Seeking multiple income sources

- Market volatility and lower yields are expected to stay. It’s time to embrace the challenges, differentiate and invest where opportunities can be found via a flexible approach.

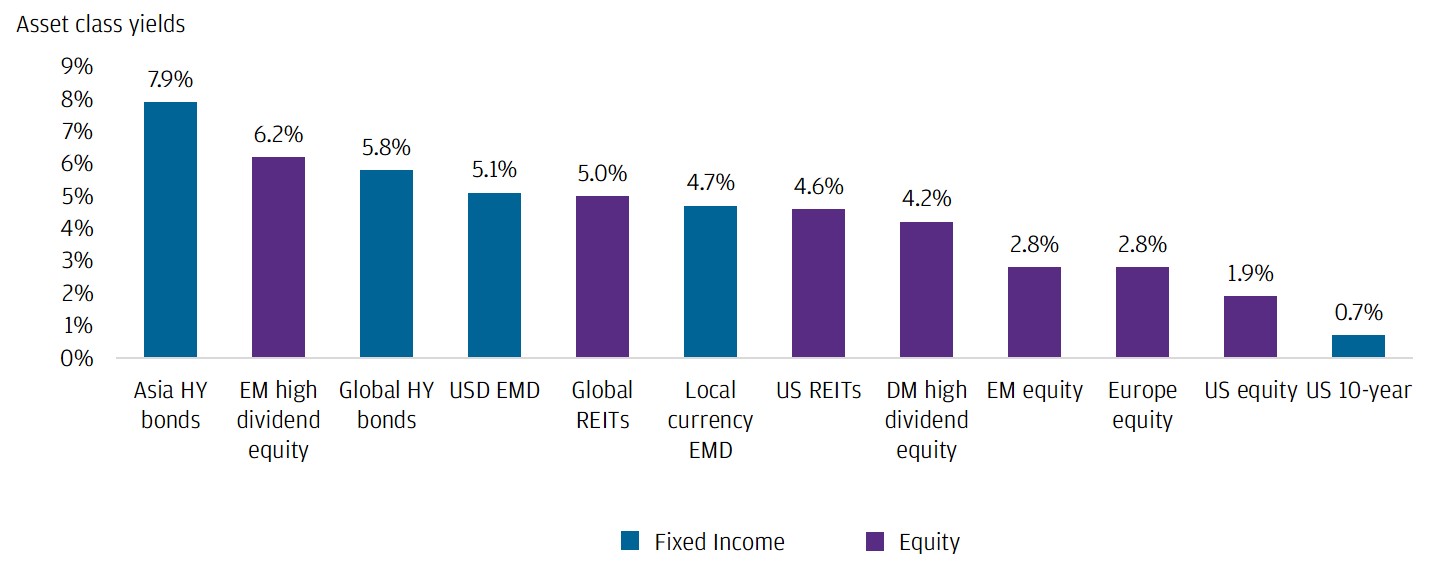

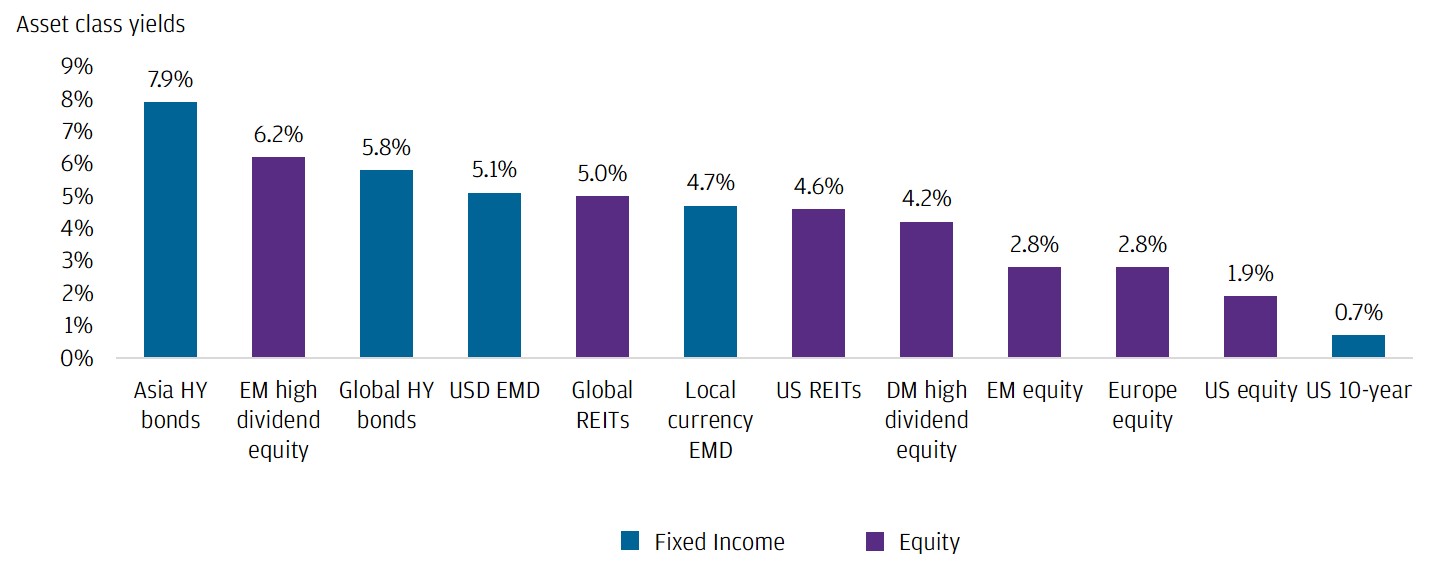

- Income can be harvested from different sources, such as stock dividends and bond coupons, and these can be found globally across asset classes and regions3.

A range of income sources4

3. Yields are not guaranteed. Positive yield does not imply positive returns.

4. Source: Alerian, Bank of America, Bloomberg Finance L.P., Clarkson, Drewry Maritime Consultants, FactSet, Federal Reserve, FTSE, MSCI, NCREIF, Standard & Poor’s, J.P. Morgan Asset Management. Asset classes are based on FTSE NAREIT Global REITs Index (Global REITs), FTSE NAREIT USA REITs Index (US REITs), Bloomberg Barclays Global High Yield Index (Global HY bonds), J.P. Morgan Government Bond Index EM Global (GBI-EM) (Local currency EMD), J.P. Morgan Emerging Market Bond Index Global (EMBIG) (USD EMD), J.P. Morgan Asia Credit Index Non-investment Grade (Asia HY bonds), MSCI Emerging Markets Index (EM equity), MSCI Emerging Markets High Dividend Yield Index (EM high dividend equity), MSCI World High Dividend Yield Index (DM high dividend equity), MSCI Europe Index (Europe equity), MSCI USA Index (US equity), US 10-Year Treasury Note (US 10-year). Yields of EM high dividend equity and DM high dividend equity were as of 31.05.2020. Yield is not guaranteed. Positive yield does not imply positive return. Past performance is not a reliable indicator of current and future results. Guide to the Markets – Asia 3Q 2020. Data reflect most recently available as of 30.06.2020.

Investments involve risk. Not all investments are suitable for all investors. Please seek financial advice before investing. Securities rated below investment grade are considered high-yield/ below investment-grade. Although they might provide higher yields than higher-rated securities, they could carry risk.

REITs: Real estate investment trusts; HY: High yield; EMD: Emerging market debt; USD: US dollar; EM: Emerging market; DM: Developed market.