Important information

1. The Fund invests primarily in debt securities.

2. The Fund is therefore exposed to risks related to emerging markets, debt securities (including below investment grade/unrated investment, investment grade bond, credit, sovereign debt, interest rate, valuation and asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”) risks), concentration, convertible securities, currency, derivative, hedging, distribution (no assurance on distribution or the frequency of distribution or distribution rate or dividend yield), class currency and currency hedged share classes. Pertaining to investments in below investment grade or unrated debt securities, these securities may be subject to higher liquidity risks and credit risks comparing with investment grade bonds, with an increased risk of loss of investment. Investments in ABS and MBS may be subject to greater credit, liquidity and interest rate risks compared to other debt securities such as government issued bonds and are often exposed to extension and prepayment risks. These securities may be highly illiquid and prone to substantial price volatility. Investment in RMB hedged share class is subject to risks associated with the RMB currency and currency hedged share classes risks. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point.

A ballast with higher income

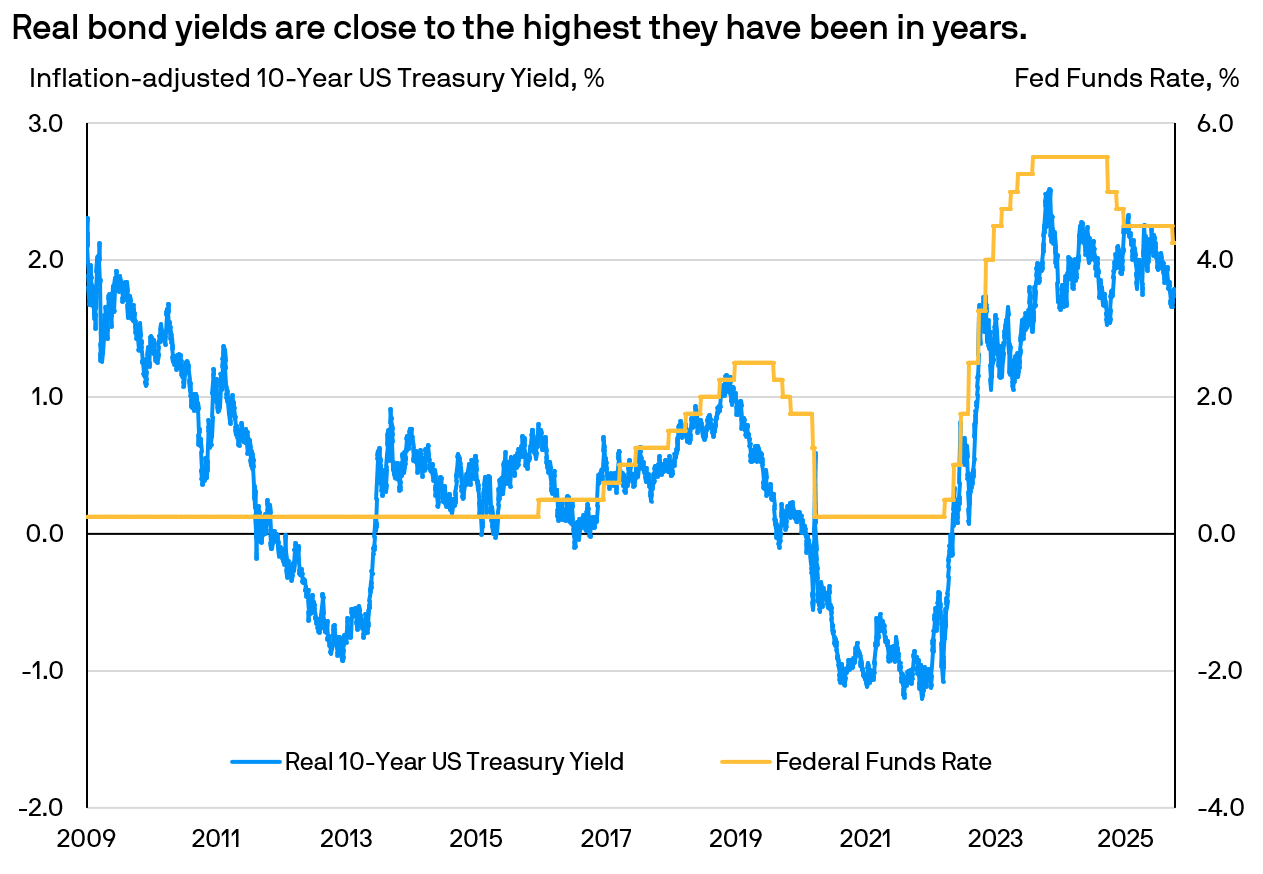

To say that bonds have regained relevance in portfolios would be to state the obvious. As the chart on the right shows, current inflation-adjusted yield on the 10-Year US Treasury continues to hover within the highest range in over a decade, following an extended period of low or even negative real yields.

