Advance your portfolio with

an award-winning ETF manager

Demystifying the ETF marketplace

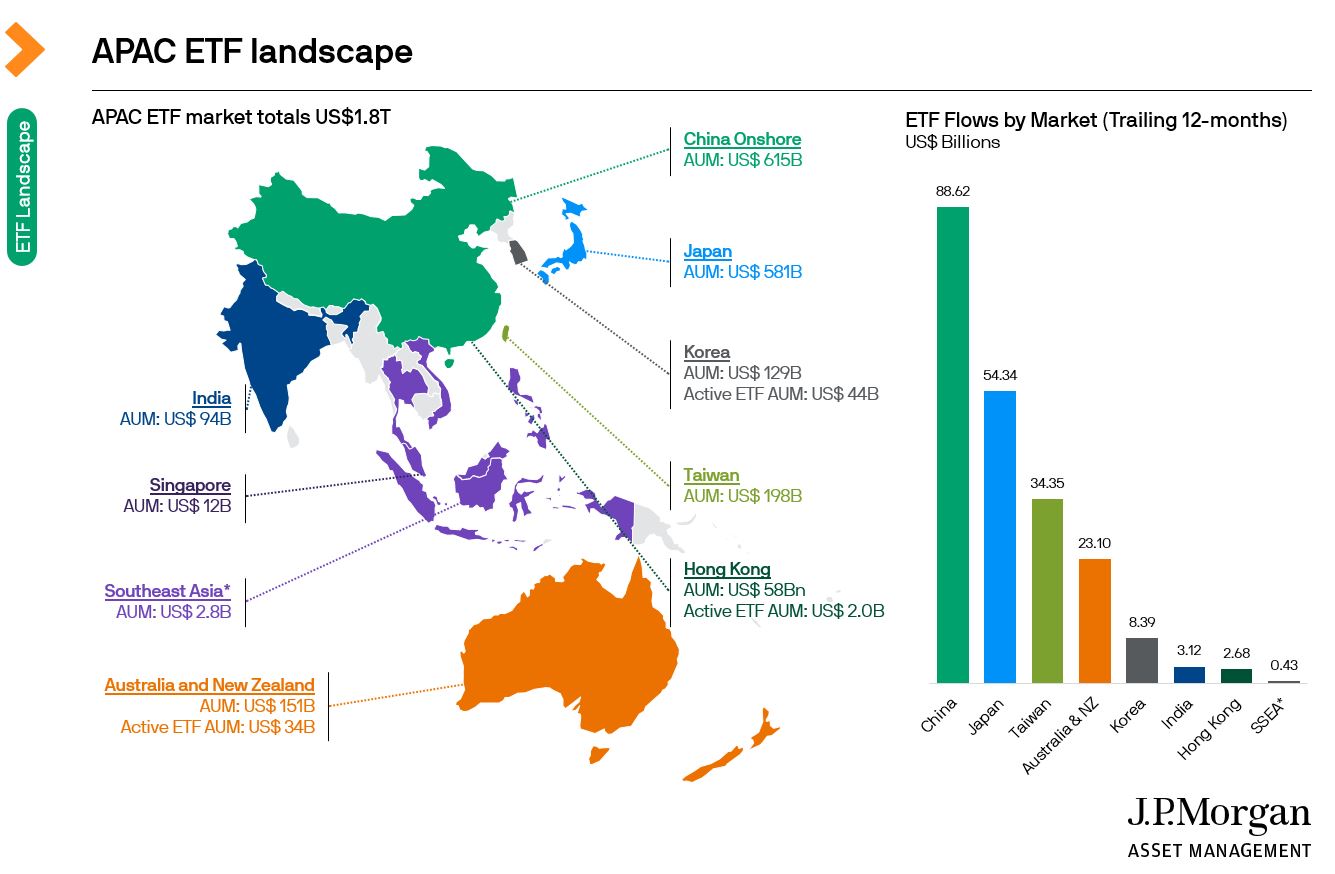

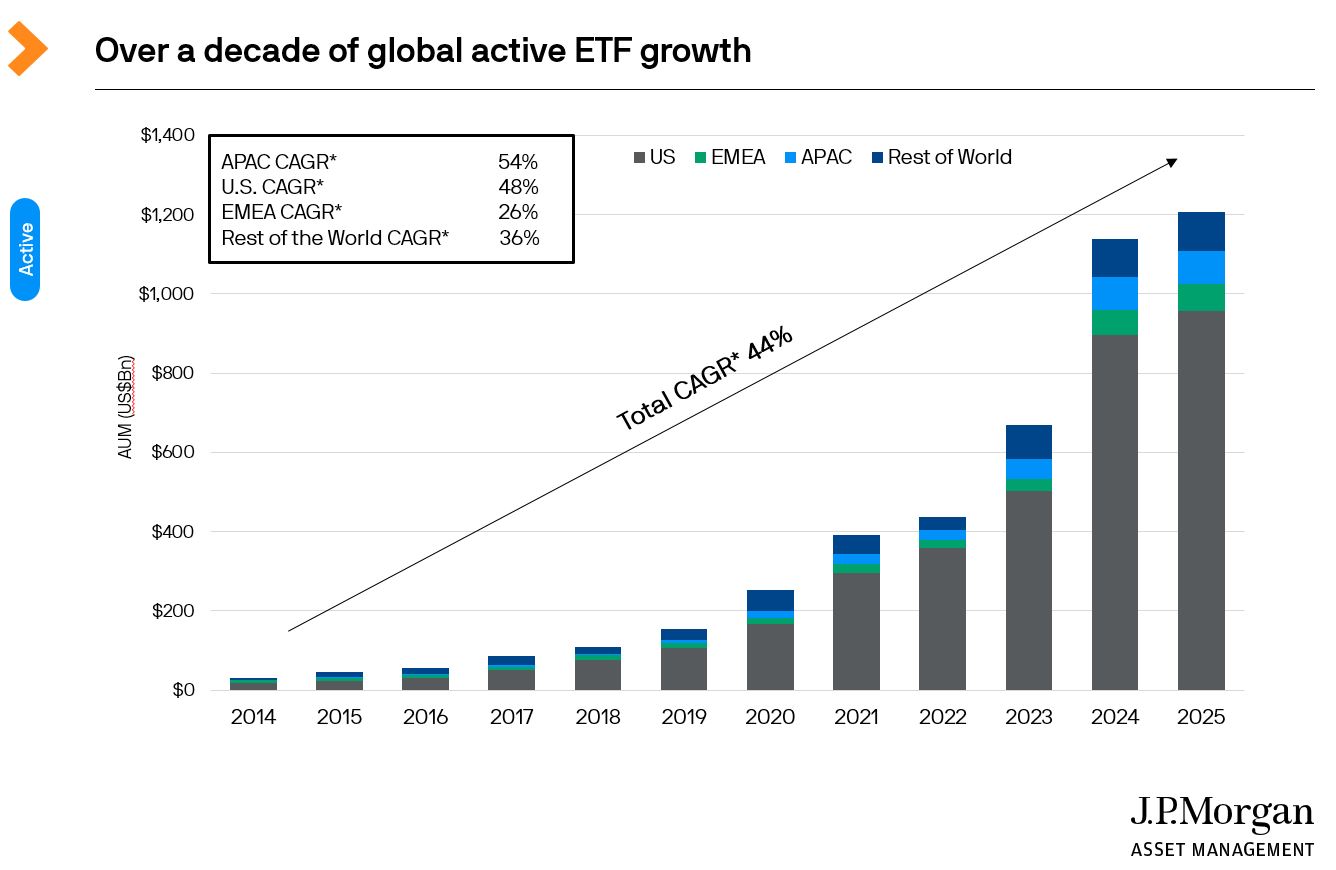

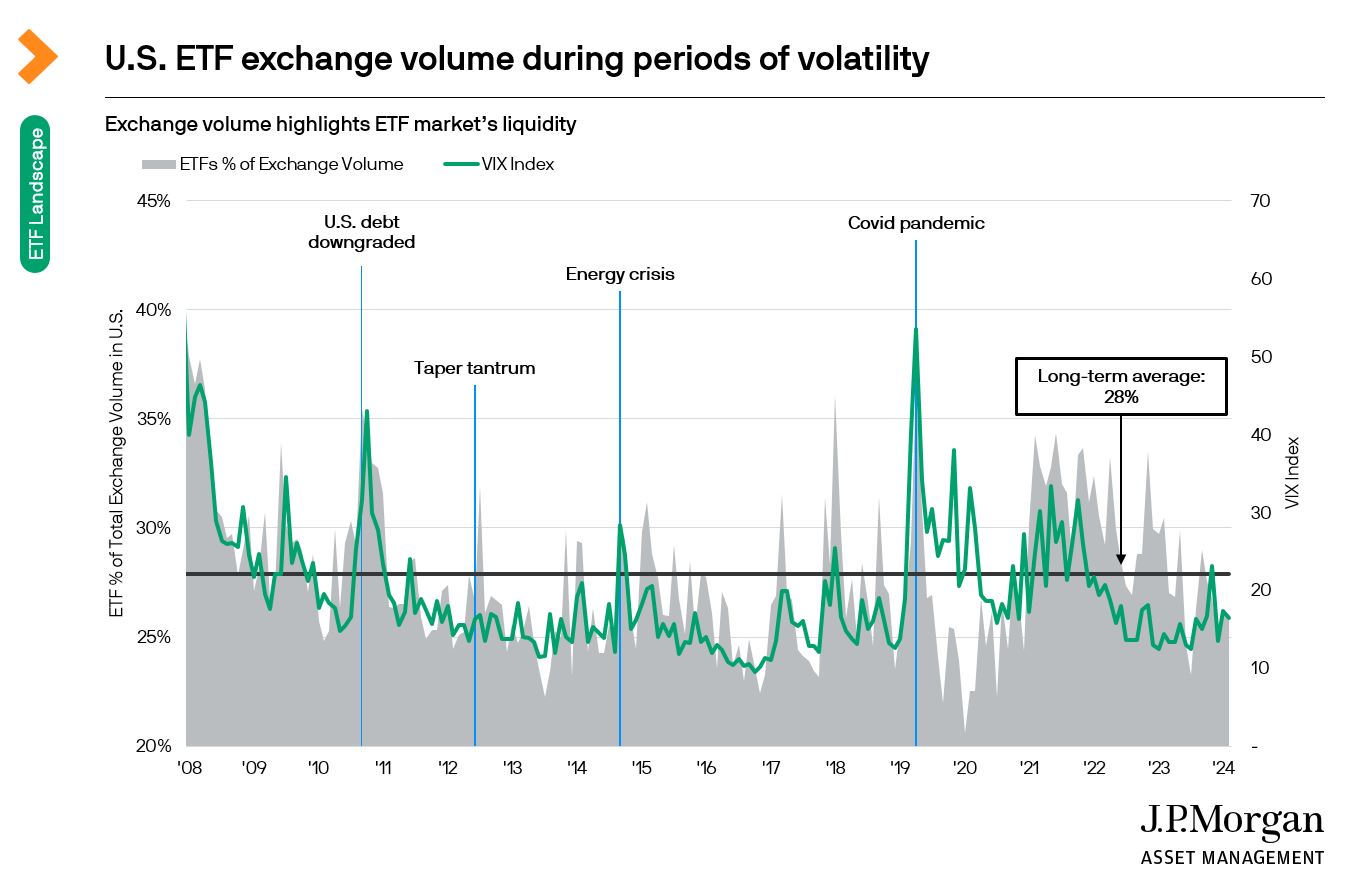

Exchange-traded funds (ETFs) have surged in popularity, and in recent years have transitioned from passive index-tracking instruments to actively managed ones. This rapid evolution means the industry, despite holding over US$15T in assets and registering the highest annual inflow on record in 20241, is still new to many investors.

To demystify the ETF marketplace, we have launched our inaugural Guide to ETFs (GTE) in the Asia Pacific region. The guide is designed to serve as a handy resource for all things ETFs – highlighting the trends shaping the industry, providing helpful guidance around portfolio construction and outlining best practices for trading.

