Important Information

- Investment in the Funds is not the same as placing funds on deposit with a bank or deposit-taking institution. The manager has no obligation to redeem units at the issue price. Investors may be subject to risks related to Funds.

- Investors may be subject to substantial losses.

- Investors should not solely rely on this document to make any investment decision, but should read in detail the offering documents and the risk disclosures of the relevant investment products.

Three key highlights of Digital Share Class

Exclusively launched on the J.P. Morgan DIRECT investment platform, the Digital Share Class helps save costs on your monthly investments.

Related funds for Digital Share Class and Year to Date Performance

as of 30 Sep 2025

Relevant fund list as of 10 February 2025. The digital share class is exclusively available for the aforementioned funds. For further details, please refer to the respective prospectus.

Performance calculation is NAV to NAV in denominated currency with income reinvested. The investment returns are calculated in denominated currency. For funds/classes denominated in foreign currencies, US/HK dollar-based investors are therefore exposed to fluctuations in the currency exchange rate.

Launch date of digital share classes - JPMorgan Pacific Technology, JPMorgan Korea, JPMorgan Asia Growth, JPMorgan ASEAN, JPMorgan Asian Smaller Companies: 10.09.24; JPMorgan Japan (Yen) : 01.08.24

^Calendar Year 2024 -Since launch to end of year for fund classes incepted in that year.

Watch this video to learn more about Digital Share Class and its cost-saving potential

