While further policy adjustments are very uncertain, the bar for hiking rates still seems high.

At its final meeting, the Federal Open Market Committee (FOMC) voted to reduce the Federal funds rate by 0.25% to a target range of 4.25%-4.50%, cutting rates by a 100 basis points (bps) or 300bps annualized in 2024. However, forward guidance via the Summary of Economic Projections (SEP) suggests a shallower path of rate cuts next year. The statement also tilted hawkish adding “In considering the extent and timing of additional adjustments” from “considering additional adjustments” to the target range, suggesting the Fed will pause cutting at its next meeting and wants the optionality to not have to cut rates at all next year depending on how the data evolves.

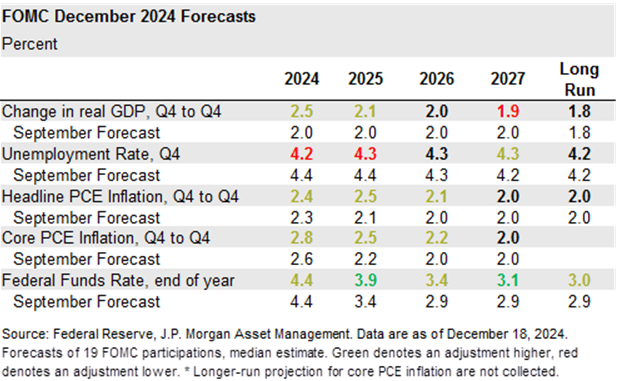

Updates to the Summary of Economic Projections (SEP) suggest arguably a no-landing scenario forecast rather than a soft landing:

- Real GDP growth projections were upgraded to 2.5% this year, 2.1% in 2025, and reaches trend growth of 2% by the fourth quarter of 2026.

- Unemployment rate projections were nudged lower to 4.2% and 4.3% in 2024 and 2025, respectively, and remains at 4.3% through 2027.

- Both headline and core PCE projections were raised to 2.4% and 2.8% in 2024, and to 2.5% in 2025 before normalizing to 2.0% by the fourth quarter of 2027.

- The committee slashed its median policy rate projections (dot plot) signaling just two rate cuts next year, down from four rate cuts at its September meeting. Long run Fed funds rate projection was also raised to 3.0% from 2.9%.

Interestingly—and reflective of a lack of consensus with regards to policy forecasts—one member voted not to cut rates at this meeting. Dissents are generally rare, prior to the September meeting, which was regarding the size of the reduction, the last dissent was in 2005.

It must be acknowledged the impressive resilience of the U.S. economy with growth tracking ~3.0% q/q for the fourth quarter. Moreover, the bounce back in job growth last month suggests a labor market that is cooling but not crumbling. That said, given progress on inflation has slowed recently, Chairman Powell highlighted a renewed concern around inflation.

Notably, when asked how tariff policy might impact the committees’ forecast, he pointed to the Fed’s approach in 2018 in which the committee looked through tariffs. November inflation data highlighted early signs of disinflation in sticky services sectors which should allow for more material cooling in price pressures relative to its forecast. That said, Powell mentioned a few members did incorporate potential fiscal and tariff policies under the incoming administration in these estimates.

Both the US 2-year and 10-year Treasury yield popped by 10bps, stocks sold off and the dollar spiked as cuts were priced out. While further policy adjustments are very uncertain, the bar for hiking rates still seems high. The committee is now in line with market expectations of two 25bp rate cuts next year. For investors, the macro backdrop has not shifted materially, we still expect growth and inflation to normalize, labor to gradually cool and for modest policy easing next year. This should keep earnings growth positive providing support for equities and credit next year, and elevated yields keep income attractive in bond markets. However, in the face of significant policy uncertainty, maintaining broad diversification across stocks, bonds and alternatives is the best protection.