The FOMC statement indicated a shift in sentiment regarding the outlook since January, noting that “uncertainty around the economic outlook has increased”.

The Federal Open Market Committee (FOMC) voted to maintain the Federal funds rate at a target range of 4.25%-4.50%. The statement indicated a shift in sentiment regarding the outlook since January, noting that “uncertainty around the economic outlook has increased”. Moreover, the committee removed the language that risk to its inflation and employment goals were “roughly in balance”, suggesting members may be more sensitive to slowing growth than price pressures.

Elsewhere, the committee announced it will slow the pace of balance sheet runoff, reducing the monthly redemption cap on Treasury securities from $25bn to $5bn, while maintaining the $35bn cap on agency mortgage-backed securities (MBS). The wind down of QT is likely in anticipation of potential liquidity risks around the debt ceiling “X-date”, estimated to be some time over the summer.

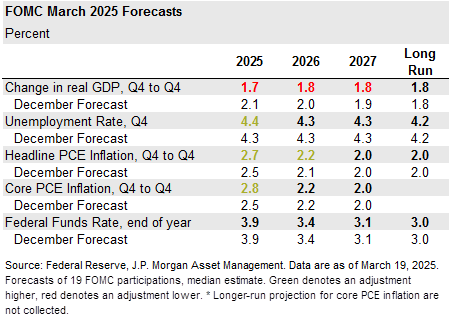

Updates to the Summary of Economic Projections (SEP) signal rising near term stagflation risks:

- Growth was downgraded from 2.1% to 1.7% this year and adjusted modestly lower in 2026 and 2027.

- The unemployment rate was nudged higher by 0.1% to 4.4% in 2025.

- Both headline and core PCE were raised by 0.2% and 0.3% to 2.7% and 2.8%, respectively, for 2025. Further out, forecasts were essentially unchanged suggesting tariff related policy implications on prices will be a transitory inflation shock.

- No changes were made to the median interest rate forecast.

During the press conference, Chairman Powell acknowledged the uncertainty in Washington and that tariffs—those implemented and proposed—are expected to contribute to upward pressure on near term inflation but took some solace in that longer run inflation expectations have remained well anchored. On recession risk, Powell mentioned that it’s not the committee’s base case, but the risk has risen albeit from a low level at the start of the year.

Both stocks and bonds rallied, likely reflecting the Fed’s consistent bias for rate cuts despite upside risks to inflation. For investors, the outlook for growth and inflation remains highly uncertain. Therefore, remaining well diversified across high quality bonds, reasonably priced stocks, international assets, and alternatives seems most appropriate.