Volatility in perspective

Global market swings and heightened uncertainty can be unsettling. And while investors can’t avoid volatility, they could make the most of it. Investments grounded in research and guided by data and insights can help investors achieve their long-term objectives.

In challenging times, it is always useful to keep a few things in perspective.

First, volatility is normal, and market declines are part and parcel of investing.

The urge to exit can be overwhelming when markets are falling, but doing so may mean selling at the most inopportune time and missing potential market rebounds. This can be costly for portfolios in the long run.

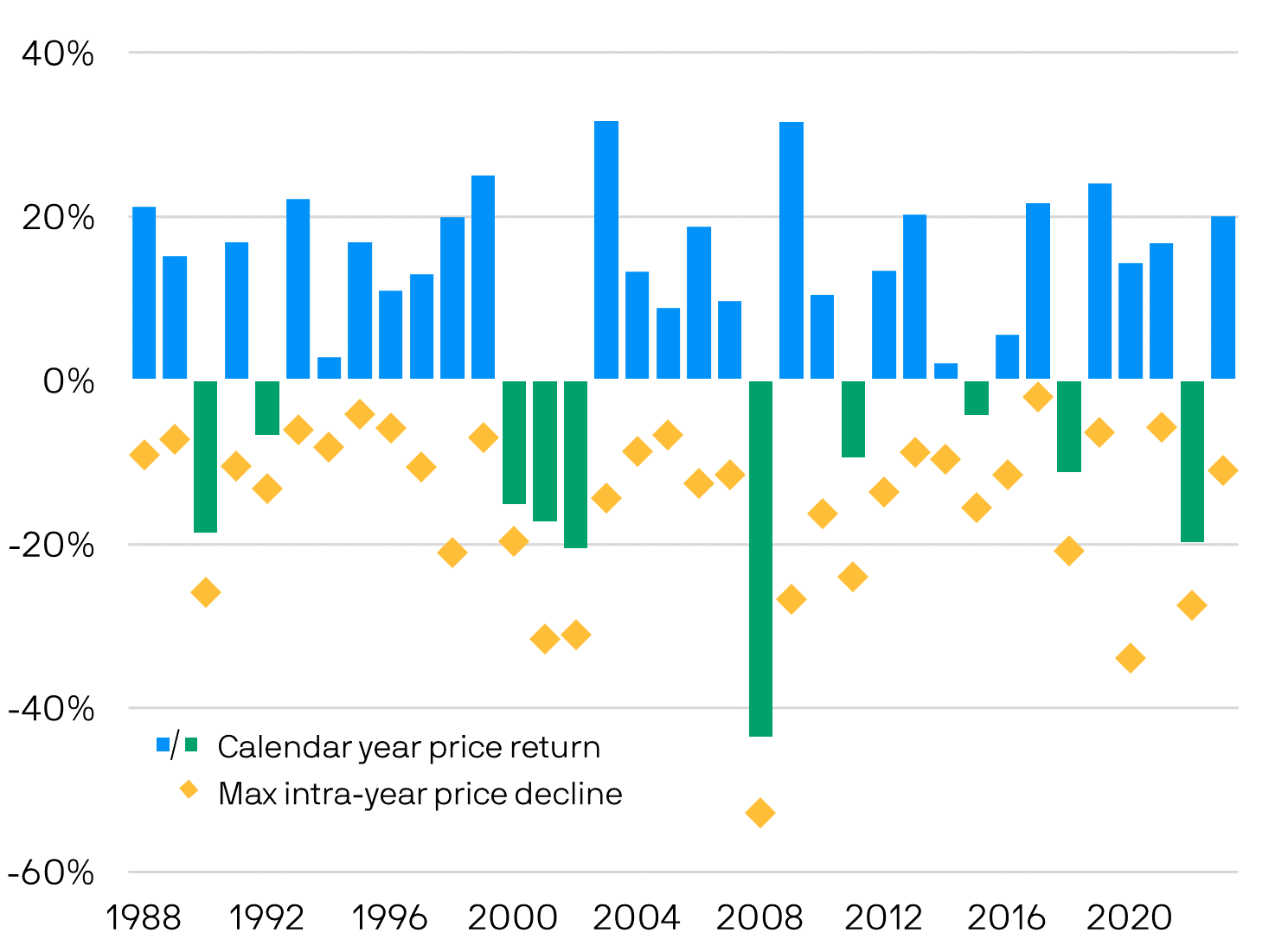

While periodic pull-backs are not uncommon, 27 of the last 37 years have ended with positive returns for the MSCI All Country World Index.

