Energy transition and carbon neutrality

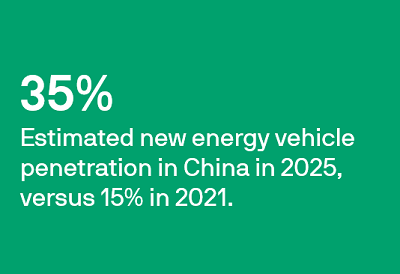

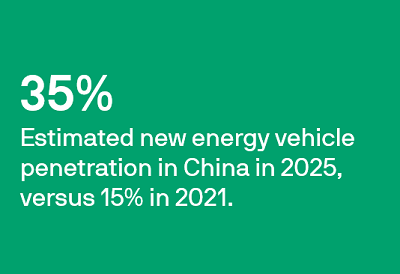

Energy transition and carbon-neutrality are likely to remain one of the core investment themes. We expect rising new energy vehicle penetration, stricter emission standards and controls, and faster adoption of renewable energy to continue, and this could support revenue and earnings growth of related segments.

Source: China Association of Automobile Manufacturers, data as of February 2022. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Additionally, the electric vehicle supply chain and renewables such as solar power supply chains, installation, and storage could present opportunities too.

The expanding middle class

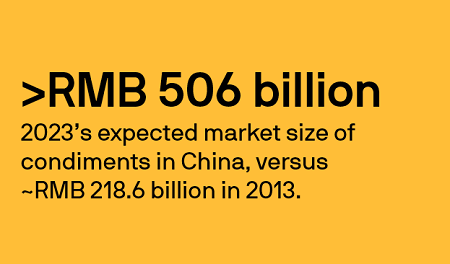

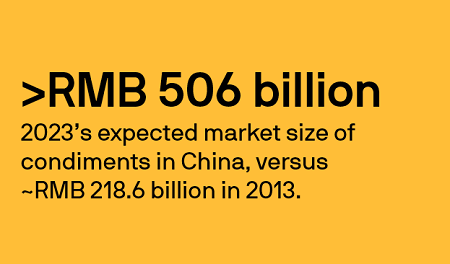

We continue to see brands benefiting from the longer term ‘premiumisation’ trend as the growing middle class demands better and healthier products. In some areas, industry consolidation opportunities can help compound growth.

Source: China Condiment Industrial Association, Euromonitor, as of January 2022. Forecasts and estimates are indicative of macro trends, may or may not come to pass.

Healthcare spending will also likely continue to increase, and we see opportunities in areas such as medical equipment and contract research organisations (CROs) and contract manufacturing organisations (CMOs).

Conclusion

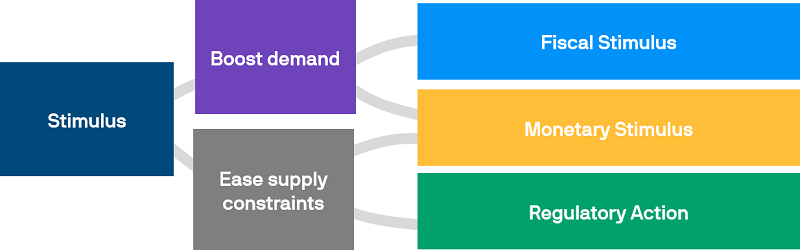

Overall, we are of the view that China’s policy seems to be shifting from de-risk to pro-growth. We are taking a longer term view, despite short term volatility, and are considering to selectively build positions from here.