Alternative assets such as real estate, infrastructure and real assets, can make an important contribution to a consistent income stream, as well as provide an inflation hedge.

Despite the potential delay of a Fed rate cut, a resilient U.S. economy has driven global equities higher in the first half of 2024. Fixed income has underperformed our expectations, particularly government bonds and investment-grade corporate debt.

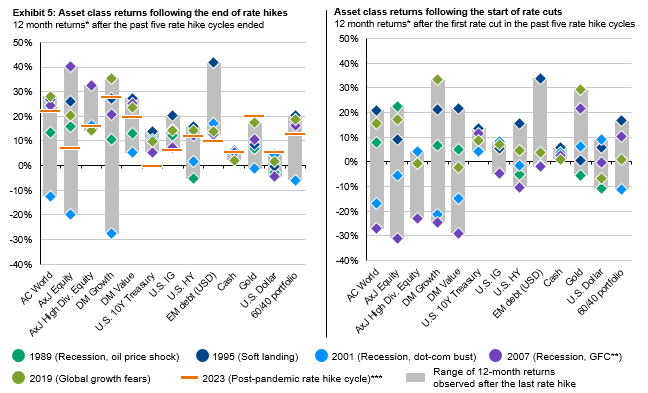

Given our view that the U.S. rate cut cycle is merely delayed and not derailed, we maintain our view that both stocks and bonds should outperform cash in the next 6-12 months.

Investors may consider a two-stage approach to allocating between equities and fixed income.

In the first stage, on the back of robust macroeconomic data from the U.S. that are broadly consistent with trend growth, investors might choose to focus more of their allocation to global equities. Sticky inflation suggests companies will still have the pricing power necessary to protect their profit margins. Fixed income remains an important part of return generation, but performance will likely be driven more by the income component than duration. This favors high-yield corporate bonds.

The second stage is characterized by inflation data showing consistent moderation, hence allowing central banks to start cutting rates. Europe and the UK are arguably approaching this stage. This would call for an increase in allocation of bonds versus stocks. Within fixed income, investors can focus on government debt and high-quality corporate bonds given the possibility of slower growth. For equities, lower yields could drive a valuation re-rating of growth and tech stocks, while weaker growth momentum could present a more challenging backdrop for small cap companies and cyclically sensitive sectors.

The prospect of Fed rate cuts should also weaken the USD. While Asia and emerging markets have performed reasonably well during the recent period of USD strength, a weaker dollar could provide further tailwinds, encouraging more capital flows into these markets, both within equities and fixed income.

As discussed on the following pages, alternative assets such as real estate, infrastructure and real assets, can make an important contribution to a consistent income stream, as well as provide an inflation hedge. These assets present further diversification benefits in portfolio construction.

Rate cuts and economic soft landing should be positive for stocks and bonds