year Ahead, we discussed the risks of a U.S. recession, a sharp correction in the Chinese real estate sector, and the impact of geopolitics and elections. While the U.S. and Chinese economies are always on our radar, let’s focus on event risks and possible solutions for investors.

Amid a busy calendar of elections around the world in 1H 2024, the U.S. presidential and congressional elections remain a key focus. For APAC investors, the next administration’s policy on trade is probably a primary concern. Indeed, the Biden administration has recently introduced or raised tariffs on Chinese exports of electric vehicles, solar panels and medical equipment. Former U.S. President Donald Trump has warned of raising import tariffs on a broader number of trade partners. Investors might consider diversifying their portfolios with companies or products that would be less impacted by protectionist measures from the U.S. or Europe. This could include Asian companies focusing on serving domestic consumers or products that are less likely to be produced locally, such as labor-intensive manufactured goods. India and ASEAN markets are also less likely to be targeted.

Beyond elections, geopolitics in the Middle East has raised concerns over energy supply disruptions. While there is sufficient spare capacity in global oil production to limit supply shocks, investors could protect themselves from a surge in energy prices by investing in the energy sector and sectors with lower energy intensity, such as consumer services.

As we approach the summer months, record temperatures in many parts of the northern hemisphere and extreme weather conditions, such as floods and droughts, should not come as a surprise given the experience of the past few years. One question is whether this could lead to disruptions in supply chains or other economic activities. For example, low water levels due to droughts could limit the carrying capacity of waterways or the amount of water available to cool power stations. Even if the impact of these events on production and the global economy is short-lived, a globally diversified allocation can help, especially if multinational companies are looking to diversify their supply chains to address these issues. Alternative assets, such as infrastructure and transportation, can also provide a useful hedge against higher inflation given that their revenue is typically linked to consumer prices.

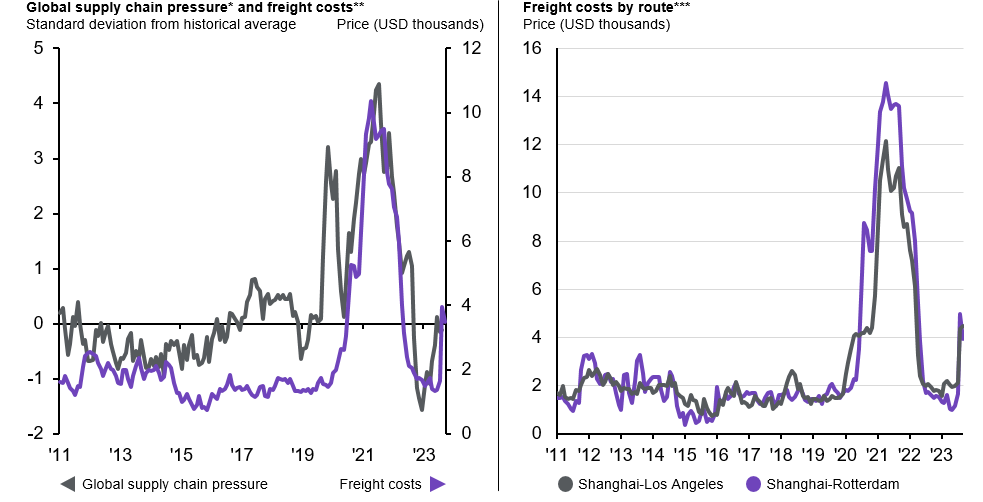

Global supply chain disrupted by the pandemic, the attacks in the Red Sea

Exhibit 10: Global supply chains

Source: Applied Macroeconomics and Econometrics Center, Bloomberg, FactSet, J.P. Morgan Asset Management. *The Global Supply Chain Pressure Index tracks the state of global supply chains using data from the transportation and manufacturing sectors. **Freight costs are represented by the Drewry World Container Index, which tracks the freight costs of a 40-foot long container via eight major East-West trade routes, including spot rates and short-term contract rates. *** Shanghai-Rotterdam and Shanghai-Los Angeles represent the two trade routes in the index with the highest volume and thus highest weighting.

Guide to the Markets – Asia. Data reflect most recently available as of 31/03/24.

Conclusion

It is usually difficult to solve two problems with one solution. The convergence of global growth and the start of the rate cut cycle around the world should provide a constructive backdrop for investors. Meanwhile, geopolitics and event risks, such as extreme climate conditions, can introduce volatility. For investors to take advantage of the former and protect against the latter, a well-diversified portfolio is key to solving these two tasks.