The “around 5%” growth target signals a pro-growth policy stance, supported by monetary and fiscal policies.

In brief

- China’s “Two Sessions” of 2024 started in Beijing on March 5 and will close on March 11, and a key agenda is to set the economic growth target and policy priorities by Chinese Premier Li Qiang.

- The annual growth target has been set once again at around 5%, and inflation target is set at 3%, unchanged from last year.

- Fiscal policies are likely to play a key role in supporting growth, and monetary policy should stay accommodative.

- Chinese stock market rebounded from the lows after market interventions in February, and we remain constructive about long-term opportunities, buoyed by attractive valuation.

China’s “Two Sessions” of 2024, comprising the National People's Congress (NPC) and the Chinese People's Political Consultative Conference, convened in Beijing this week. All eyes were on the policy targets and priorities announced in Government Work Report on March 5 by Premier Li Qiang amid subdued economic momentum and weak market confidence.

Overall, the announcements were in line with market expectations. The “around 5%” growth target signals a pro-growth policy stance, supported by monetary and fiscal policies. Moreover, new initiatives are proposed in areas of “in with the new” consumer goods, manufacturing equipment upgrade, and real estate policy, which may point to incremental stimulus to stabilize aggregate demand and boost confidence.

Growth and inflation targets are essential in expectation management

The annual gross domestic product (GDP) growth target serves as a guideline for policymakers and helps to align expectations among businesses and investors. In order to allow for some policy flexibility, the target continues to be set as a range, at "around 5%" for 2024.

Inflation target this year is becoming equally as important as the 5% growth target, amid ongoing deflationary risk. Since 2015, the government has always set its consumer price index (CPI) inflation target at 3%, which usually served as an upper bound reference to gauge monetary policy stance. Even though Chinese CPI inflation fell to +0.2% for 2023 and contracted by 0.8% in December, the inflation target is once again set at 3% for 2024. If the trend of deflation continues into the first half of 2024, we believe there will be greater urgency for more aggressive monetary measures, including quantitative easing.

More fiscal and monetary boost needed to hit 5%

To achieve the 5% growth target, monetary and fiscal policies are likely to be stepped up. Against the backdrop of weak confidence and deflation risks, lower rates or reserve requirement ratio are probably not enough. Fiscal tools will need to do more of the heavy lifting to boost aggregate demand.

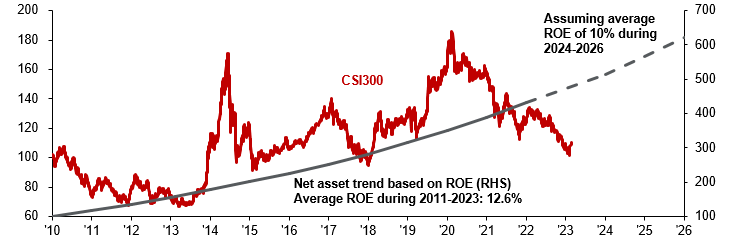

Exhibit 1: Chinese stock market performance

Indexed, Dec. 31, 2010 level set as 100

Source: Wind, J.P. Morgan Asset Management. ROE means return on equity.

Guide to the Markets – China. Data reflect most recently available as of 01/03/24.

In late 2023, the government expanded fiscal policy further, raising its budget deficit target to 3.8% of GDP, and issuing CNY 1trillion of special central government bonds and CNY 1.5trillion of local government refinancing bonds. At the NPC meeting, the 2024 budget deficit ratio was set lower at 3%, but this was the same as the original 2023 target (before revision).

Starting this year, the government plans to issue ultra-long special government bonds for the next few years outside the current deficit target, specifically for the implementation of major strategic development and security initiatives. The total size of this issuance will be around CNY 1trillion in 2024, which will likely bring the actual deficit beyond 3%.

Policy measures remain stable

Besides traditional investment projects, new priorities this year also include direct subsidies to consumers and manufacturers. Right before the two sessions, the State Council published guidelines to promote "large-scale equipment upgrade" and to encourage consumers to replace old home appliances and cars with new ones. These actions may be supported by expanded fiscal deficits.

In order to support fiscal stimulus, monetary condition needs to remain accommodative. In early February, People's Bank of China (PBoC) cut required reserve ratio and five-year loan prime rate each by 25bps. Further cuts are expected this year to bring down interest rate to boost credit expansion.

Major challenges remain in the property sector. Although purchase restrictions have largely been removed and mortgage rates reduced in 2023, demand remained weak across the country. Although the government proposed larger investment into public housing projects, questions remain in terms of scale and impact when local governments are under revenue pressures. As a result, financial support from the PBoC is essential. At the end of 2023, the PBoC reactivated its pledged supplementary loans to facilitate shantytown renovation projects by local governments, and the total scale may be expanded to CNY 1trillion to 1.5trillion in 2024, if the property market weakness continues.

Investment implications

Using CSI300 as the benchmark, Chinese domestic stock market declined 11.4% in 2023. This trend continued in January ahead of the Lunar New Year holiday. As shown in Exhibit 1, the market has been trading deeply below the long-term trend of net asset that is consistent with historical return on equities, reflecting the excessively pessimistic sentiment among investors.

Since February 5, state intervention and national fund purchase supported market rebound from the lows. With policy signals from the two sessions that were in line with market expectations, the market will focus on the next catalysts, such as the pace, magnitude and effectiveness of ongoing support to the real estate sector, to improve buyers’ confidence as well as to boost private sector investment recovery.

Based on current valuation and growth prospects, we remain constructive in Chinese stocks in selective sectors. After recent market correction, growth sectors such as technology hardware, consumer discretionary and healthcare are trading at attractive valuations for long-term investors. Structural themes such as technology self-sufficiency and developing the digital economy should continue to gain traction. In the short term, large-caps with foreseeable earnings growth and dividend income opportunities may attract local investors, who are still waiting to see more concrete signs of economic and earnings recovery.