This underscores the importance of patience and perseverance to ride out choppy markets. Investors should not let short-term volatility derail their long-term investment plans and stay focused on their end goal.

Volatility is normal. As a general macro trend, annual returns of the MSCI All Country World Index were positive in 27 of the last 37 years despite average intra-year drop of 15.11%.

MSCI All Country World Index annual price return and intra-year declines (1988 – 2024)

Source: Bloomberg, J.P. Morgan Asset Management. Data as of 31.12.2024. Max intra-year price declines refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Past performance is not a reliable indicator of current and future results. Average annual return between 1988 to 2024 was 7.45%.

Second, investing is about time in the market, not timing the market.

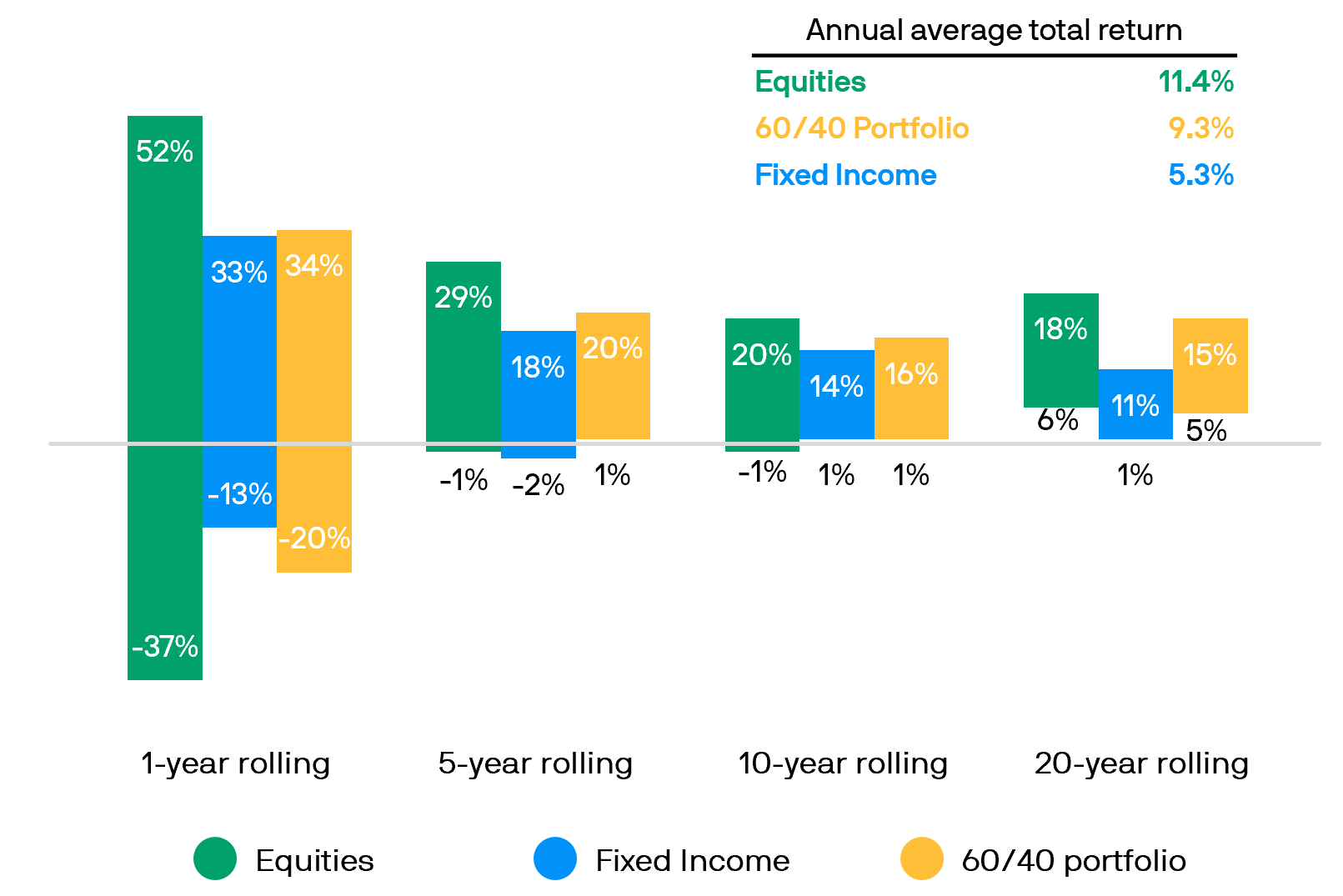

For one, the range of return outcomes narrows considerably and skews positive over longer time horizons.

The data shows the resilience of a 60/40 stock-bond portfolio by illustrating its 1-year and 3-year returns in excess of cash during each market shocks. In most scenarios, a 60/40 portfolio can outperform cash over a 3-year period despite these market shocks.

While there is no guarantee of future returns, the data demonstrate the importance of staying invested, focusing on time in the market and not timing the market.

A 60/40 stock-bond portfolio during market shocks

1-year and 3-year returns of a 60/40 stock-bond portfolio in excess of cash (Cash returns are based on Bloomberg U.S. Treasury Bellwethers (3M) Total Return Index.)

Source: Bloomberg, FactSet, MSCI, J.P. Morgan Asset Management. Portfolio returns reflect allocations of 60% in the MSCI AC World Index and 40% in the Bloomberg Aggregate Bond Index. Cash returns are based on Bloomberg U.S. Treasury Bellwethers (3M) Total Return Index. Returns are total returns. *Based on incident-to-date returns due to less than 3 years of track record. Past performance is not a reliable indicator of current and future results. Data reflect most recently available as of 06.05.2025.

Third, diversification can be useful to ease the journey through choppy markets.

Diversifying portfolios across a variety of negatively correlated and/or uncorrelated asset classes can help manage the risks during a market downturn.

