What is different about this commodity cycle?

Explore the divergence between metals and energy prices in modern markets, what drives commodity volatility, and how investors can hedge risks with smart asset allocation.

Guide to the Markets

Comprehensive insights on all the latest global economic and market developments.

![]()

On Investors' Minds - APAC Edition

Listen to the latest insights from Tai Hui to better understand what is happening in the financial markets from our Asia Pacific headquarters in Hong Kong

Explore the divergence between metals and energy prices in modern markets, what drives commodity volatility, and how investors can hedge risks with smart asset allocation.

Kevin Warsh’s nomination as Federal Reserve Chair in 2026 signals a potential shift in U.S. monetary policy, with implications for interest rates, inflation, and financial markets.

Corporate bond yields remain attractive despite tight spreads and elevated risks, with income driving returns and active selection key amid full valuations and robust fundamentals.

Explore how robotics is emerging as the next frontier for AI in 2026, shifting market focus from model creators to infrastructure and real-world applications. Discover the technological breakthroughs, economic trends, commercialization challenges and investment opportunities shaping the future of AI-powered robots.

Regulators are fostering a sustainable uptrend in China’s stock market, anchored by rising insurance premiums and reforms, with balanced growth and high-dividend strategies to help manage volatility in 2026.

This paper discusses how developments within the tech sector could spill over to other sectors as AI adoption broadens over time.

This paper discusses the possibility of further Fed rate cuts in 2026, and the investment implications.

This paper discusses the factors that could drive Singapore equities as a compelling investment opportunity within Asian equity allocations.

This paper discusses the factors surrounding Asian equities' robust 3Q25 earnings results, and the investment strategy ahead.

This paper discusses the use cases for stablecoins, the key risks surrounding stablecoin transactions, and the investment implications.

This paper discusses the case for Asian credit on the back of investment-grade corporates showing strong fundamentals and high-yield credit with lower default risk.

This paper discusses the impact of the tech sector and AI in driving the 3Q 2025 earnings season in the U.S., and the investment implications.

This paper discusses the interplay between energy demand and AI data centers, energy supply and current constraints, and the investment implications.

This paper discusses the recent defaults in the auto sector, and the potential implications for private credit.

This paper discusses the key takeaways from the 4th Plenum of the 20th Communist Party of China Central Committee, and the investment implications.

This paper explores how overlapping partnerships among hyperscalers, chipmakers and model developers are reshaping AI markets with robust fundamentals.

This paper discusses why the yield curve could steepen further with the Federal Reserve cutting rates, and the investment implications.

This paper discusses the potential policy implications of Sanae Takaichi’s election win amid concerns over fiscal deterioration and rising inflation in Japan.

This paper discusses why ASEAN equities can act as effective diversifiers in investors’ Asian equity portfolios in light of uncertain U.S. trade policies.

This paper discusses the potential impact of a U.S. government shutdown on global markets, and the need for investors to diversify across asset classes.

This paper discusses how private equity presents a viable investment opportunity on the back of high valuations and concentration in public markets, and lower rates around the corner.

This paper discusses the support to Chinese equities from AI developments, anti-involution and globalization.

This paper discusses the potential impact of policy rate cuts on risk assets, like equities and corporate credits.

This paper discusses the downward revision of India's 2025 earnings despite a robust macro environment, and the investment implications.

This paper discusses the resilience of China's trade amidst complicated trade dynamics, and the long-term outlook.

This paper discusses the growing importance of the private equity space, and how it can represent superior investment opportunity over small cap stocks.

This paper explores the resilience of Asia's earnings growth for 2Q25 on the back of ongoing U.S. trade policy uncertainty and developments in AI, and the possible investment implications.

This paper discusses the investment implications from the latest 2Q25 U.S. earnings update, and the strategies by companies to mitigate risks from tariff uncertainties and the inflation spike.

This paper addresses the impact of ongoing uncertainties around tariffs on trade, and the investment implications.

This paper discusses the Federal Reserve's dilemma on the back of a slowdown in labor demand and supply, and the investment implications.

This paper discusses the positioning of securitized assets in portfolios on the back of pick-up in yields above U.S. Treasuries and low correlation to equities.

This paper discusses the outperformance of European equities compared to the S&P 500 in 2025, and the factors that could further drive portfolio rebalancing away from the U.S.

This paper discusses the potential for diversification of growth and income opportunities for investors within Chinese equities.

This paper discusses the potential impact of the OBBBA on the U.S. economy, its fiscal position and debt levels, and the investment implications.

This paper discusses the opportunity in real estate on the back of higher-for-longer interest rates creating dislocation and supply constraints.

This paper discusses the need for currency hedging on the back of U.S. economic slowdown and policy directions pressuring the USD downwards.

This paper discusses the ongoing tensions between Israel and Iran, and the implications on oil prices and the global economy.

This paper discusses the impact of artificial intelligence advancement on businesses, and the investment implications.

This paper discusses how commodities, especially gold, can be a valuable investment tool for diversification and hedging against global growth risks.

This paper discusses the possibility of the U.S. economy continuing to slow given materially higher tariff levels and lagged effects from earlier escalations, and the investment implications.

This paper discusses the reasons for Moody's downgrade of the U.S., and the implications for markets and investors.

This paper discusses the impact of a weaker U.S. economy and supportive monetary policies across Asia on Asian growth, and the investment implications.

This paper discusses the resiliency and flexibility of private credit structures, and the possible risks associated during a challenging economic environment.

This paper, written by Adrian Wong, highlights Asian equities' resilience amid tariff uncertainties, offering diversification with undemanding valuations.

This paper discusses the reasons why APAC could be more cushioned to withstand an economic downturn in the U.S. this time around, and the investment implications.

This paper discusses the strong first quarter U.S. earnings data points on the back of tariff uncertainty and a lower U.S. dollar, and the investment implications.

This paper discusses the recent weakness in the U.S. dollar as a result of both policy and economic reasons, and the investment implications.

This paper discusses how investors can diversify their portfolios during market volatility with liquid alternatives, risk management and tactical asset allocation for capital preservation and potential gains.

This paper discusses the latest GDP and economic activity numbers in China and the factors that may impact strong growth for the rest of 2025, along with the investment implications.

This paper discusses the factors surrounding the rise in U.S. Treasury yields, and the investment implications.

This paper discusses the 90-day pause on reciprocal tariffs by U.S. President Trump, and the investment implications.

This paper addresses the potential impacts of the universal and reciprocal tariffs announced by the U.S. on 2nd April, and the investment implications.

This paper, written by Raisah Rasid and Jennifer Qiu, addresses the importance of a diversified portfolio to manage market volatility and capture potential recovery upside.

This paper discusses the tariff proposed and implemented by the Trump administration, and what to expect on April 2nd and the potential impact.

This paper discusses the slowdown in growth in the U.S. economy and the possibility of a recession on the back of policy uncertainty, and the investment implications.

This paper addresses the case for defensive and income seeking strategies on the back of growing uncertainties around government policies, geopolitics and monetary policies.

This paper discusses the key takeaways from the Chinese NPC annual session, and the investment implications for Chinese and Asian investors based off recent market volatility.

This paper discusses how investors can manage the concentration risk in the global equity markets, and the investment implications from diversifying across indices, geographies and asset classes.

This paper discusses the motivation and impact of the proposed U.S. tariffs on its trading partners, and the investment implications.

This paper discusses the impact of higher tariffs and lower immigration on the U.S. economy, and the uncertainty accompanied by the rapid pace of the executive orders initiated by U.S. President Trump.

This paper discusses U.S. President Trump's trade and foreign policy approach, and the possible impact of reciprocal tariffs on markets.

This paper discusses the upward trend in Chinese equities in 2025 on the back of the recent AI developments, and how more positive macro catalysts can help further sustain this market and investor sentiment.

This paper, written by Adrian Wong, discusses the attractiveness of Asian equities on the back of 4Q earnings releases, and the investment implications.

This paper addresses the case for transport assets as a means for portfolio diversification on the back of broader trade uncertainty and economic volatility.

This paper addresses why the Indian market continues to remain a promising investment opportunity in spite of recent downturn in macroeconomic and market performance.

This paper, written by Tai Hui, addresses why policy easing amid a soft landing backdrop should be positive for both equities and fixed income.

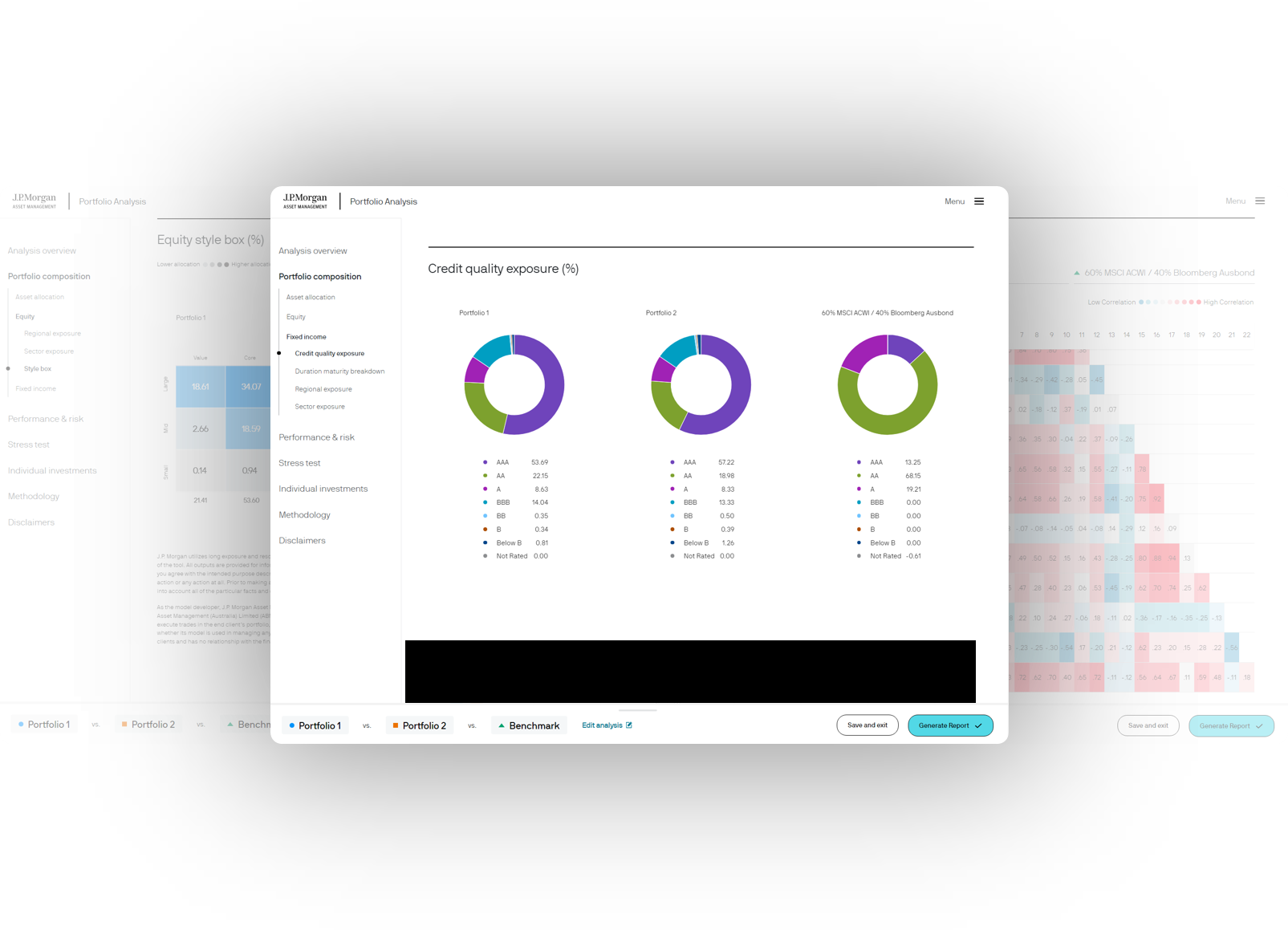

Portfolio insights

Keep portfolios on course through fast-moving markets

Get instant portfolio analytics, side-by-side comparisons, historic stress tests, future scenarios, observations and client reports – all at no cost.

For more information, please call or email us. You can also contact your J.P. Morgan representative.

1800 576 100 (Application enquiries)