The flexibility to thrive in any rate environment

Important information

- The Fund invests primarily in debt securities.

- The Fund is therefore exposed to risks related to emerging markets, debt securities (including below investment grade/unrated investment, investment grade bond, credit, sovereign debt, interest rate, valuation and asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”) risks), concentration, convertible securities, currency, derivative, hedging, distribution (no assurance on distribution or the frequency of distribution or distribution rate or dividend yield), class currency and currency hedged share classes. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. Investments in ABS and MBS may be subject to greater credit, liquidity and interest rate risks compared to other debt securities such as government issued bonds and are often exposed to extension and prepayment risks. These securities may be highly illiquid and prone to substantial price volatility. Investment in RMB hedged share class is subject to risks associated with the RMB currency and currency hedged share classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point.

10 years of income and returns

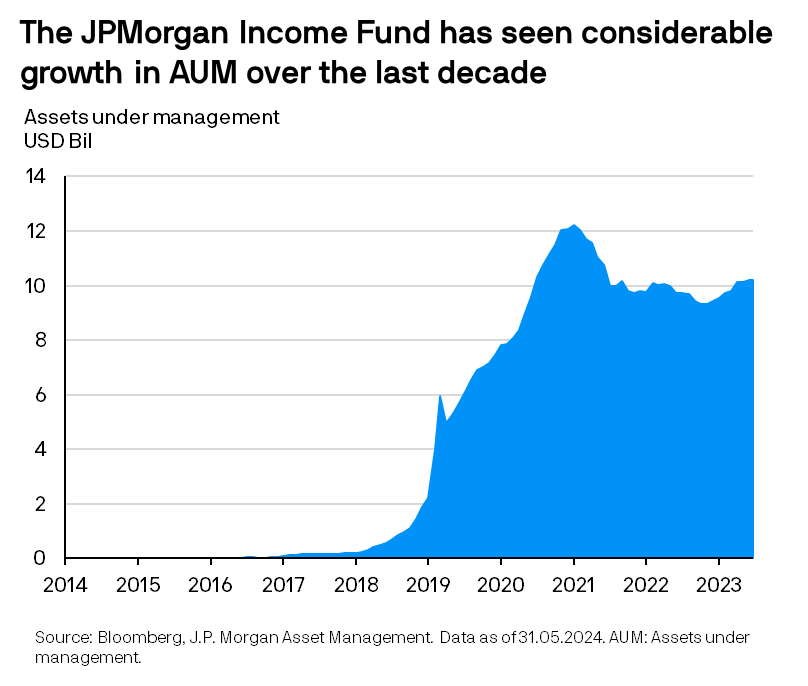

Since its inception about a decade ago, the JPMorgan Income Fund has sought to provide investors with a consistent income stream1, by investing opportunistically across a wide range of bond sectors while actively managing credit and interest rate risks2.