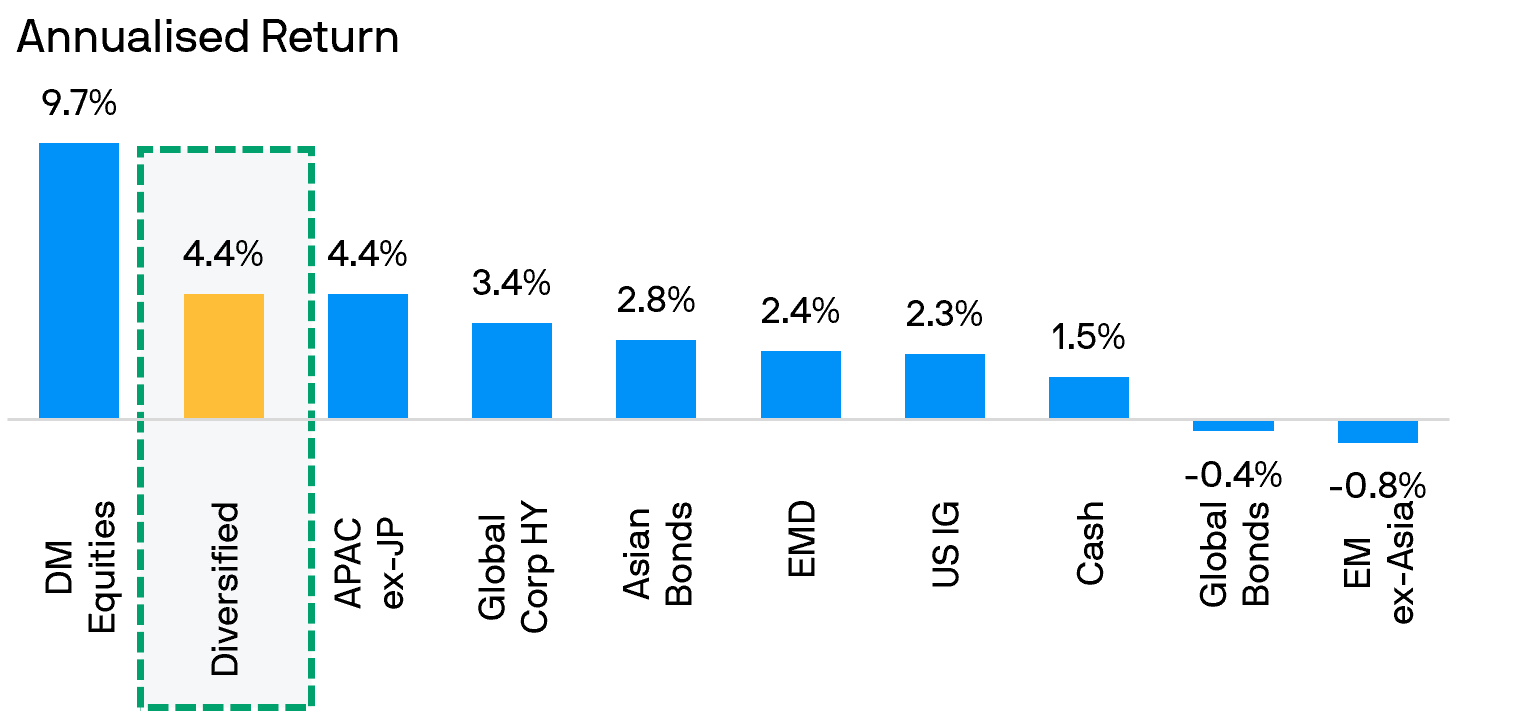

As an illustration of the macro trend, a well-diversified portfolio1 has recorded average returns of around 4.8% annually over the last decade, comparing favourably with other individual asset classes.