This steep climb can be traced back to the Federal Reserve’s rapid rate hike cycle in 2022-2023, aimed at quelling inflationary pressure. Three years on, nominal yields continue to offset expected inflation, with real yields firmly back in positive territory. As such, the asset class continues to maintain its relevance as an income-generating ballast for portfolios.

Looking ahead, we believe the fixed income investing landscape remains constructive for several reasons.

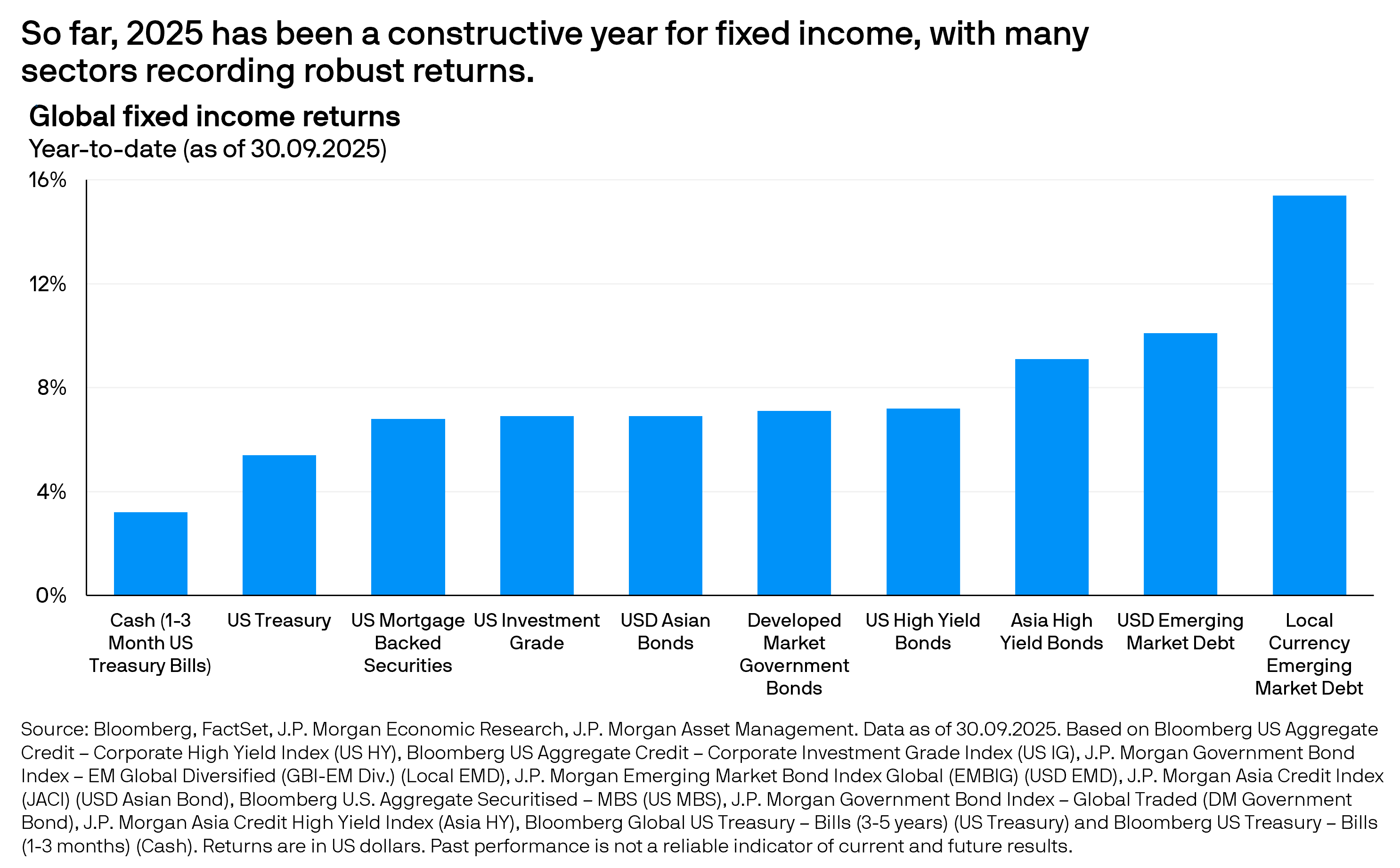

1. Yields across multiple bond sectors continue to trade meaningfully above the past 15-year median, presenting attractive opportunities for income generation.

