Important Information

Below shows the Important Information of JPMorgan Provident Growth Fund, JPMorgan Provident Balanced Fund, JPMorgan Provident Capital Fund, please click Read More to view full details.

JPMorgan Provident Growth Fund

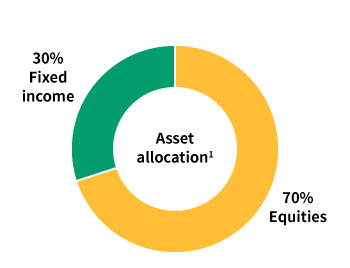

1. The Fund invests primarily (at least 70%) in a professionally managed portfolio of interests in collective investment schemes (including exchange-traded funds). The underlying assets of the Fund will have a majority investment in global equity markets to seek potential higher returns although the

Read More

We understand that different people have different life goals. To start living your dream life, investing can be instrumental in helping you meet your financial goals at the different stages of life.

Available exclusively on J.P. Morgan DIRECT Investment Platform for monthly investment is the newly launched Distribution Unit – R of the JPMorgan Provident Fund Series which comprises three key strategies. Based on your investment objectives and risk appetite, you can consider what could be your ideal plan and invest monthly to help grow your wealth.

Please click JPMorgan Provident Fund Series – Distribution Unit – R: JPMorgan Provident Growth Fund, JPMorgan Provident Balanced Fund, JPMorgan Provident Capital Fund for more Fund Details, including Important Information above.

Features of JPMorgan Provident Fund Series

(Distribution Unit – R)

Designed for monthly investment

JPMorgan Provident Fund Series Distribution Unit – R is now available exclusively on J.P. Morgan DIRECT Investment Platform for monthly investment. You can consider the advantage of dollar-cost averaging by investing a fixed amount regularly, regardless of asset price, to help you better manage market volatility.

# The lower management fee refers to the management fee of the JPMorgan Provident Fund Series – Distribution Unit – R: JPMorgan Provident Growth Fund (1%), JPMorgan Provident Balanced Fund (1%), JPMorgan Provident Capital Fund (0.8%), compared respectively to the management fee of JPMorgan Provident Fund Series – Distribution Unit: JPMorgan Provident Growth Fund (1.25%), JPMorgan Provident Balanced Fund (1.25%), JPMorgan Provident Capital Fund (1.25%). Please note that investing in the JPMorgan Provident Fund Series – Distribution Unit – R involves ongoing charges. Total ongoing charges including management fees and other expenses are: JPMorgan Provident Growth Fund (1.27%), JPMorgan Provident Balanced Fund (1.28%), JPMorgan Provident Capital Fund (1.27%). The ongoing charges figure is estimated because the class is newly set up and recently launched. The figure is based on the estimated costs and expenses of the respective Fund’s investment/administration unit class over 12 months, as of 30 June 2021. The actual figure may be different from the estimated figure and may vary from year to year. For details, please refer to the respective product key facts statements of the funds.

Please click JPMorgan Provident Fund Series – Distribution Unit – R: JPMorgan Provident Growth Fund, JPMorgan Provident Balanced Fund, JPMorgan Provident Capital Fund for more Fund Details, including Important Information above.

JPMorgan Provident Funds

(Distribution Units and Distribution Units – R)

JPMorgan Provident

Balanced Fund

For investors who are willing to take additional risk, aims to increase potential investment returns.

Investment in global equity and bond markets.

Seek to maintain capital and income stability, whilst seek growth opportunities.

Check out annualised yield and performance record on Fund Details.

Remarks:

JPMorgan Provident Growth Fund and JPMorgan Provident Balanced Fund with risk rating 3. JPMorgan Provident Capital Fund with risk rating 2. Risk ratings are based on J.P. Morgan Asset Management’s assessment of relative risk by asset class and historical volatility of the fund where applicable. The risk ratings are reviewed annually or as appropriate and for reference only.

The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

Please click JPMorgan Provident Fund Series – Distribution Unit – R: JPMorgan Provident Growth Fund, JPMorgan Provident Balanced Fund, JPMorgan Provident Capital Fund for more Fund Details, including Important Information above.