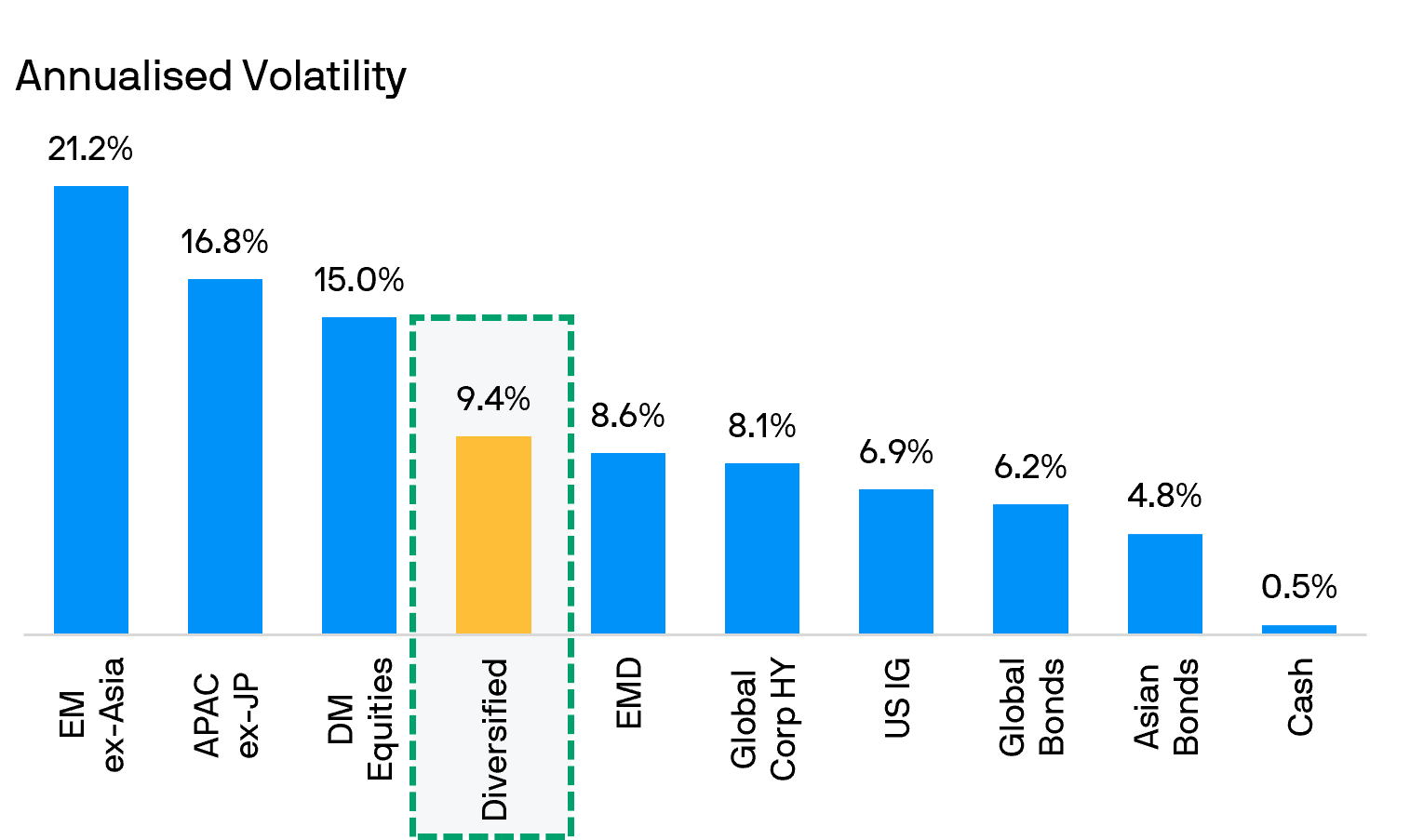

Such a portfolio also experienced just two-thirds of the volatility of developed market equities and less than half of the volatility of emerging market equities.

As such, diversification can help mitigate volatility and harness opportunities across various asset classes.

A diversified portfolio has posted reasonable returns with meaningfully lower volatility versus equities over the last decade.

Annualised performance and annualised volatility (Apr 2015- Apr 2025)

Source: Bloomberg Finance L.P., Dow Jones, FactSet, J.P. Morgan Economic Research, MSCI, J.P. Morgan Asset Management. The “Diversified” portfolio assumes the following weights: 20% in the MSCI World Index (DM Equities), 20% in the MSCI AC Asia Pacific ex-Japan (APAC ex-JP), 5% in the MSCI EM ex-Asia (EM ex-Asia), 10% in the J.P. Morgan EMBIG Index (EMD), 10% in the Bloomberg Barclays Aggregate (Global Bonds), 10% in the Bloomberg Barclays Global Corporate High Yield Index (Global Corporate High Yield), 15% in J.P. Morgan Asia Credit Index (Asian Bonds), 5% in Bloomberg Barclays U.S. Aggregate Credit – Corporate Investment Grade Index (U.S. IG) and 5% in Bloomberg Barclays U.S. Treasury –Bills (1-3 months) (Cash). Diversified portfolio assumes annual rebalancing. All data represent total return in U.S. dollar terms for the stated period. 