2. Global central banks have shifted into an easing mode, as inflation pressure recedes and growth momentum moderates. Falling rates may enhance the potential for capital gains.

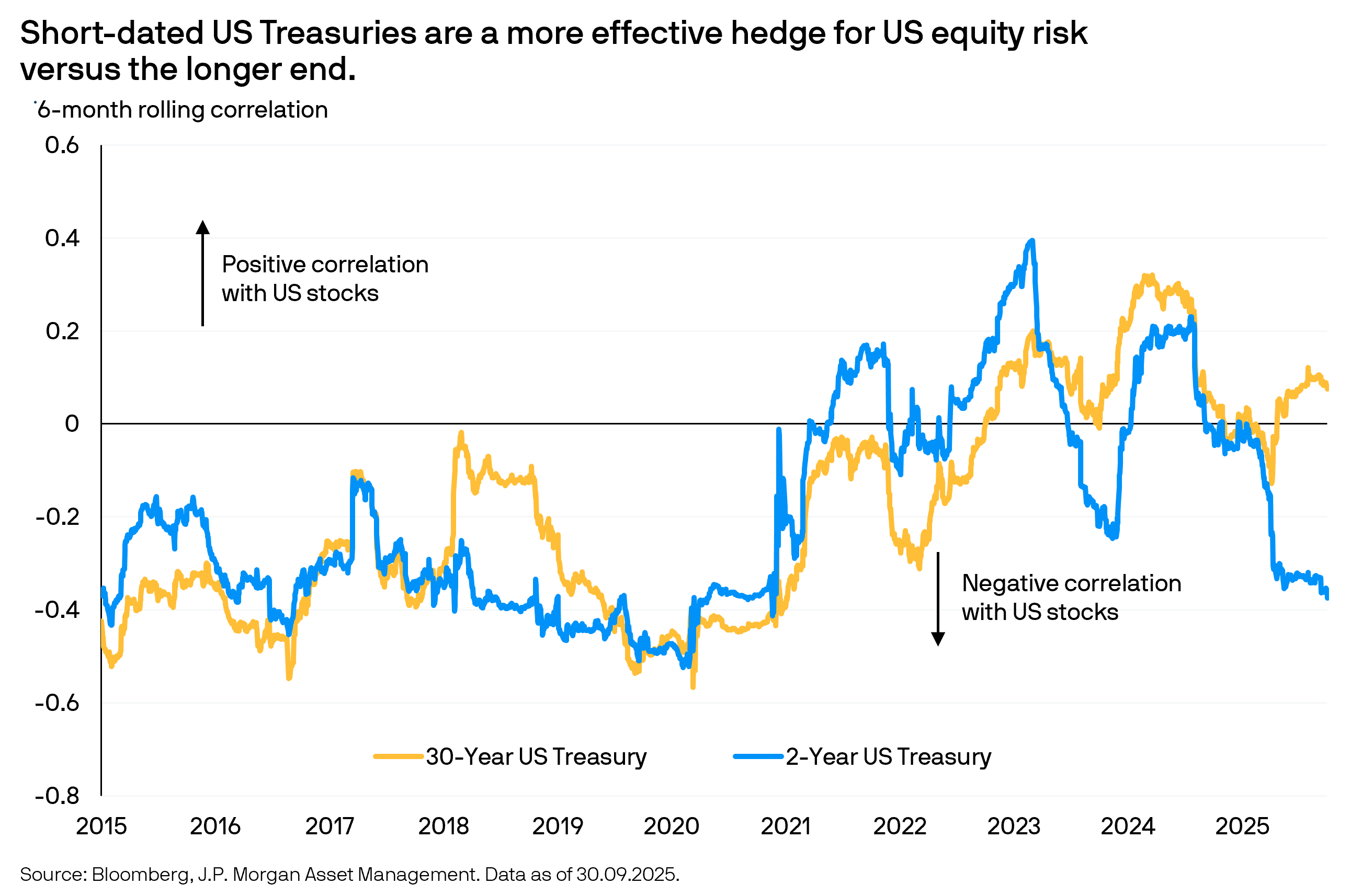

3. Stock-bond correlations have turned negative, particularly as it relates to the shorter-end of the yield curve. This suggests that short duration1 bonds can fulfil its role as a potential ballast for portfolios should downside risks to growth intensify.

