Policy easing amid a soft landing backdrop should be positive for both equities and fixed income.

In brief

- Central bankers are adopting a cautious approach as they navigate the current economic landscape.

- The U.S. Federal Reserve (Fed): 75 basis points (bps) of cut expected before year-end, with the first cut likely to happen in the June meeting.

- The Bank of Japan (BoJ) has dismantled the framework of ultra-loose monetary policy, but is yet to commit to a consistent program to bring policy rate to a higher level. The overnight index swap (OIS) market is only expecting the policy rate to rise to 27bps by the end of 2024.

- June seems to be where several central banks could begin their rate cut cycles. This includes the U.S., UK and eurozone. We continue to argue that policy easing amid a soft-landing backdrop should be positive for both equities and fixed income.

Central bankers are adopting a cautious approach as they navigate the current economic landscape. Recent monetary policy meetings held by key central banks, including the Fed, the Bank of England (BoE), and the Reserve Bank of Australia (RBA), have resulted in no major shifts in policy rates. However, there is an expectation of gradual easing in inflation later in the year, which may prompt more central banks to cut rates. Notably, the Swiss National Bank surprised the market with a 25bps rate cut, positioning itself as one of the first movers among developed market central banks.

The BoJ introduced policy changes that signaled a departure from its ultra-loose monetary policy. Despite the perception of a radical shift away from negative rates and Yield Curve Control (YCC), the actual policy changes were relatively modest.

Chair Powell & Co. sticking to the script

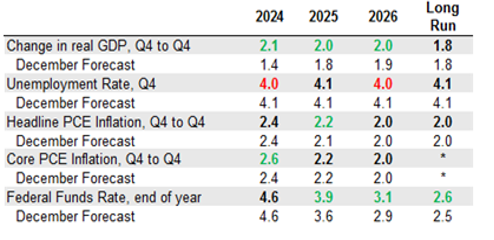

Concerns were raised about the Summary of Economic Projections and the potential need to revise down rate cut forecasts for the year due to strong growth momentum and persistent inflation. However, the committee expressed increased confidence in economic growth, revising its growth forecasts for 2024, 2025, and 2026. While core personal consumption expenditure (PCE) inflation for the fourth quarter of 2024 was revised higher, and unemployment rate forecasts were lowered for 2024 and 2026, the median projection for the policy rate of the fourth quarter of 2024 remained unchanged at 4.6%.

FOMC March 2024 Forecasts

Percent

Source: Federal Reserve, J.P. Morgan Asset Management. Forecasts of 19 FOMC participants, median estimate. Green denotes an adjustment higher, red denotes an adjustment lower. *Longer-run projection for core PCE inflation is not collected. Data are as of 26/03/24.

This suggests a total of 75bps cut before the year-end, with a reduction in the size of rate cuts from 100bps to 75bps for 2025. The market was relieved by these projections, as the Fed is keeping to cut rates this year. We see the first opportunity likely to arise during the June meeting, which is consistent with market expectations.

Bank of Japan: Stepping away… very slowly

The BoJ announced that it is ending negative interest rates, YCC on the Japanese Government Bond (JGB) market, and purchases of exchange traded funds (ETFs) and Japan real estate investment trusts. On paper, these are historical steps to end its ultra-loose monetary policy and quantitative easing. Yet, upon looking more closely, the actual changes are less dramatic. Negative interest rates only affected about 5% of banks’ balance with the central bank, as it was to penalize excess reserves parked with the BoJ. The remaining balance is paid 0%-0.1% interest. After the announcement, all balances with the central bank would be paid 0.1% interest.

On YCC, while the program has officially ended, the BoJ is committed to continue to purchase JGBs at a similar amount as before, which has been around JPY 6trillion in recent months. This does give the BoJ more flexibility to operate. However, it would want to carefully manage the rise in JGB yields to prevent abrupt capital flow by Japanese financial institutions repatriating their overseas investment, as well as a rapid drop in JGB value that could undermine these institutions’ balance sheets. Moreover, given that Japan’s government debt-to-gross domestic product ratio is over 250%, the rise in borrowing cost would also add to the government’s interest payment burden. On ETF purchases, the BOJ’s ETF holdings at book value has been stable at around JPY 3.7trillion since mid-2022. Hence, this was a tool that has been effectively retired for some time. We also don’t think the BoJ will be in a hurry to reduce its ETF holdings, despite some substantial mark-to-market gains.

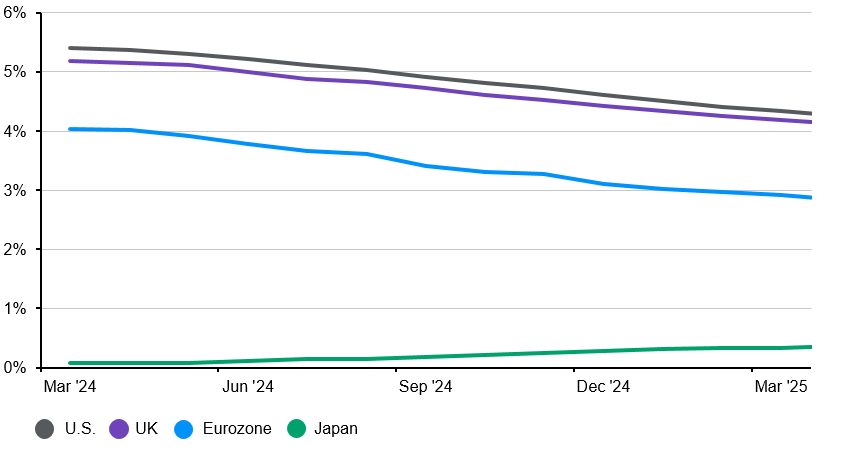

In sum, the Bank of Japan has dismantled the framework of ultra-loose monetary policy, but it has yet to commit to a consistent program to bring policy rate to a higher level. The OIS market is only expecting the policy rate to rise to 27bps by the end of 2024.

Market expectations* for central bank policy rates

Source: Bloomberg L.P., Bank of England, Bank of Japan, European Central Bank, U.S. Federal Reserve, J.P. Morgan Asset Management . *Expectations are based on OIS rates. Past performance is not a reliable indicator of current and future results. Guide to the Markets – Asia. Data reflect most recently available as of 26/03/24.

Patience is a virtue

Switzerland took the lead in cutting rates last week by 25bps to 1.5%. It was able to make the first move because inflation was never a significant problem. It peaked at 3.5% in August 2022, and has since fallen to 1.2% in February 2024. Other developed market central banks don’t have this luxury just yet, but they are patiently looking for signals.

The RBA and the BoE both kept their policy rates unchanged in their March meetings. The RBA is still watchful over the tight labor market, which could lead to wage inflation. For the BoE, the voting pattern of the Monetary Policy Committee (MPC) members is telling. In the February meeting, two MPC members voted for higher policy rates, while one voted for a cut. In March, the vote was 8-1, with one member voting for a cut. The meeting minutes showed that there is still some divergence in view over the economic performance and inflation outlook.

Investment Implications

Overall, June seems to be when several central banks could begin their rate cut cycles. This includes the U.S., UK and eurozone. We continue to argue that policy easing amid a soft- landing backdrop should be positive for both equities and fixed income. Hence, we see an internationally diversified allocation to large cap, quality equities would fit into this scenario. On fixed income, the resilient economic backdrop in the U.S. allows high yield corporate bonds to outperform high quality fixed income, given higher all-in yields. Yet, we still see value in developed market government bonds and investment grade corporate debt to provide some cushion against downside surprises or unexpected financial stress.