Important information

- The Fund invests primarily in debt securities.

- The Fund is therefore exposed to risks related to emerging markets, debt securities (including below investment grade/unrated investment, investment grade bond, credit, sovereign debt, interest rate, valuation and asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”) risks), concentration, convertible securities, currency, derivative, hedging, distribution (no assurance on distribution or the frequency of distribution or distribution rate or dividend yield), class currency and currency hedged share classes. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. Investments in ABS and MBS may be subject to greater credit, liquidity and interest rate risks compared to other debt securities such as government issued bonds and are often exposed to extension and prepayment risks. These securities may be highly illiquid and prone to substantial price volatility. Investment in RMB hedged share class is subject to risks associated with the RMB currency and currency hedged share classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point.

Bonds are no longer a supporting character in portfolios

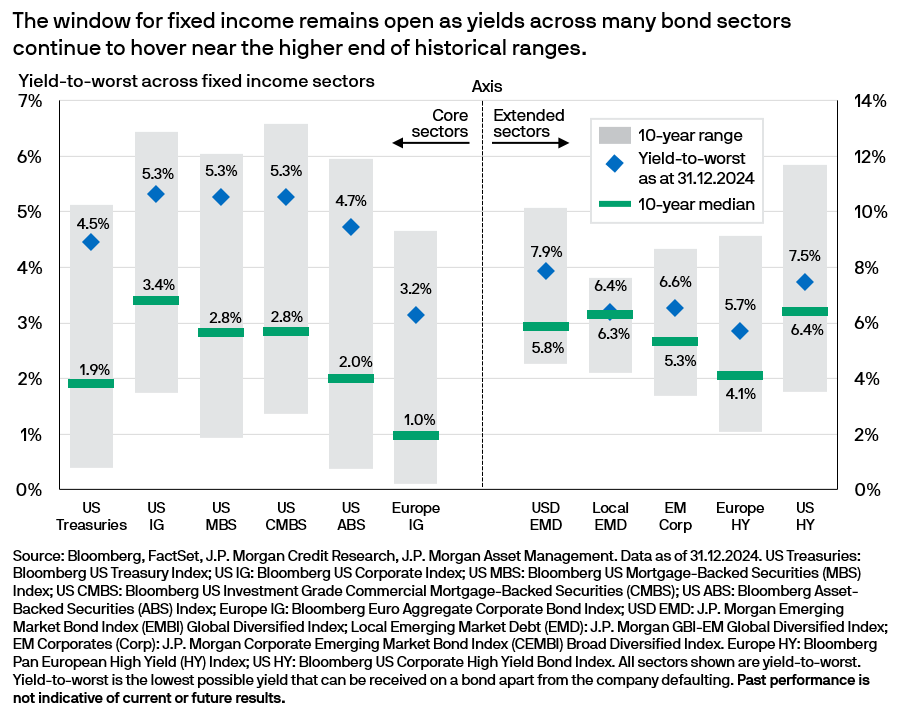

The days of the zero lower bound and negative yields have become a distant memory, allowing bonds to once again regain their rightful place in portfolios as both an attractive source of income and portfolio diversifier.

