We believe the rate cut cycle is merely delayed rather than derailed, and should begin later this year. This should continue to support the case for staying invested in fixed income.

At the start of the year, markets were expecting a total of 175 basis points of interest rate cuts. Rate cut expectations have been trimmed significantly since then amid continued evidence of U.S. economic resilience and inflation that has remained sticky. As a result, longer duration bonds suffered as the “higher-for-longer” narrative took center stage once again. High yield corporate bonds, on the other hand, did quite well. Asia and U.S. high yield returned 9.6% and 2.3%, respectively, reflecting the resilient outlook in both regions. Modest refinancing needs as well as high yield’s lower sensitivity to interest rates helped support performance.

Recent speeches by Fed officials acknowledged the lack of progress on inflation and the desire to maintain the current level of policy rates for longer. However, we believe the rate cut cycle is merely delayed rather than derailed, and should begin later this year. This should continue to support the case for staying invested in fixed income. In particular, government bonds and high-quality corporate debt have the added benefit of managing portfolios from recession risks.

While we acknowledge that there is limited scope for corporate credit spreads to tighten further, history suggests spreads can remain tight for a while. We expect yields to stabilize in the near term and for spreads to remain tight given healthy credit fundamentals and strong economic activity.

In short, not only does fixed income present opportunities for attractive income, but also there is potential for capital gains as we possibly head into a monetary easing cycle in the quarters ahead. Locking in yields at current levels seems attractive, even if bond volatility is likely to remain elevated for some time.

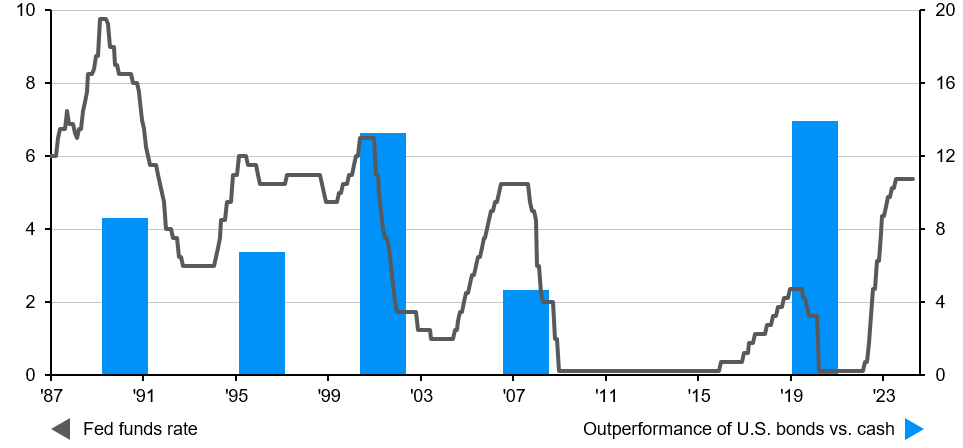

Admittedly, with short-term interest rates at cycle peaks, holding cash or fixed deposits could look tempting. However, sitting on large cash allocations entails significant reinvestment risk, as riskier assets tend to outperform cash consistently after the peak of a rate hike cycle. As illustrated in the following chart, the line tracks the evolution of interest rates over time while the bars show the subsequent 2-year performance of the U.S. Aggregate bond index relative to cash from the peak of each hiking cycle. In every instance within our sample period, bonds outperformed cash.

Furthermore, as inflation will likely remain higher for some time, holding too much cash could present challenges in the face of higher prices. Over the last 30 years, risk assets have handily outperformed inflation, while cash lagged behind higher prices. If history is any guide, investors should embrace high-quality fixed income and be mindful to avoid the cash trap.

Given our view that the U.S. rate cut cycle is merely delayed and not derailed, bonds will likely outperform cash in the next 6-12 months

Exhibit 6: U.S. bonds vs. cash after interest rate peaks

% (LHS); % points, two-year relative performance (RHS)

Source: Bloomberg, Bloomberg Barclays, Federal Reserve, ICE BofA, J.P. Morgan Asset Management. Cash refers to ICE BofA 3-Month Treasury Bill Index; U.S. bonds: Bloomberg Barclays US Aggregate Index.

Guide to the Markets – Europe. Data reflect most recently available as of 30/04/24.

Cash mentioned in this session proxied by U.S. short-term treasuries.