China’s economic momentum moderated notably in March, and the latest April activity data suggest further slowing in domestic demand, with both retail sales and fixed investments disappointing expectations.

Economic growth in Asia has picked up in recent months, with upside 1Q 2024 gross domestic product (GDP) surprises seen in China, Hong Kong, Indonesia and Korea. Asian manufacturing purchasing managers’ indices have also improved year-to-date. This is in line with the recovery in Asia’s goods exports, supported by recovering activity in key trade partners, both, intra-regionally and globally. The recovery also reflects the normalization in the trade of global goods post pandemic, led by artificial intelligence (AI)-related investment demand for chips and other tech exports from Korea and Taiwan, as well as better-than-expected China exports so far this year. As for services, with the exception of China, activity in Asia has recently reaccelerated.

Inflation for the first few months of 2024 has generally been soft, amid tepid wage trends. China and Thailand continue to report core and headline consumer price index (CPI) inflation that is close to zero on a year-over-year basis, with declining food prices being an important deflationary force in both markets. This suggests Asian central banks will be able to cut rates to support their economies, if necessary, but most central banks are happy to stay put rather than rush into cutting rates (see more about our take on Asian central banks on the following pages).

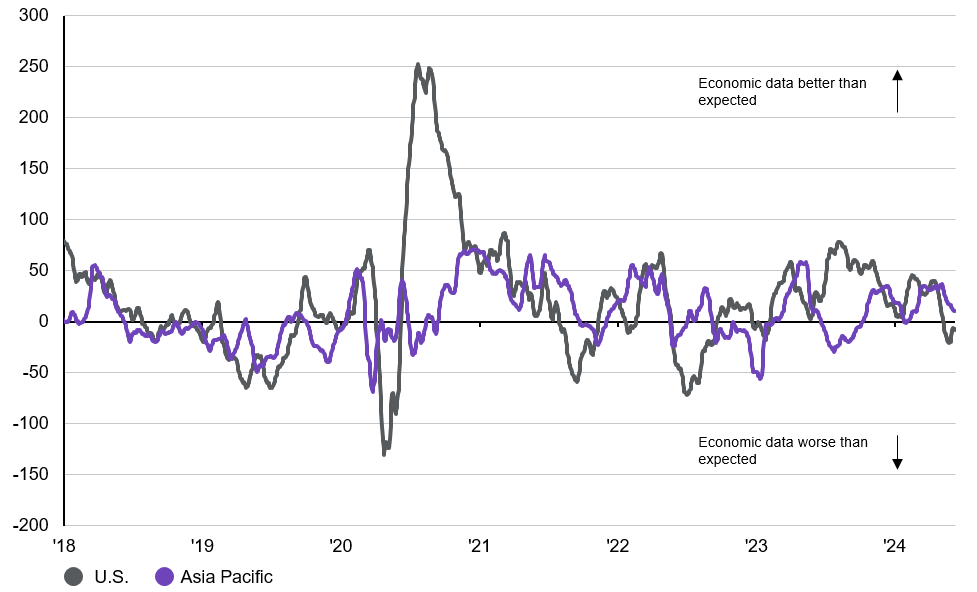

China’s economic activity continues to diverge, with production growth outpacing consumption. Within fixed investments, manufacturing investment continues to outperform, driven by the government’s industrial policy to develop new industries, such as advanced manufacturing, renewable energy and electric vehicles, while real estate investment remains sluggish. In particular, following stronger-than-expected January and February activity, China’s economic momentum moderated notably in March, and the latest April activity data suggest further slowing in domestic demand, with both retail sales and fixed investments disappointing expectations. In turn, this has dragged Asia’s Citi Economic Surprise Index in April.

China’s income confidence index is also hovering at low levels due to weak labor markets, which could be negative for demand recovery and reflation. The latest Politburo meeting reiterated efforts to stabilize the economy by issuing ultra-long government bonds to fund further stimulus. The announcement of the third Party Plenum to be held in July has also boosted hopes of a turnaround as policymakers seek to address investor concerns. The real estate market and private investments will require more time to recover, but ongoing policy support should be able to help limit the downside risks to growth. What is key is whether the relatively strong performance in April can attract more international flows into the Chinese markets.

Growth in Asia has picked up in recent months but retreated slightly as China’s domestic demand conditions weakened

Exhibit 2: Citi Economic Surprise Indices

Index, 7-day moving average

Source: Citi, J.P. Morgan Asset Management.

Data reflects most recently available as of 07/06/24.