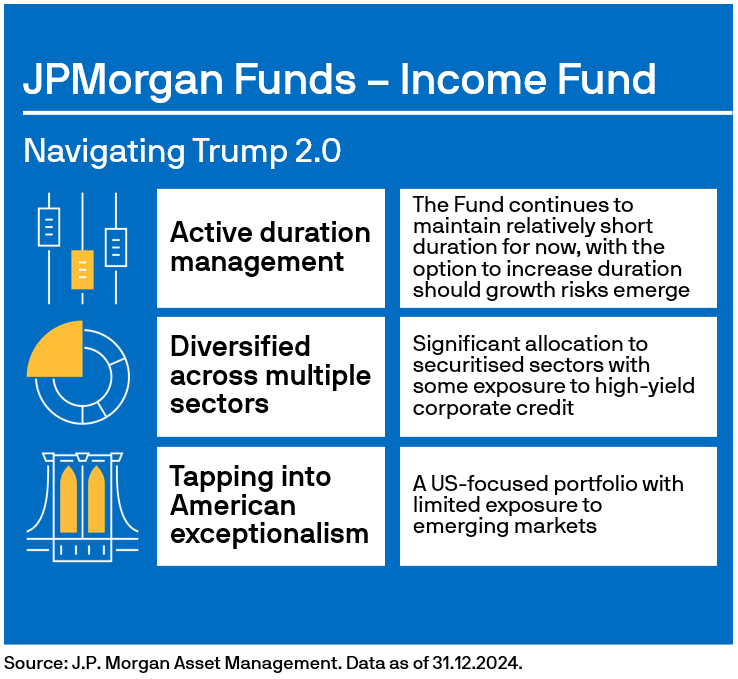

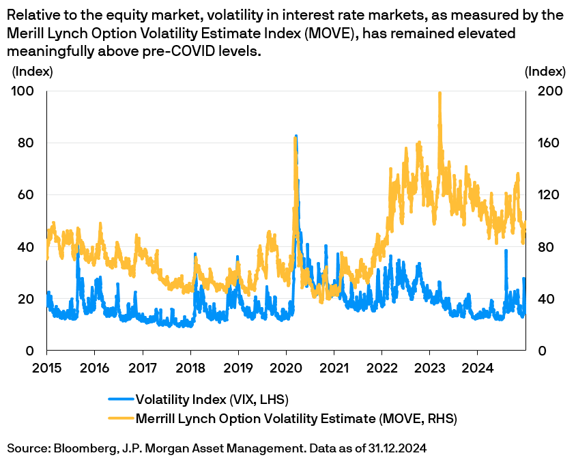

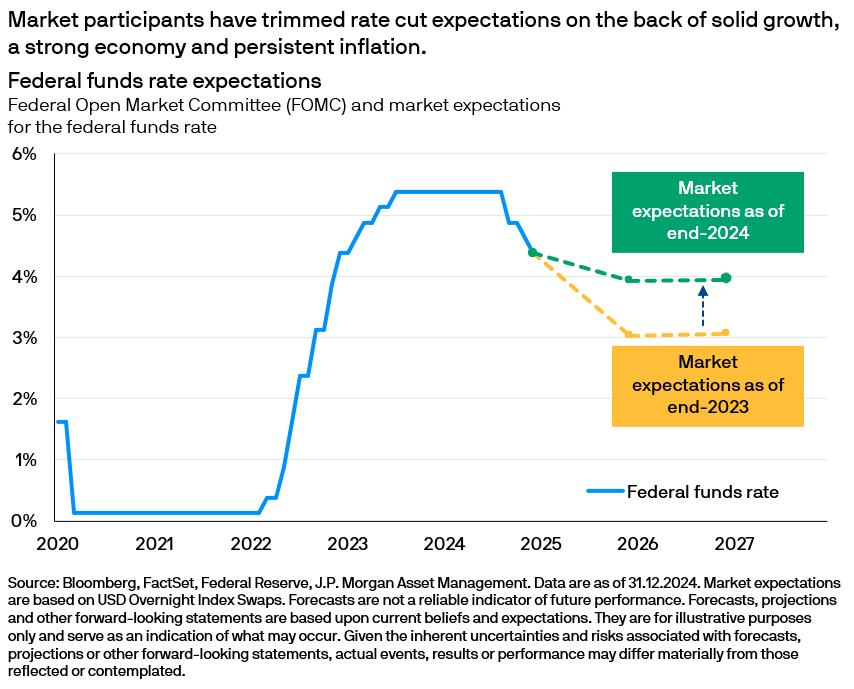

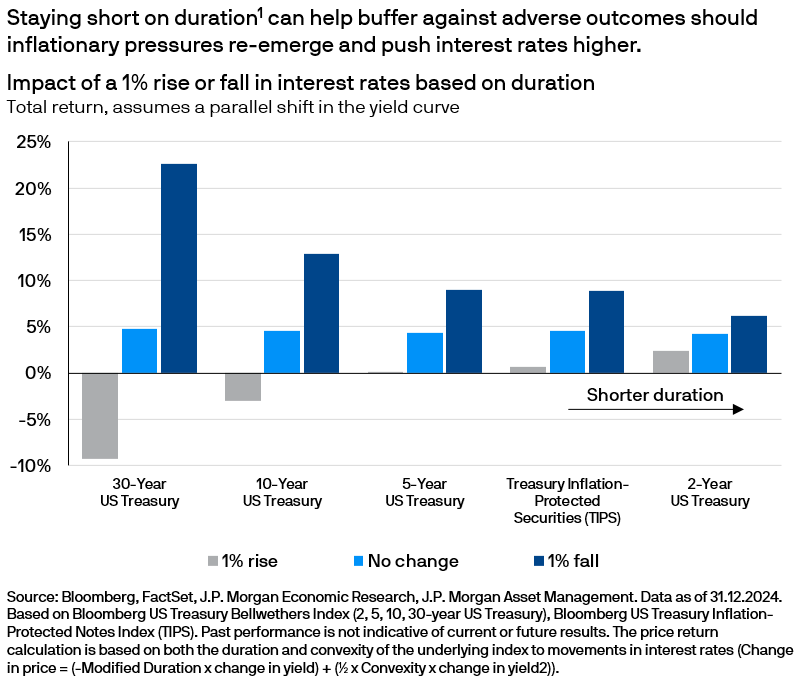

While the fixed income market is rich with opportunities, policy uncertainty, higher valuations and elevated volatility underscore the importance of actively managing duration1 and credit risks. In addition, bottom-up sector and security selection will prove critical in gaining exposure to quality assets that can withstand the vagaries of fast-changing market cycles.

For more than a decade, the JPMorgan Funds – Income Fund has steered through a complex and fast-changing macro environment, all while recording competitive returns, attractive income and lower volatility. This time-tested strategy could prove useful to navigate a constructive yet volatile market backdrop.

This could be the case with a new US administration in control, one whose policies could impact the outlook for growth, employment and monetary policy significantly and unpredictably.