10-year total return data is used to calculate annualised returns (Ann. Ret.) and 10-year price return data is used to calculate annualised volatility (Ann. Vol.) and reflect data as of the latest month-end. Please see disclosure page at end for index definitions. Past performance is not a reliable indicator of current and future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Data reflect most recently available as of 01.05.2025.

1. For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

Our Latest Insights

On Investors' Minds - APAC Edition

Listen to the latest insights from Tai Hui to better understand what is happening in the financial markets from our

Asia Pacific headquarters in Hong Kong

Multimedia

Introducing our Guide to ETFs

11 Mar 2025

Rory Caines's favourite slides - Guide to ETFs

18 Mar 2025

Philippe El-Asmar's favourite slides - Guide to ETFs

18 Mar 2025

A quick update on U.S. inflation and job market

13 May 2024

Federal Reserve’s policy outlook and its investment implications

30 Apr 2024

2Q24 Guide to the Markets Videocast

28 Mar 2024

China’s 2024 Growth Target and Economic Priorities

22 Mar 2024

Opportunities in U.S. equities

12 Mar 2024

Bank of Japan, its policy outlook and its potential impact on the Japanese yen and equity market

03 Mar 2024

Why 2024 could be a better year for Asian equities?

27 Feb 2024

Opportunities in Asia fixed income

26 Jan 2024

Year Ahead 2024 – Asset allocation and potential risks

04 Jan 2024

Are investors too optimistic about policy easing in 2024?

27 Dec 2023

Understanding small cap valuations

19 Dec 2023

How to position fixed income under different economic and interest rate scenarios?