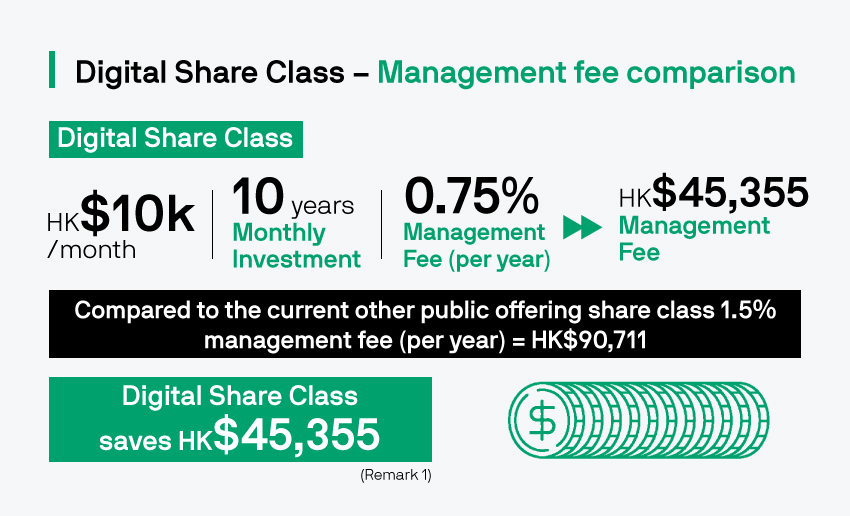

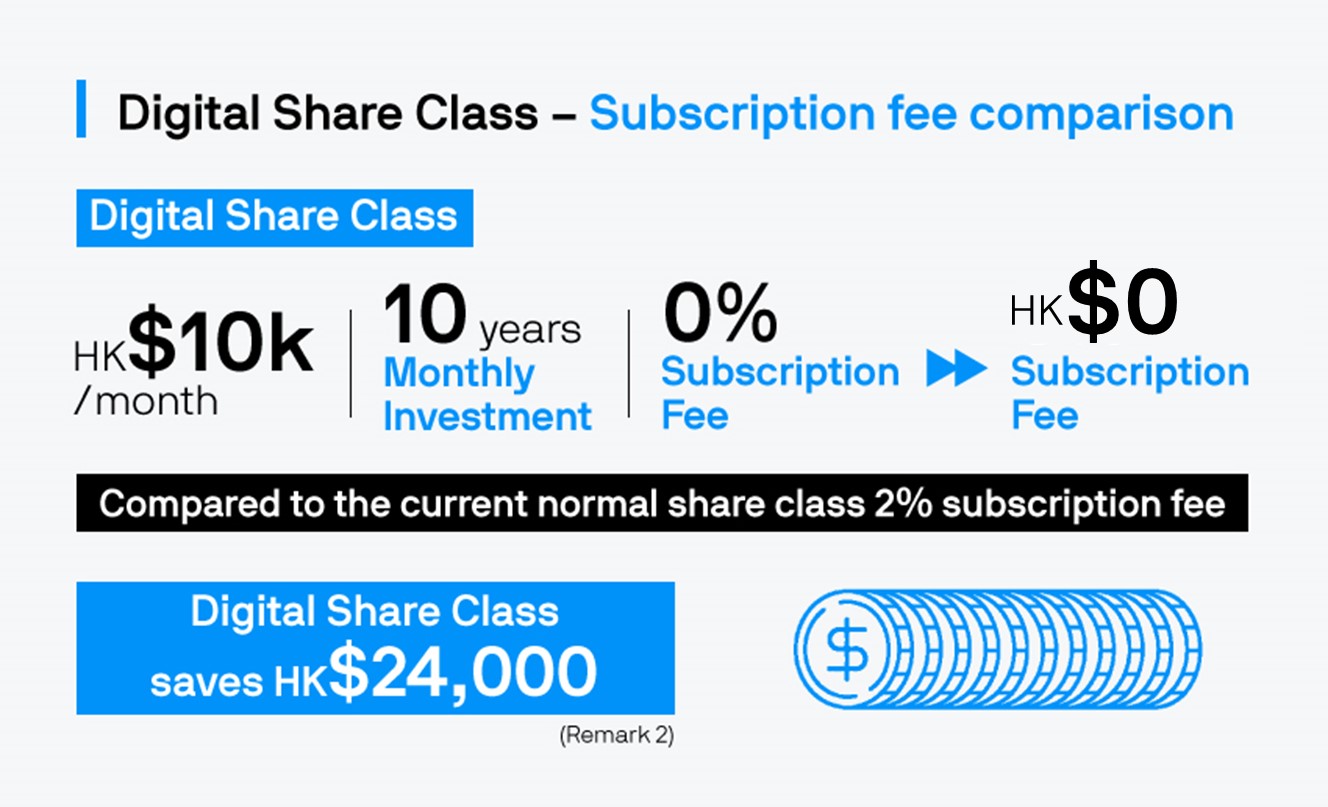

A HK$10,000 monthly investment in the Digital Share Class, may potentially save you close to HK$70,000 in subscription and management fees over a 10-year period compared to other public offering share classes of the same fund and normal 2% subscription fee1, 2, 3.

(Available in Chinese only)

Digital Share Class - Helps save more with lower costs

A HK$ 10,000 monthly investment in the Digital Share Class, may potentially save you up to HK$ 69,355 in subscription and management fees over a 10-year period compared to other public offering share classes of the same fund and normal 2% subscription fee 1, 2, 3 as shown in the table below.

1. Assuming that the subscription fee is currently waived and extended for the entire 10-year period, and the management fee for the Digital Share Class remains half of that for other public offering share class of the same fund, the cost saving can be calculated as follows: For a monthly investment of HK$10,000 (total investment of HKD 1.2 million over 10 years), the difference in management fees between the Digital Share Class (0.75%) and the accumulation class (1.5%) is 0.75 percentage points per year. After 10 years, the management fees amount to HK$45,355 for the Digital Share Class and HKD 90,711 for the accumulation class, resulting in a management fee saving of HK$45,355 over 10 years. This calculation assumes that both the Digital Share Class and other public offering share class of the same fund continue to exist, and that the fund's net asset value and management fees remain unchanged over the 10-year investment period. For details on the fees of individual funds and share classes, please refer to the relevant fund prospectus or sales documents.

2. Assuming a fund subscription platform charges a 2% subscription fee for other public offering share class of the same fund, compared to the 0% subscription fee for the Digital Share Class on the J.P. Morgan DIRECT platform, it can save HK$24,000 in subscription fees over 10 years. Please note that the subscription fee savings are for reference only, as different fund subscription platforms may have different fee calculation methods, and the relevant subscription fees (if any) may differ from the above assumptions.

3. By using the above methodology, the total cost savings of the Digital Share Class compared to other public offering share class of the same fund is HK$69,355 (comprising HK$45,355 in management fee difference and HK$24,000 in subscription fee difference).

Asia Market Outlook

#Referring to the current management fee for the Digital Share Class is half that of other public offering share classes of the same fund.

*Applicable only to specific fund share classes exclusively offered on the J.P. Morgan DIRECT investment platform. Investment involves risk. Investment products may not be suitable for all investors. Investors should consult professional advice before investing.

+The ongoing charges figure is estimated because the class is recently launched. The figure as of 04/2025 is based on the estimated costs and expenses of the class over 12 months expressed as a percentage of the estimated average net asset value of the class. The actual figure may be different from the estimated figure and may vary from year to year. Full subscription and switching fees for the relevant funds may be up to 5%. The ongoing charges figure of each fund varies. For details, please refer to our eTrading website and the offering documents of the relevant funds.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yields are not guaranteed. Positive yield does not imply positive return.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.