The glide toward slower growth in the U.S. has taken longer than expected. This has contributed to stickier inflation and could potentially delay policy easing by the Federal Reserve (Fed). An orderly moderation in growth remains our base case scenario.

Year-to-date, the global economy has performed better than expected. With some central banks having the room to ease monetary policy, this growth streak could continue into 2025. While there is always a risk that shocks could derail growth, central banks have the tools to deal with these surprises.

The glide toward slower growth in the U.S. has taken longer than expected. This has contributed to stickier inflation and could potentially delay policy easing by the Federal Reserve (Fed). An orderly moderation in growth remains our base case scenario. Retail sales have started to soften since the start of the year, while consumers remain well supported by a robust labor market. However, declining savings and a rise in borrowing costs could start to taper consumption. This should underpin a gradual moderation in inflation, even though progress in taming price rises has been disappointing over the past six months. Corporate capital expenditure remains steady despite higher funding costs, especially for larger companies.

While we continue to monitor the potential impact of commercial real estate on regional banks, prompt and decisive action by the Fed, Treasury Department and the Federal Deposit Insurance Corporation to manage the fallout from the Silicon Valley Bank turmoil in March 2023 showed that regulators are aware of the importance of maintaining bond market liquidity to ensure the smooth functioning of the financial system. As a result, we believe a severe downturn or systemic financial stress is a low probability event. Overall, we expect the U.S. economy to expand broadly in line with its trend growth going into 2025.

Europe’s manufacturing sector is gradually recovering as evidenced by bottoming manufacturing purchasing managers’ indices. The European Central Bank (ECB) cutting rates earlier this month could also provide some welcome relief to both households and businesses. Fiscal policy could potentially play a more active role in boosting demand, whether in facilitating the green energy transition or boosting defense spending amid the Russia-Ukraine conflict. Compared with the U.S., European economies arguably offer more room for upside surprises.

The case for Japan’s economic growth is more subdued. Accelerating wage growth is offset by imported inflation triggered by a weak Japanese yen (JPY). This creates a dilemma for the Bank of Japan (BoJ)—raise rates and potentially dampen growth or maintain policy accommodation and keep import prices high via a weaker JPY. Exports are benefiting from an upswing in the Asian export cycle and currency competitiveness. Solid corporate earnings growth should support corporate investments, as well as create room for wages to rise.

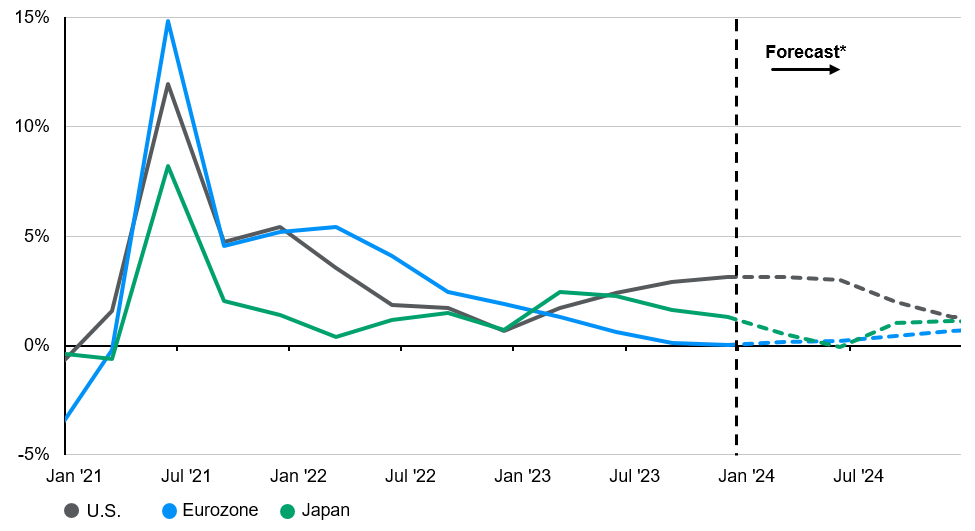

Some convergence in economic growth within developed economies

Exhibit 1: Developed markets quarterly real GDP growth forecast

Year-over-year change