23 Nov 2023

Year Ahead 2024 - U.S. & China economy outlook and 2024 elections

21 Nov 2023

Rising U.S. bond yields and implications for Asia

03 Nov 2023

What is the outlook for the 3Q23 US earnings season?

19 Oct 2023

4Q23 Guide to the Markets Videocast

29 Sep 2023

Taking stock of developed market central banks’ policy directions

03 Oct 2023

U.S. corporate investments and its impact on Asia tech

15 Sep 2023

Assessing the financial and deflation risk from a weak China recovery

04 Sep 2023

3Q23 Guide to the Markets Videocast

30 Jun 2023

Gauging the direction of global corporate earnings

19 Jun 2023

Don't overlook the opportunities within Asia fixed income

12 May 2023

2Q23 Guide to the Markets Videocast – Equities

03 May 2023

2Q23 Guide to the Markets Videocast – Fixed Income

25 Apr 2023

2Q23 Guide to the Markets Videocast

30 Mar 2023

Re-exploring investment opportunity in China

22 Mar 2023

What’s the latest 4Q22 U.S. earnings telling us?

23 Feb 2023

Year Ahead 2023 - Role of cash and fixed income

19 Jan 2023

Year Ahead 2023 - Outlook of Chinese and Asian markets

10 Jan 2023

Year Ahead 2023 - U.S. economy and monetary policy

22 Dec 2022

China market: buoyant market sentiment along a bumpy road to recovery

15 Dec 2022

Year Ahead 2023 - Introduction

13 Dec 2022

Long-term investment opportunity is looking bright

01 Dec 2022

A glimpse of hope for U.S. and China equities?

18 Nov 2022

Key events to watch out for to gauge China’s policy pivot

11 Nov 2022

4Q22 Guide to the Markets Videocast – Equities

02 Nov 2022

4Q22 Guide to the Markets Videocast – Fixed Income

24 Oct 2022

4Q22 Guide to the Markets Videocast

03 Oct 2022

A strong dollar and impact on Asian currencies

30 Sep 2022

Things to watch out for in September FOMC meeting

15 Sep 2022

Fed policy outlook after Jackson Hole

02 Sep 2022

The outlook for Asian electronics and internet platforms

11 Aug 2022

3Q22 Guide to the Markets Videocast – The return of investment in fixed income

28 Jul 2022

3Q22 Guide to the Markets Videocast – Taking a more balanced approach in asset allocation

26 Jul 2022

3Q22 Guide to the Markets Videocast

04 Jul 2022

A few thoughts on fixed income

30 Jun 2022

Gauging U.S. economic recession risk

17 Jun 2022

China stimulus measures: what have been introduced and what is the next key catalyst

02 Jun 2022

2Q22 Market Outlook

25 May 2022

How should investors handle the current bout of market volatility?

19 May 2022

Pressure on the yen and the yuan

05 May 2022

2Q22 Guide to the Markets Videocast – Some possible change in trends

27 Apr 2022

2Q22 Guide to the Markets Videocast – Asset Allocation

26 Apr 2022

2Q22 Guide to the Markets Videocast

31 Mar 2022

Key drivers and outlook of U.S. inflation

18 Mar 2022

Should investors worry about stagflation?

11 Mar 2022

What to expect from the NPC annual session?

23 Feb 2022

Liquid alternatives 101

15 Feb 2022

4Q21 U.S. earnings update

10 Feb 2022

The Year Ahead 2022 - Asset allocation and investment outlook

23 Dec 2021

Year Ahead 2022 - Inflation outlook of the US and Fed policy

20 Dec 2021

The Year Ahead 2022_Global economic outlook and China’s growth prospects

28 Dec 2022

Why does Japan deserve investors’ attention?

08 Dec 2021

How should Asian investors react to the Omicron variant?

03 Dec 2021

Will the COVID-19 resurgence derail Chinese economic recovery?

17 Nov 2021

Why is COP26 relevant to Asian investors?

03 Nov 2021

4Q21 Guide to the Markets Videocast – Equity allocation

25 Oct 2021

4Q21 Guide to the Markets Videocast – Asset Allocation

25 Oct 2021

4Q21 Guide to the Markets Videocast

29 Sep 2021

How to navigate the three challenges in China?

