An extended business cycle, improving earnings outlook and better relative valuations in some of the unloved parts of the market provide a constructive outlook for U.S. equites.

The U.S. equity market has notched up successive all-time highs this year after shrugging off a brief period of consolidation in April. A robust economic backdrop has supported the earnings recovery while driving expectations that earnings will continue to expand in the quarters ahead, lifting investor sentiment.

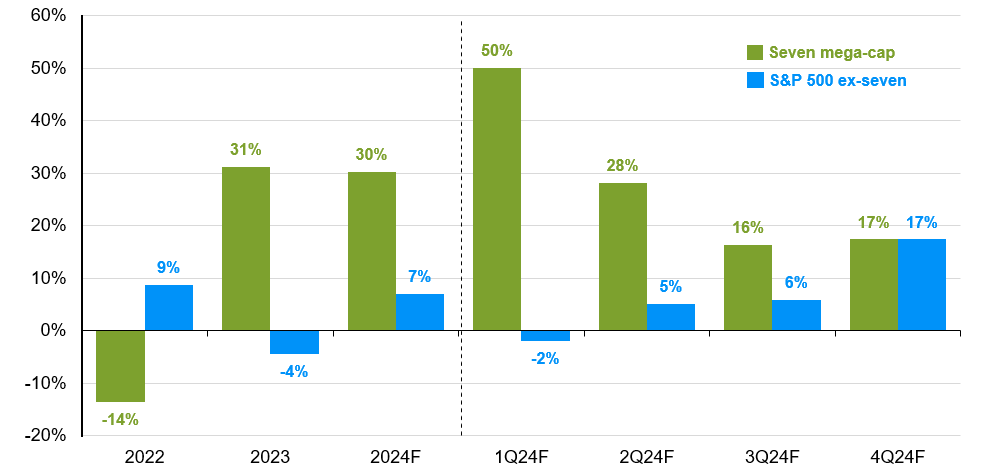

Growth stocks and the seven mega-cap names still account for the bulk of this year’s rally. Year-to-date, these seven companies have returned 20%, compared to 6% for the rest of the market. However, a broader participation of sectors and stocks in the equity rally is expected. The earnings outlook for the market, excluding the big seven names, is expected to improve through the year. 1Q 2024 earnings will likely mark this year’s low, with earnings growth expected to improve on both a sequential quarterly and year-over-year basis.

A more inclusive market rally can be fueled by still respectable nominal GDP growth in the U.S. and a better balance between real growth and inflation. This should help companies maintain or defend margins through a combination of steady sales and easing input costs.

This constructive outlook for U.S. equities is balanced against a recognition that the market may not be considered cheap. The rally in U.S. equities has resulted in rising valuations, with the forward price-to-earnings (P/E) multiple of the S&P 500 well above its long-run average at around 20.5x. However, headline valuation numbers mask the dispersion within the index. The top 10 companies by market weight are trading at 28.2x P/E, while the other 490 companies are trading at 17.4x. A decline in bond yields may allow for some re-rating of longer-duration sectors such as growth stocks.

An extended business cycle, improving earnings outlook and better relative valuations in some of the unloved parts of the market provide a constructive outlook for U.S. equites. There are still risks to the outlook, which creates a preference for quality, but this can be found across both growth and value styles, as well as in large and mid-cap companies.

A broader earnings recovery should support the U.S. equity market over the rest of 2024

Exhibit 7: U.S. S&P 500 earnings growth

EPS, year-over-year

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management. Earnings estimates for 2024 are forecasts based on consensus analyst expectations. Data are as of 30/05/24.