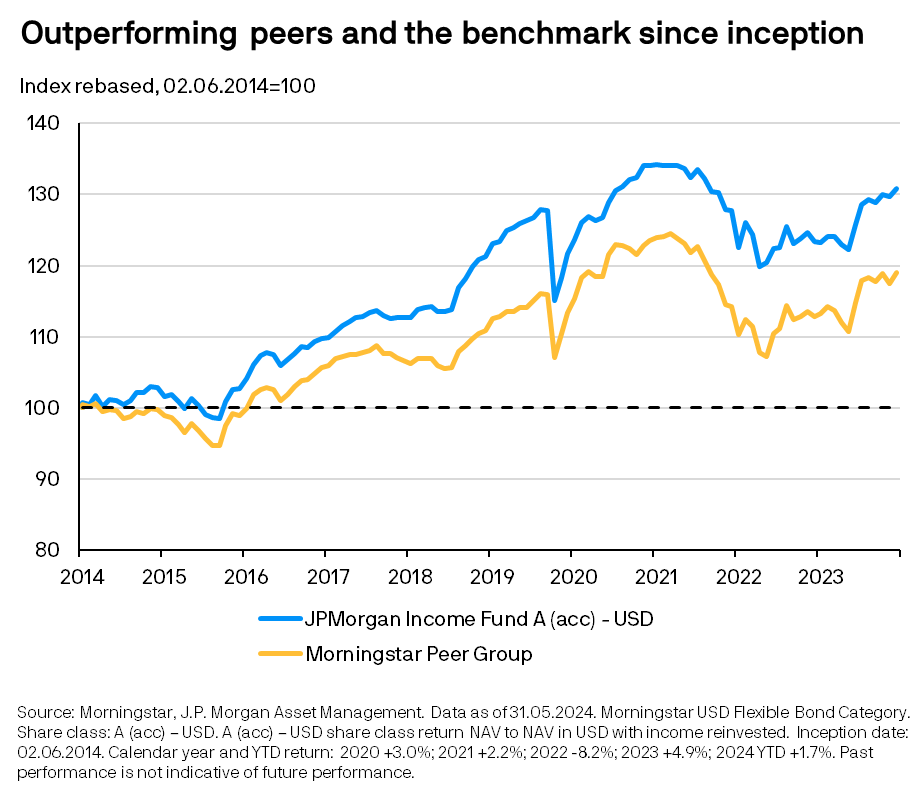

Through the years, the Fund has grown to become one of the largest fixed income strategies within the Morningstar USD flexible bond fund category3 and has also achieved robust returns by harnessing a broad-based, globally unconstrained and flexible approach to bond investing.

Let’s look at what the Fund has achieved over the last 10 years.

09ei241807092104

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yield is not guaranteed. Positive yield does not imply positive return.

JPMorgan Income Fund is the marketing name of the JPMorgan Funds - Income Fund.

- The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

- The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

- Source: Morningstar, J.P. Morgan Asset Management. Data as of 31.05.2024. Total fund size of the SICAV range: US$10.2 billion. Morningstar USD Flexible Bond Category.

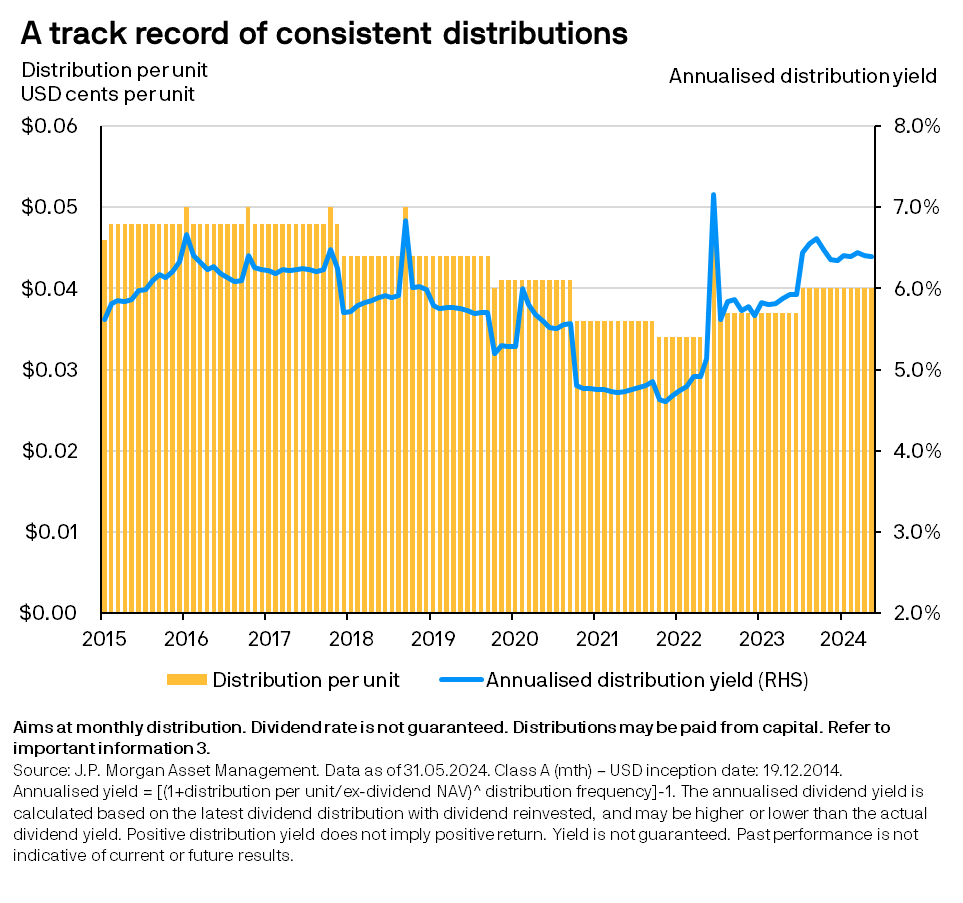

- Source: Bloomberg. Data as of 31.05.2024. Share class: A (mth) – USD. Inception date: 19.12.2014. Yield is not guaranteed. Positive yield does not imply positive return. Past performance is not indicative of current or future results.