23 Sep 2021

What could trigger a market correction?

16 Sep 2021

Will disappointing payrolls derail the taper?

09 Sep 2021

How would QE tapering impact on investment?

02 Sep 2021

Firmer than expected U.S. 2Q earnings

19 Aug 2021

What now for Chinese equities?

05 Aug 2021

3Q21 Guide to the Markets Videocast – Income generation in a rising yield environment

03 Aug 2021

3Q21 Guide to the Markets Videocast – Asset Allocation

22 Jul 2021

3Q21 Guide to the Markets Videocast

30 Jun 2021

Is a more hawkish Federal Reserve bullish for the USD?

02 Jul 2021

Is equity market correction coming?

17 Jun 2021

What’s driving the Chinese yuan stronger and what’s next?

04 Jun 2021

J.P. Morgan China Income Strategy

26 May 2021

J.P. Morgan China Growth Strategy

26 May 2021

1Q21 U.S. earnings season and its investment implications

21 May 2021

What will higher U.S. taxes mean for the market?

06 May 2021

2Q21 Guide to the Markets Videocast – Equity allocation

23 Apr 2021

2Q21 Guide to the Markets Videocast – Investing in a rising yield environment

23 Apr 2021

2Q21 Guide to the Markets Videocast

31 Mar 2021

Are emerging markets vulnerable to the recent rise in U.S. Treasury yields?

18 Mar 2021

What to expect from the upcoming National People’s Congress in China?

04 Mar 2021

Reasons behind rising bond yields and inflation concern

25 Feb 2021

How should Asian investors handle the current bout of market volatility?

18 Feb 2021

U.S. President Joe Biden’s policy priorities and its investment implications

27 Jan 2021

1Q21 Guide to the Markets Videocast – Equities

25 Jan 2021

1Q21 Guide to the Markets Videocast – Asset Allocation

21 Jan 2021

1Q21 Guide to the Markets Videocast

23 Dec 2020

Market concern on inflation and its investment implications

11 Dec 2020

Implications from rising corporate bond defaults in China

03 Dec 2020

Year Ahead 2021 - Generating Income

03 Dec 2020

Year Ahead 2021 - Asset Allocation

23 Nov 2020

COVID-19 vaccine breakthrough and its investment implications

19 Nov 2020

Year Ahead 2021 - Economic and policy outlook

17 Nov 2020

Recent wave of COVID-19 outbreak and its investment implications

06 Nov 2020

4Q20 Guide to the Markets Videocast – Generating Income

03 Nov 2020

4Q20 Guide to the Markets Videocast – Asset Allocation

20 Oct 2020

4Q20 Guide to the Markets Videocast

05 Oct 2020

China’s improving macro data, recent major catalysts on financial market development and their investment implications

30 Sep 2020

Latest U.S. equity market and its investment implications

18 Sep 2020

Federal Reserve’s monetary policy framework and its investment implications

03 Sep 2020

China’s policy priorities and investment implications

20 Aug 2020

Reasons behind the weakness of U.S. dollar and its investment implications

07 Aug 2020

3Q20 Guide to the Markets Videocast – Fixed Income

16 Jul 2020

3Q20 Guide to the Markets Videocast – Asset Allocation

10 Jul 2020

3Q20 Guide to the Markets Videocast

30 Jun 2020

What should investors do following strong equity market rebound?

