During the press conference, Chairman Powell suggested a measured approach going forward, while acknowledging the wide range of views driven by their employment and inflation mandate at odds.

The Federal Reserve delivered on market expectations and reduced the target federal funds rate by 0.25% to 3.50%-3.75%. However, there are a range of views regarding the path of policy rates going forward as evidenced by the number in dissents among governors at the final meeting of this year. Interim governor, Stephen Miran dissented in favor of a larger half percent cut, while Governors Schmid (Kansas City) and Goolsbee (Chicago) voted in favor of no further reductions. Moreover, outside of the twelve voting members, four members within the total FOMC body of nineteen whom submit projections, elected for no cuts, a few of which may be rotating onto the committee next year.

In addition, as funding markets move from abundant to ample, the committee concluded quantitative tightening and will increase the current size of the balance sheet by investing maturing U.S. Treasury securities and agency mortgage-backed securities (MBS) largely into short-term U.S. Treasuries. Importantly, this should not be viewed as additional monetary easing, but rather as reserve management in order to maintain orderly functioning of short-term rates.

Adjustments to the statement language were uncontroversial, though the small tweak stating “in considering the extent and timing of additional adjustments” to policy rates suggests a January reduction is unlikely. Elsewhere, moderate changes to the committee’s Summary of Economic Projections (SEP) tilt hawkish:

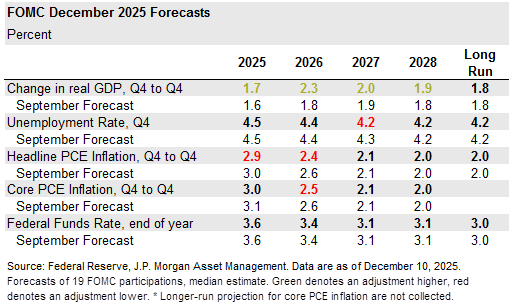

- Growth was nudged higher by 0.1% to 1.7% for this year but jolted higher for 2026 to 2.3% from 1.8%. It’s expected the hit to growth in the fourth quarter driven by the government shutdown will contribute to growth next year, in addition to OBBBA stimulus.

- Unemployment rate forecasts were essentially unchanged.

- Both headline and core PCE forecasts were nudged lowered through next year. This year was adjusted to 2.9% and 3.0%, and to 2.4% and 2.5% for 2026, respectively. The committee continues to see tariffs as a one-time boost to inflation but will subside relatively quickly.

- The median interest rate outlook maintained just one cut for next year and in 2027. That said, the most hawkish members see no further rate cuts through 2027 while the most dovish members see rates falling to 2.4% over that time.

During the press conference, Chairman Powell suggested a measured approach going forward, while acknowledging the wide range of views driven by their employment and inflation mandate at odds. It’s worth mentioning that Powell asserted that the drivers of stronger GDP growth alongside a more benign inflation outlook could be guided by productivity gains, though hesitant to declare these gains were driven by Artificial Intelligence…yet.

Yields jumped initially but settled lower while stocks rose. Perhaps markets have taken some solace in the fact that rate hikes are not in any members’ base case, suggesting an easing bias from the Fed remains. In summary, while the Fed may be less active next year in adjusting policy rates, an easing bias likely continues to provide support for risk assets and slightly lower short to intermediate yields. However, investors would be wise to manage the range of outcomes next year, and therefore embrace active fixed income, disciplined risk control and careful positioning across the bond market.