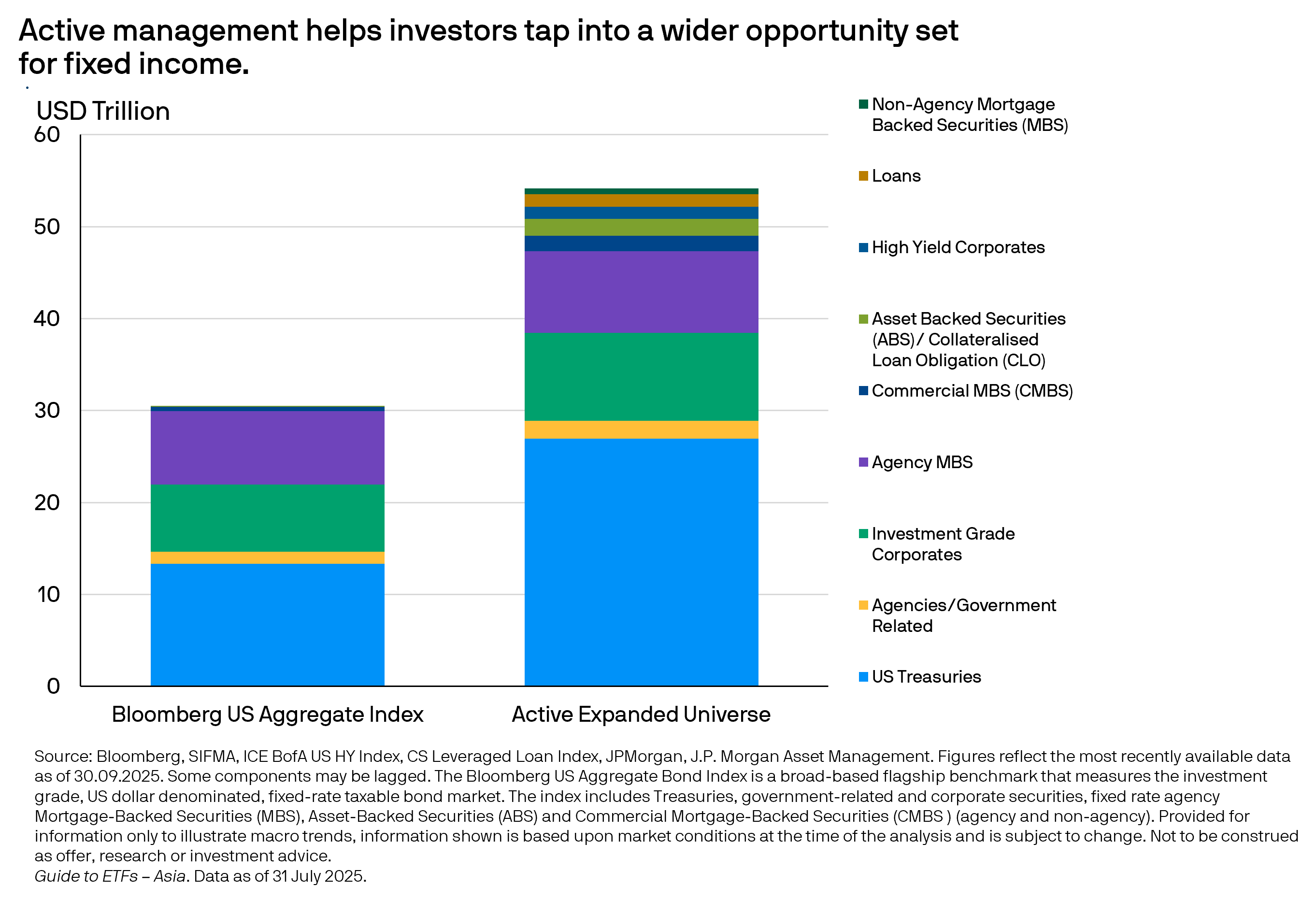

Nevertheless, staying active and flexible will be crucial to harness income opportunities across multiple sectors while dynamically managing credit and duration risks amid a fast changing and uncertain macro environment.