In the spirit of our two-decade strong Guide to the Markets programme, the GTE provides actionable thought leadership and resources for both financial professionals and investors alike.

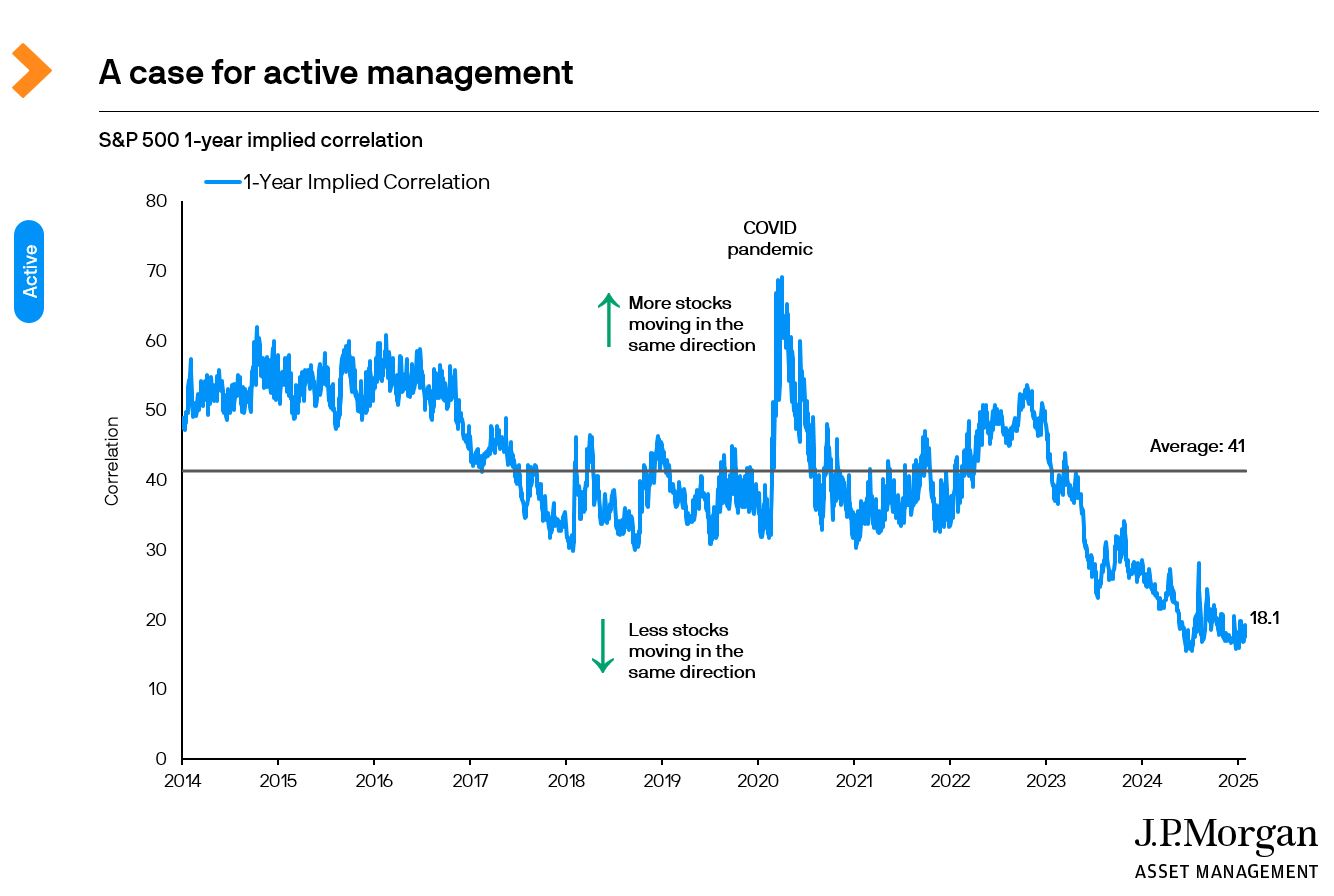

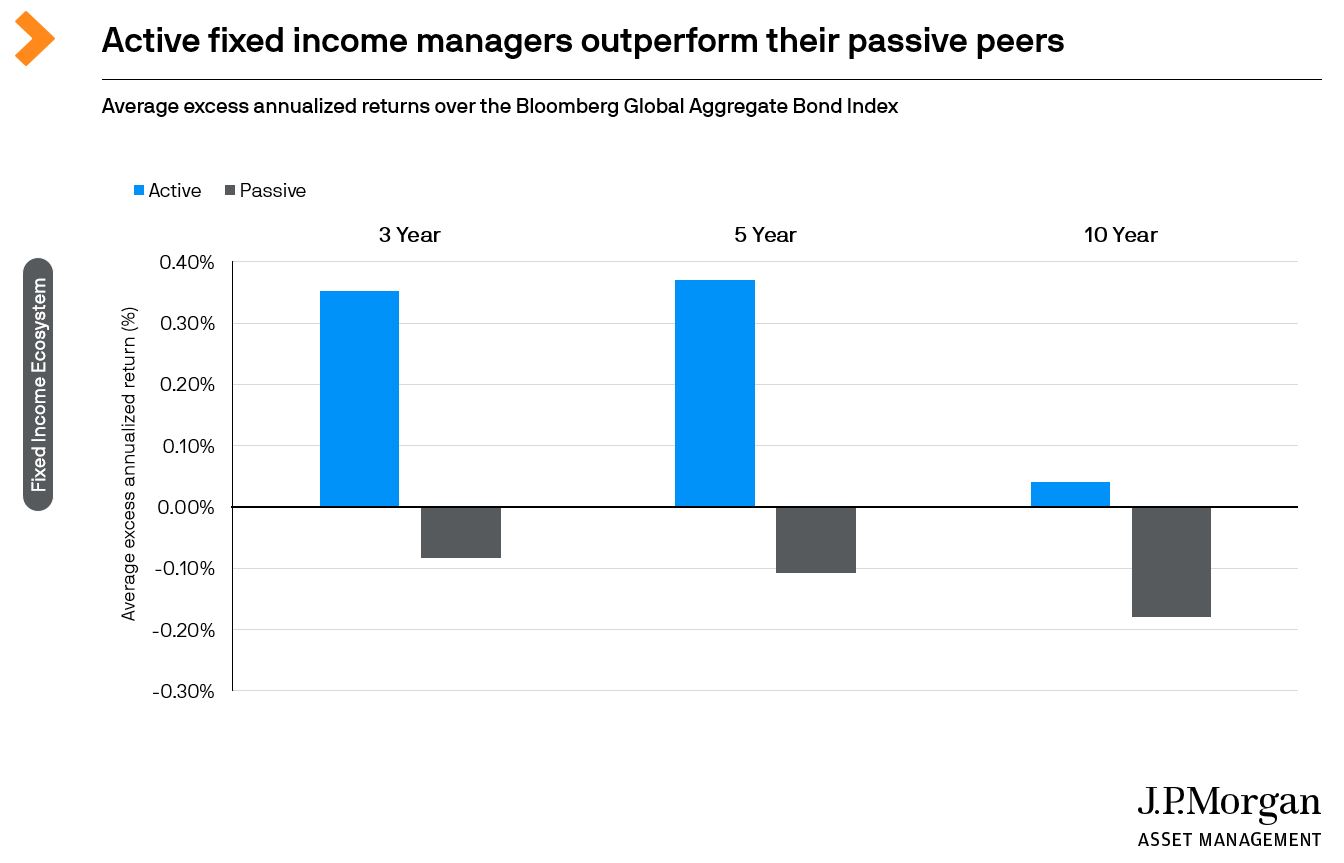

Our 40 plus page quarterly guide explores six key areas: the ETF landscape, active ETFs, the fixed income ecosystem, industry trends, principles of ETF investing, and ETF trading best practices.

The current iteration, among other things, also cast a light on several pertinent topics as highlighted below.

Explore more

Advance your portfolio with

an award-winning ETF manager