Bonds 101: ‘ABS’ and ‘MBS’ as a diversifier in a portfolio

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Aug 2021 (2-minute read)

Long-term investing is an essential and key component in financial planning. For some people, the process of achieving their financial goals can seem overwhelming, and this could sometimes lead to hesitation over when and how to begin investing.

In a two-part series, we share our insights on five frequently asked questions (FAQs) on long-term investing. We begin this investment journey with the first two FAQs.

1. When should I start investing?

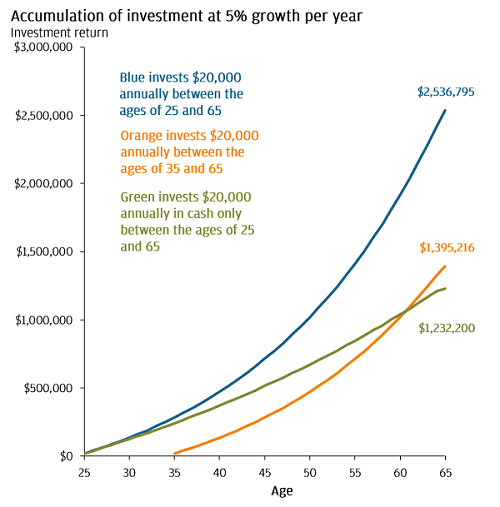

Some people may wonder when is an optimal time to start investing. And the answer - based on your investment objectives and risk appetite, start as early as possible so that you can use time to your advantage.

Harness compounding1

1. Source: J.P. Morgan Asset Management. Investment involves risks. For illustrative purposes only, assumes a 5% return on investment and a 2% return on yearly basis on cash in investors’ base currency with no indication and/or implication of actual return of investments. Actual investments may incur higher or lower growth rates and charges or even negative growth rates. Data reflect most recently available as of 30.06.2021.

2. How to take the first step in investing?

Just as you would choose a destination before you start travelling, you would need to set financial goals for your long-term investing journey.

Conclusion

While the process of achieving their financial goals can seem overwhelming for some people, it could help to leverage the power of time. Based on individuals’ investment objectives and risk appetite, it is key to start investing early to optimise the benefits of compounding.

As you embark on your long-term investing journey, defining your financial goals and crafting a plan to achieve these objectives could help you stay on track.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current or future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.

Going beyond the traditional fixed income sectors to tap into the potential of securitisation.

Fixed income isn’t just government or corporate bonds, it also includes non-traditional debt securities.

Casting a spotlight on exchange-traded funds (ETFs) in Asia Pacific. The guide serves as a go to source for APAC ETF investors – from global trading best practices to tips on portfolio construction.

Feel free to call our InvestorLine or email us if you would like further information about our Funds or J.P. Morgan DIRECT Investment Platform services: