Important Information

1. The Fund invests primarily (at least 70%) in equity securities of listed companies in Asia (excluding Japan), and using derivatives where appropriate.

2. The Fund is therefore exposed to risks related to equity, derivatives, emerging markets, concentration, smaller companies, currency, liquidity, hedging, class currency and currency hedged classes. RMB hedged class also exposes to risks associated with the RMB currency. RMB is currently not freely convertible and RMB convertibility from offshore RMB (CNH) to onshore RMB (CNY) is a managed currency process subject to foreign exchange control policies of and restrictions imposed by the Chinese government. There can be no assurance that RMB will not be subject to devaluation at some point. The Manager may, under extreme market conditions when there is not sufficient RMB for currency conversion and with the approval of the Trustee, pay redemption monies and/or distributions in USD.

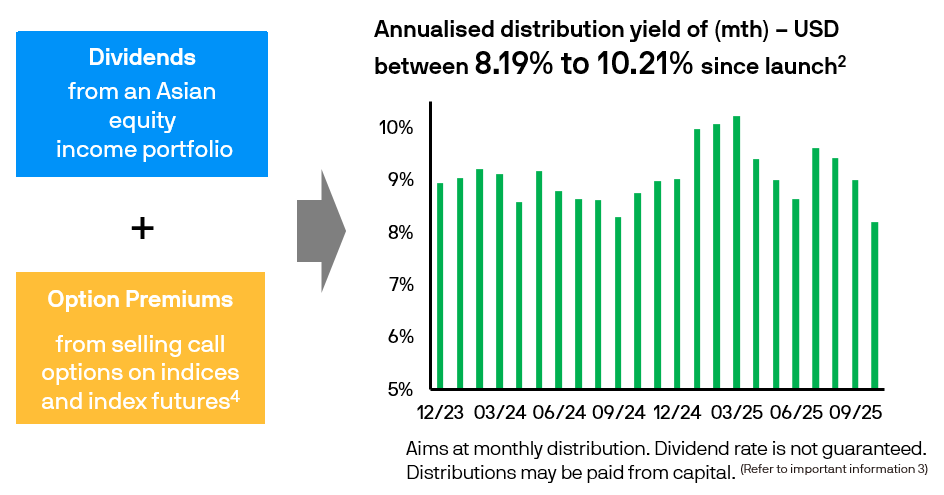

Going beyond traditional equity dividends to consistently generate income

Why Asian equities?

-

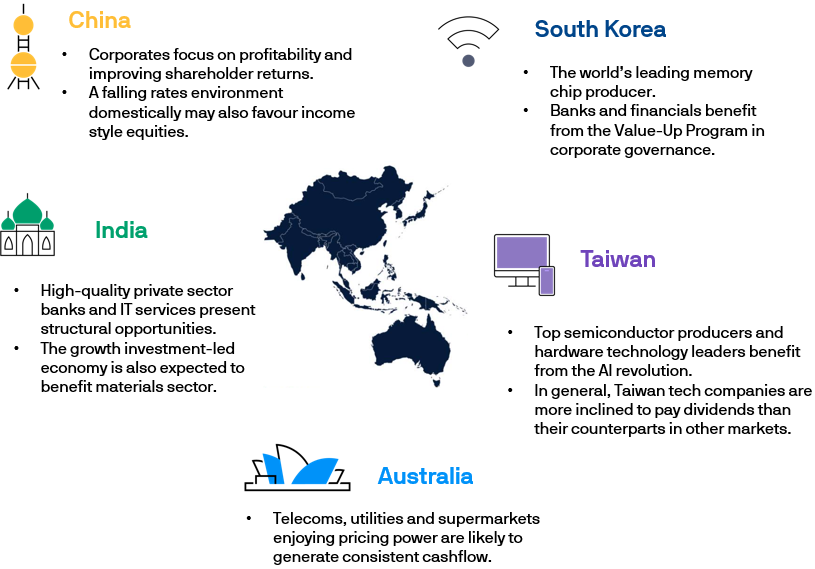

Diverse income & growth opportunities across Asian markets

-

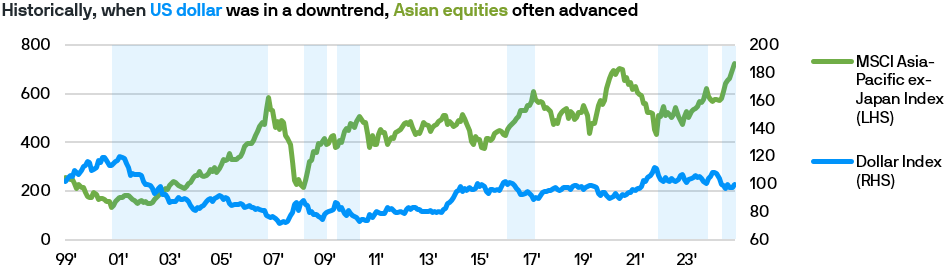

Falling interest rates and a weaker US dollar may favour Asian equities

-

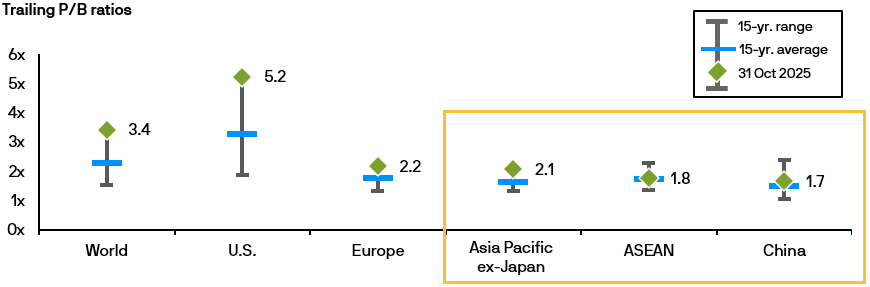

Valuation of Asian stocks are more attractive than global peers

Source: Invest Korea, S&P, J.P. Morgan Asset Management. Data as of end-October 2025.

Source: Bloomberg, J.P. Morgan Asset Management. Data as of end-October 2025. Indices do not include fees or operating expenses and are not available for actual investment.

Source: FactSet, MSCI, J.P. Morgan Asset Management, data as of end-October 2025. Price-to-book (P/B) ratios are calculated by dividing the market price by the book value, using local currency terms. 15-year range for P/B ratios are cut off to maintain a more reasonable scale for some indices.

More Investment Ideas

1. Source: J.P. Morgan Asset Management, from 21.12.2023 to 31.10.2025. Asian equities: MSCI Asia Pacific ex-Japan Index (benchmark of the Fund). ‘Income’ refers to the average dividend yield of the benchmark and the average annualised distribution yield of (mth) – USD of the Fund during the specified period. ‘Volatility’ refers to the standard deviation of the benchmark and the Fund. Standard deviation is a measure of dispersion relative to the mean. Data represents the mathematical results between the benchmark and the Fund. Fund inception date: 21.12.2023. Yield is not guaranteed. Positive yield does not imply positive return. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not a reliable indicator of current and future results.

2. Source: J.P. Morgan Asset Management. Data as of 31.10.2025. Annualised yield = [(1+distribution per unit/ex-dividend NAV)^distribution frequency]-1. The annualised dividend yield is calculated based on the latest dividend distribution with dividend reinvested, and may be higher or lower than the actual dividend yield. Positive distribution rate does not imply positive return. Dividend rate is not guaranteed.

3. Please refer to the Fund’s offering documents for further details on its objectives. The manager seeks to achieve its stated objectives and there is no guarantee they will be met.

4. For illustrative purposes only. There is a potential to forego some capital appreciation as a result of selling call options.

Provided for information only based on market conditions as of date of publication, not to be construed as investment recommendation or advice. The manager seeks to achieve the stated objectives. There can be no guarantee the objectives will be met.

Diversification does not guarantee investment return and does not eliminate the risk of loss. Yields are not guaranteed. Positive yield does not imply positive return.

Investment involves risk. Not all investments are suitable for all investors. Past performance is not a reliable indicator of current and future results. Please refer to the offering document(s) for details, including the risk factors. Investors should consult professional advice before investing. Investments are not similar to or comparable with fixed deposits. The opinions and views expressed here are as of the date of this publication, which are subject to change and are not to be taken as or construed as investment advice. Estimates, assumptions and projections are provided for information only and may or may not come to pass. This document has not been reviewed by the SFC. Issued by JPMorgan Funds (Asia) Limited.