The current consensus is that China’s rally has been driven by a combination of reasonable valuation, light positioning by both domestic and international investors and more consistent effort by the government to support the economy.

We have seen several themes playing out in Asian markets in 2024. The first is the tech rally, where Asia has benefited from spillover interest in U.S. tech stocks. Earnings growth estimates for this sector remain strong, and as long as investor focus stays on AI globally, we remain constructive on the Asian tech sector. We believe this theme has room to run despite high valuations.

The second theme has been the interest in Chinese and Indian stock markets. Indian equities significantly outperformed their Chinese counterparts in 2023 (MSCI India +21.3% vs. MSCI China -11.0%). The relative performance of the two economies can explain this difference. Weak economic momentum, cautious consumer sentiment and the challenges facing the real estate sector had put downward pressure on Chinese equities. India, on the other hand, saw more supportive factors, including positive earnings growth outlook and prospects of further investments to develop its manufacturing sector.

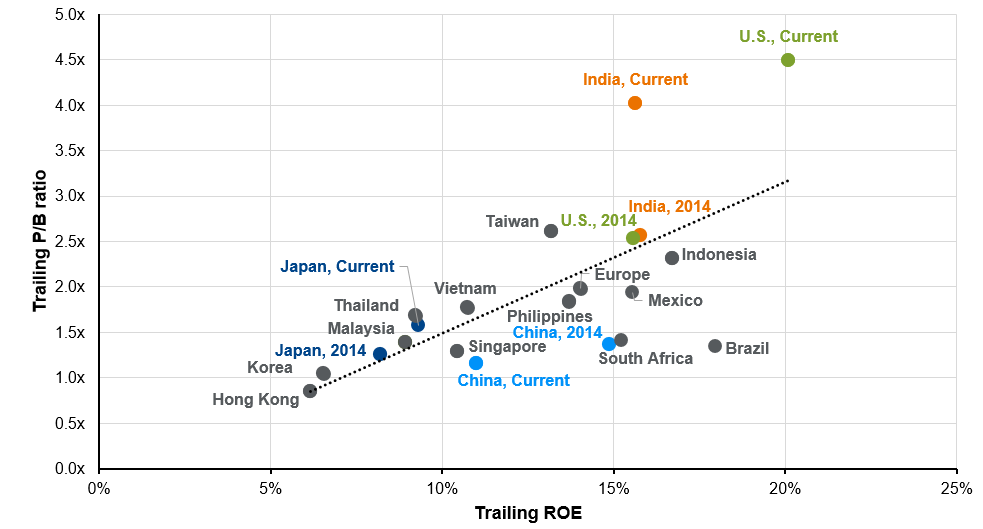

This trend has reversed in 2024, with China outperforming (MSCI China up 13.6% vs. MSCI India’s 3.6% over the past three months). The current consensus is that China’s rally has been driven by a combination of reasonable valuation, light positioning by both domestic and international investors and more consistent effort by the government to support the economy. By contrast, valuation of Indian equities is elevated and sentiment on the ground took a hit after the surprise election results. Although current earnings momentum remains positive, the margin of error is narrower.

The real estate sector and general business sentiment hold the key for China’s rally to continue into 2H 2024. The upcoming third Party Plenum should focus on long-term development objectives rather than policies to address the economic downturn. This should solidify markets’ expectations on those sectors with more policy tailwinds, such as renewable energy, advanced manufacturing and AI. For India, long-term prospects remain attractive given its track record in delivering consistent economic and earnings performance over the long term.

India’s longer-term prospects remain attractive, despite higher valuations

Exhibit 9: Return-on-equity and price-to-book ratio for different markets

Last 12 months

Source: FactSet, MSCI, Standard & Poor's, J.P. Morgan Asset Management. Numbers are based on MSCI Indices except for the U.S. which is based on the S&P 500 Index. ROE = return-on-equity and P/B = price-to-book.

Guide to Investing in Asia. Data are as of 30/04/24.