Portfolio Chart: A menu of options as bond yields reset higher

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

Aug 2023 (3-minute read)

Positioning for peak rates with bonds

As we head towards the end of the Federal Reserve’s (Fed) rate-hike cycle, history provides two useful lessons.

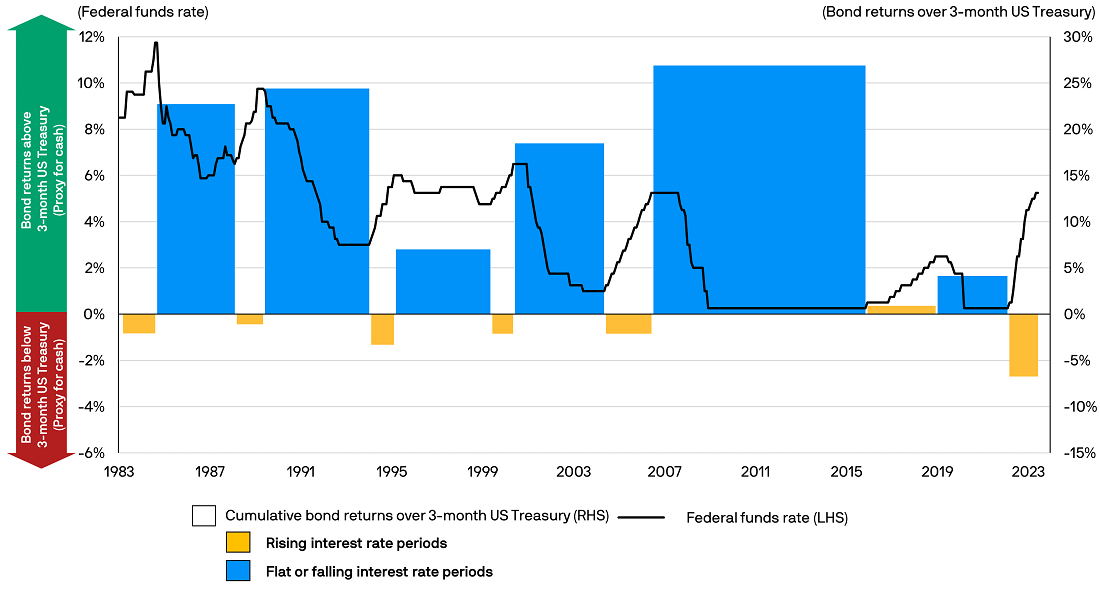

Historically, bonds typically outperform 3-month US Treasury Bills1 in flat and falling interest rate environments. 3-month US Treasury Bills are often used as a proxy for cash, due to its very short duration and low default risk by the US government.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 30.06.2023. Bond returns are cumulative and represented by the Bloomberg 1-5 Year Government/Credit Total Return Index. Returns of 3-month US Treasury are cumulative and represented by the Bloomberg 3-Month US Treasury Bellwether index. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results. This information is provided for illustrative purposes only to demonstrate general market trends. Information shown is based upon market conditions at the time of the analysis and is subject to change. Not to be construed as an offer, research or investment recommendation.

Lesson 1: Be mindful of reinvestment risk as interest rates peak

Lesson 2: Duration2 shines as interest rates peak and growth stalls

Review, revise and reoptimise

Staying short on duration may have worked well amid the fastest rate hike cycle in 40 years. Yet, in the face of its looming conclusion and potentially higher reinvestment risk, this strategy could prove less useful. As we enter the next phase of the policy cycle, duration could present opportunities not just for income, but capital appreciation should rates fall.

As we arrive at the end of the rate hike cycle, it is important for investors, based on their investment objectives and risk appetite, to review and revise their fixed income exposure to reoptimise portfolios to make the most of evolving economic conditions.

Dive deeper to discover a new world of active income solutions

Intelligent income strategies to navigate an inflationary world

Provided for information only based on market conditions as of date of publication, not to be construed as offer, investment recommendation or advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

1. Treasury bills (or T-bills) are short-term financial instruments that is issued by the US Treasury with maturity periods ranging from a few days up to 52 weeks (one year).

2. Duration is a measure of the sensitivity of the price (the value of the principal) of a fixed income investment to a change in interest rates and is expressed as number of years. The higher the duration of a bond, the more sensitive is its price to changes in interest rates. As a rule of thumb, every 1% increase in interest rates leads to a 1% decline in a bond’s price for every year of duration. The reverse also applies.

© 2023 All Rights Reserved – JPMorgan Asset Management (Australia) Limited ABN 55 143 832 080, AFSL No. 376919

Future performance and return of capital is not guaranteed. Information is considered correct at the time of issue but no liability for errors or omissions will be accepted by JPMorgan Asset Management (Australia) Limited or its affiliates. ETFs have fees that reduce their performance, indexes do not. Dividends or returns are not guaranteed. Please refer to offering documents for details on distribution policy.

No provider of information presented here, including index and ratings information, is liable for damages or losses of any type arising from use of their information. Information from communications with you will be recorded, monitored, collected, stored and processed consistent with our Australian Privacy Policy available at am.jpmorgan.com/au/en/asset-management/adv/privacy-policy/.

Fund information, including any performance calculations and other data, is provided by J.P. Morgan Asset Management (the marketing name for the asset management businesses of JPMorgan Chase & Co and its affiliates worldwide).

All investments contain risk and may lose value. The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs. Therefore, before you decide to buy any product or keep or cancel a similar product that you already hold, and for more detailed information relating to the risks of the Fund, the type of customer (target market) it has been designed for and any distribution conditions, it is important that you read and consider the relevant JPMorgan fund Product Disclosure Statement (PDS) and Target Market Determination, which have been issued by Perpetual Trust Services Limited, ABN 48 000 142 049, AFSL 236648, as the responsible entity of the fund and are available to download on this website and make sure that the product is appropriate for you. Before making any decision, it is important for you to consider these matters and to seek appropriate legal, tax, and other professional advice.

With yields hovering close to decade highs across many fixed income sectors, investors are presented with a “menu of options”. Still, selectivity matters as recession risks loom.

After a difficult year for bonds, we explain why fixed income could once again prove to be a useful diversifier for portfolios.

We explain why investors should pay greater attention to quality bonds.

We share insights on how actively-managed fixed income ETFs can help build stronger portfolios.

Here is a chart indicating IG bond opportunities as US Treasury yields stay elevated.

Employing an equity premium income approach in an income-hungry world.

We share a flow chart to help explain ETF liquidity.

Seeking income as the outcome is the aim of our actively managed equity premium income ETF strategy.

Flexibility is at the heart of our approach to fixed income markets.

We share our insights on optimising call options in equity income ETFs.

We share the basics of call options in equity income ETFs.

We share the basics about thematic ETFs and how they are employed in portfolios.

Income investing can help tap investment opportunities while managing volatility through cash flows from a diversified portfolio of income generating assets.

We share our views on the fixed income themes and opportunities in current choppy markets.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

The securitisation market has regained much ground in the past decade.

Harnessing an active equity ETF to seek out low-risk alpha in a high-risk world.

For more information, please call or email us. You can also contact your J.P. Morgan representative.

1800 576 100 (Application enquiries)