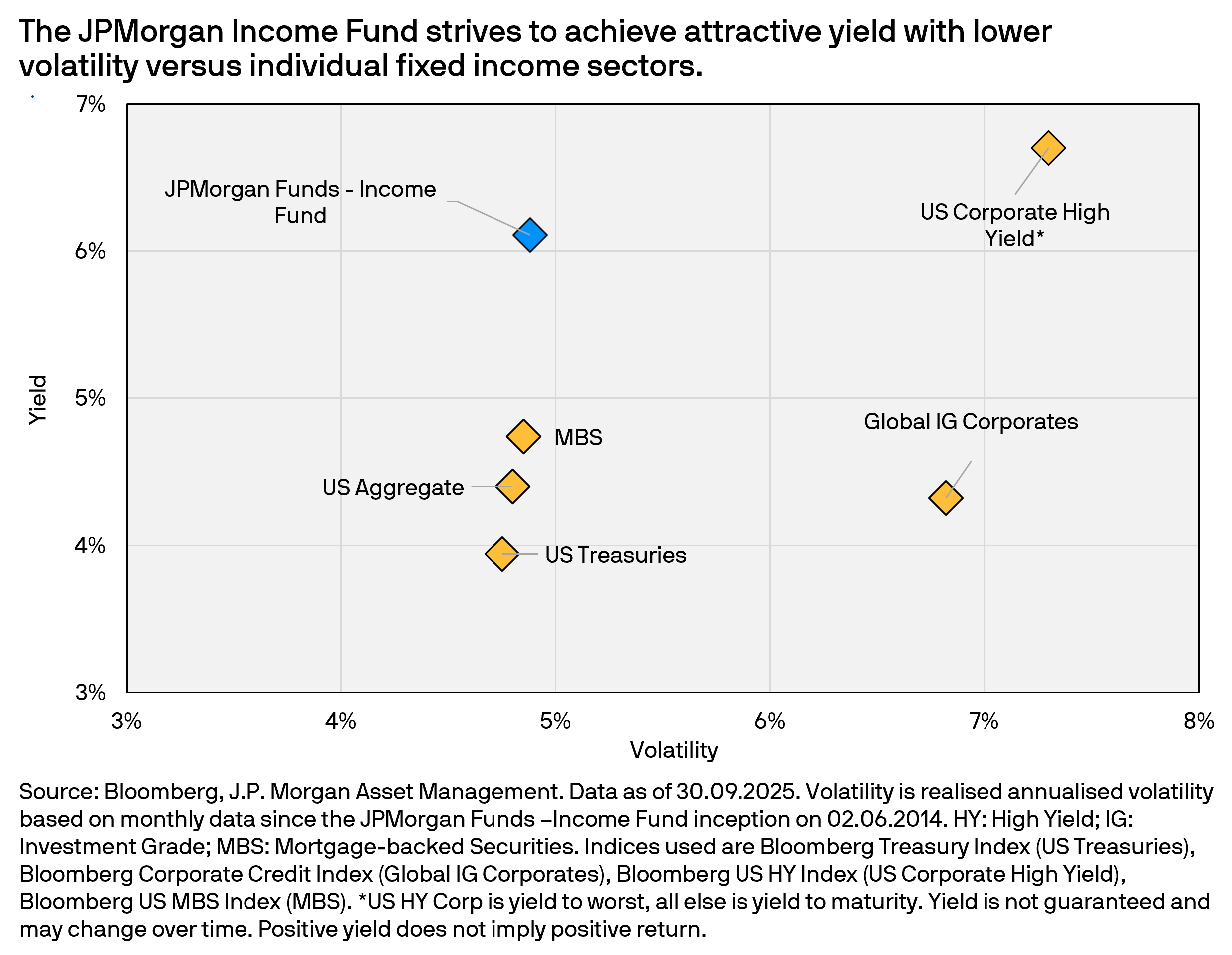

For over a decade, the JPMorgan Funds – Income Fund has successfully navigated multiple economic and political cycles, while recording robust returns, attractive income and lower volatility versus global investment grade bonds. Its long track record of actively managing duration exposure may prove valuable in navigating potential downside growth risks and inflation surprises in the current market environment.