18 Jun 2020

Potential investment opportunities in Chinese bond market

04 Jun 2020

Federal Reserve’s interest rate policy and its investment implications

21 May 2020

Potential economic structural changes and its impact on the investment landscape

07 May 2020

Updates on COVID-19 pandemic and its investment implications

23 Apr 2020

2Q20 Guide to the Markets Videocast – Asset Allocation

16 Apr 2020

2Q20 Guide to the Markets Videocast – Dealing with zero policy rates

08 Apr 2020

2Q20 Guide to the Markets Videocast

01 Apr 2020

Demand for liquidity and its investment implications

27 Mar 2020

Oil price collapse and its investment implications

12 Mar 2020

Latest development on the COVID-19 outbreak and its impact on market sentiment

27 Feb 2020

Chinese policy on coronavirus outbreak and its investment implications

13 Feb 2020

1Q20 Guide to the Markets Videocast – Asset allocation

14 Jan 2020

1Q20 Guide to the Markets Videocast – China economic outlook

08 Jan 2020

1Q20 Guide to the Markets Videocast

02 Jan 2020

Latest U.S. Fed policy rate decision and its investment implications

17 Dec 2019

Year Ahead 2020 - The macroeconomic outlook

14 Nov 2019

Latest Asian export performance and its investment implications

02 Dec 2019

Year Ahead 2020 - The economic environment

09 Dec 2019

4Q19 Guide to the Markets Videocast – Asset Allocation

22 Oct 2019

4Q19 Guide to the Markets Videocast – Negative yields

09 Oct 2019

October FOMC meeting and its investment implications

01 Nov 2019

3Q U.S. earnings and its investment implications

18 Oct 2019

4Q19 Guide to the Markets Videocast

03 Oct 2019

The A-share weighting increase by MSCI and its investment implications

29 Aug 2019

The inverted yield curve and its investment implications

18 Aug 2019

INTRODUCING RETIREMENT INSIGHTS (PERSONAL INVESTORS)

22 Jul 2019

3Q19 Guide to the Markets – Income Generation

18 Jul 2019

3Q19 Guide to the Markets - Asset Allocation

10 Jul 2019

3Q19 Guide to the Markets Overview

03 Jul 2019

2Q19 Guide to the Markets – Asian Equities

24 Apr 2019

2Q19 Guide to the Markets – Asset Allocation

08 Apr 2019

2Q19 Guide to the Markets Overview

02 Apr 2019Selecting an active ETF to meet your long-term goals can feel overwhelming. As a starting point, you may consider focusing on three key factors, just like when you ponder on your food preferences.

Consider three factors to help guide your decision.

First, the strategy

Unlike passive ETFs, each active ETF has a distinct management style and investment strategy.

Some may seek outperformance, while others may aim to achieve certain outcomes such as generating regular income or reducing volatility.

So, take a look at the 'menu' that tells you what it is trying to deliver, its composition and long-term performance.

Then make sure the chosen active ETF is a good fit for your own investment goals and risk appetite.

Second, the brand.

Choosing a provider with a good track record is key to active ETF investing.

You need someone who is experienced, possesses strong research capabilities, and has a dedicated capital markets team to ensure adequate liquidity.

Finally, the cost.

Remember higher fees can eat into your returns, and lower fees alone don’t always mean better value.

Compare both cost and performance to get the best value.

Are you ready to select your active ETFs now?

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programmes are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programmes, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain su cient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its a liates worldwide. This communication is issued by the following entities: in the United Kingdom by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions by JPMorgan Asset Management (Europe) S.à r.l.; in Hong Kong by JF Asset Management Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited; in Singapore by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), or JPMorgan Asset Management Real Assets (Singapore) Pte Ltd (Co. Reg. No. 201120355E); in Taiwan by JPMorgan Asset Management (Taiwan) Limited; in Japan by JPMorgan Asset Management (Japan) Limited which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Korea by JPMorgan Asset Management (Korea) Company Limited; in Australia to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Cth) by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919); in Brazil by Banco J.P. Morgan S.A.; in Canada for institutional clients’ use only by JPMorgan Asset Management (Canada) Inc., and in the United States by JPMorgan Distribution Services Inc. and J.P. Morgan Institutional Investments, Inc., members of FINRA; and J.P. Morgan Investment Management Inc. In APAC, distribution is for Hong Kong, Taiwan, Japan and Singapore. For all other countries in APAC, to intended recipients only. Copyright 2018 JPMorgan Chase & Co. All rights reserved.

Material ID: 0903c02a8237b71d

You can’t be a step ahead of the market, but you can be ahead in your investing. Access our investment ideas.

Seeking attractive income opportunities

Tapping into viable long-term trends

Navigating market highs and lows

Featured solutions

Multi-asset Solutions

Fixed Income Solutions

Provided for information only based on market conditions as of date of publication, not to be construed as offer, research, investment recommendation or advice. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met. Indices do not include fees or operating expenses and are not available for actual investment.

Diversification does not guarantee investment return and does not eliminate the risk of loss.