- Positive distribution yield does not imply positive return. Yield is not guaranteed. Past performance is not indicative of current or future results.

- Source: Morningstar, J.P. Morgan Asset Management. Data as of 31.05.2024. Peer group refers to Morningstar USD Flexible Bond Category. Volatility based on monthly data. Inception date: 02.06.2014. Share class: A (acc) – USD. A (acc) - USD share class return NAV to NAV in USD with income reinvested. Calendar year and YTD return: 2020 +3.0%; 2021 +2.2%; 2022 -8.2%; 2023 +4.9%; 2024 YTD +1.7%. Past performance is not indicative of future performance.

- Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years.

- High-yield credit refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Yield is not guaranteed. Positive yield does not imply positive return.

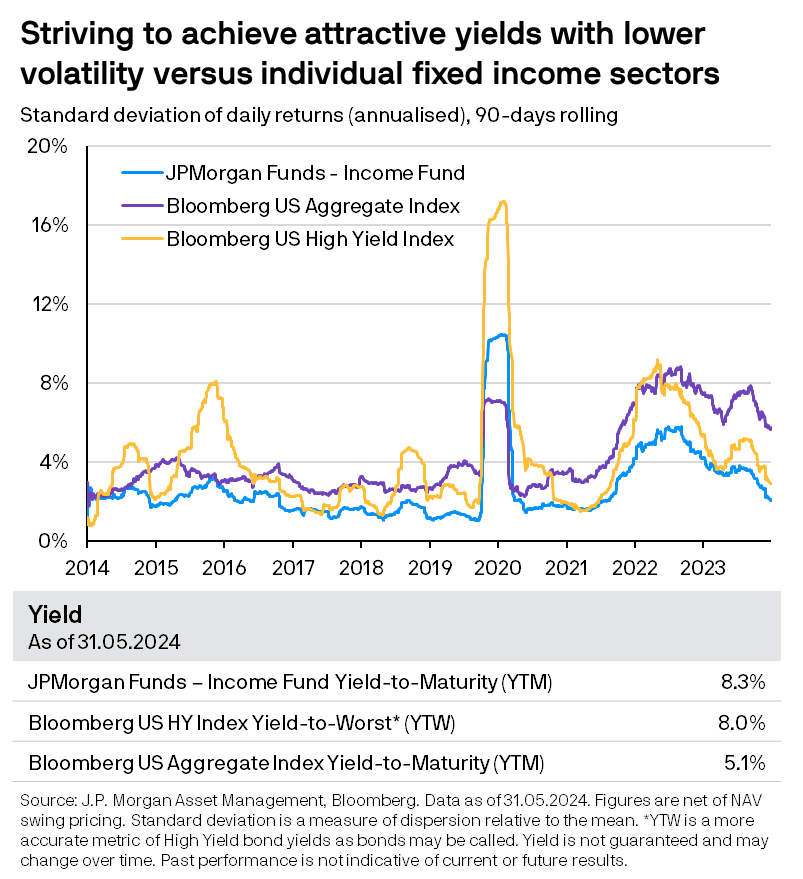

- Source: J.P. Morgan Asset Management. Data as of 31.05.2024. Share class: A (acc) – USD. Inception date: 02.06.2014. Benchmark: Bloomberg US Aggregate Bond Index (Total Return Gross). Past performance is not indicative of current or future results.

- Source: Morningstar, J.P. Morgan Asset Management. Data as of 31.05.2024. Morningstar USD Flexible Bond Category. Share class: A (acc) – USD. A (acc) - USD share class return NAV to NAV in USD with income reinvested. Inception date: 02.06.2014. Calendar year and YTD return: 2020 +3.0%; 2021 +2.2%; 2022 -8.2%; 2023 +4.9%; 2024 YTD +1.7%.

- Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.05.2024. Past performance is not indicative of current or future results.

- Asian Private Banker Asset Management Awards for Excellence are issued by Asian Private Banker in 2024, reflecting product performance, business performance, service competency, branding and marketing as at end-December 2023.

- The Refinitiv Lipper Fund Awards Hong Kong 2023 are issued by Refinitiv Lipper in the year specified, reflecting performance as at end-December 2022. Refinitiv Lipper Fund Awards, © 2023 Refinitiv. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of this content without express written permission is prohibited.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.