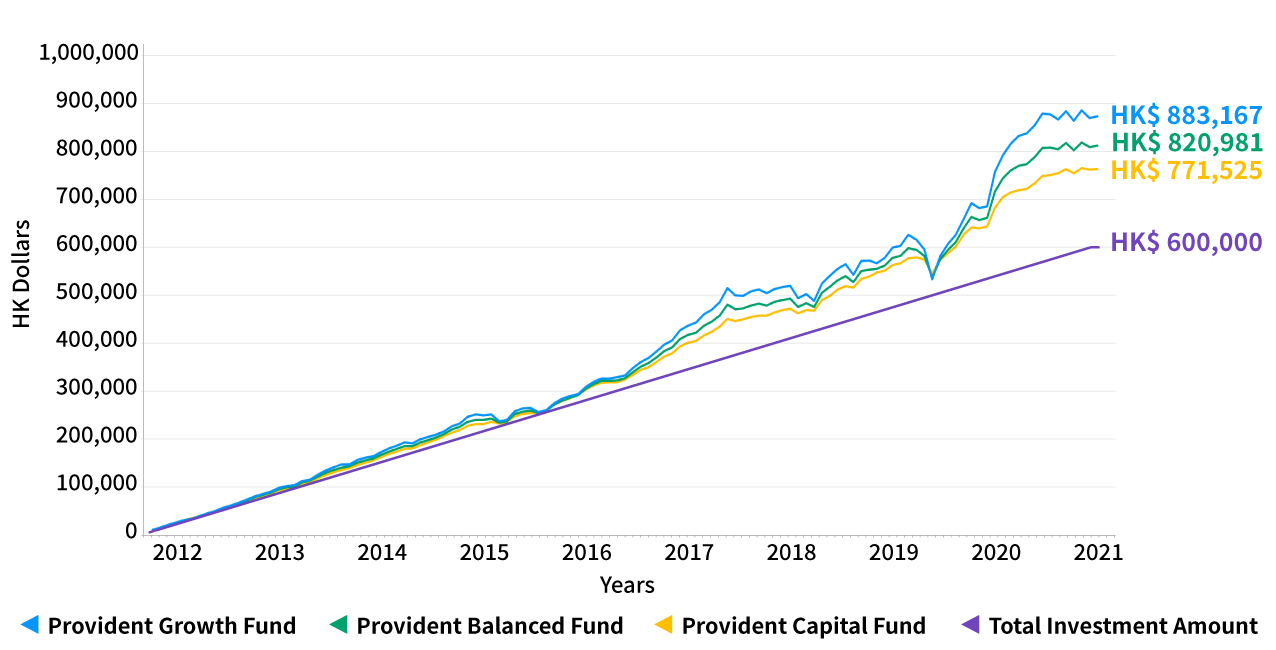

JPMorgan Provident Fund Series Performance Record

(Investment Unit)

Managed by a team of investment professionals, JPMorgan Provident Fund Series can help you navigate changing markets with a spectrum of strategies, seeking capital appreciation, and striving for long-term wealth creation.

Performance of JPMorgan Provident Fund Series – Investment Unit over the past 10 years3:

Monthly investment: HK$5,000

10 years of investment from 1 January 2012 until 31 December 2021

Start investing early to maximise the benefits of compounding.

Let JPMorgan Provident Fund Series be a part of your investment journey.

Remarks:

● The performance calculations shown are based on the historical performance data of the respective funds by contributing the monthly investments for the period of time as shown above with no redemptions during the period. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Provided for information and illustrative purposes only, not to be construed as investment recommendation or advice.

● Figures illustrated in the graph above are rounded to the nearest digit, returns are in Hong Kong Dollar, based on NAV to NAV with income reinvested on ex-dividend dates and are not annualized.

● Investment units of Provident Funds are specifically designed for retirement scheme, and these units are not available on the J.P. Morgan DIRECT Investment Platform. The “Distribution Unit - R” share class of the Provident Funds can be subscribed by retail investors via eScheduler monthly subscription available on the J.P. Morgan DIRECT Investment Platform. Although the classes of units (each as “Class”) whose assets will be commonly invested; where a specific fee structure, currency or distribution policy may be applied. Each Class may have a different charging structure with the result that the net asset value attributable to each Class may differ.

Please click JPMorgan Provident Fund Series – Distribution Unit – R: JPMorgan Provident Growth Fund, JPMorgan Provident Balanced Fund, JPMorgan Provident Capital Fund for more Fund Details, including Important Information above.

* Terms and conditions apply.

1. The Funds are actively managed portfolios; holdings, sector weights, allocations and leverage, as applicable are subject to change at the discretion of the Investment Manager without notice. Individual figures may not add up exactly to the total due to rounding.

Unless stated otherwise, all fund information is sourced from J.P. Morgan Asset Management, as of end-July 2022. The information contained in this document does not constitute investment advice, or an offer to sell, or a solicitation of an offer to buy any security, investment product or service. Informational sources are considered reliable but you should conduct your own verification of information contained herein.

Provided for information only based on market conditions as of date of publication to illustrate macro trends and investment team’s current view, not to be construed as offer, research or investment advice. Forecasts, projections and other forward looking statements are based upon current beliefs and expectations, may or may not come to pass. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecast, projections or other forward statements, actual events, results or performance may differ materially from those reflected or contemplated.

Diversification does not guarantee investment returns and does not eliminate the risk of loss.

For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions. Investors should consult professional advice before investing.