Emerging markets debt: stronger than it’s ever been

21/11/2019

Andrew Bartlett, CFA

Emerging Markets (EM) Fixed Income spreads remain at the lower range of the last 2 years amidst a 2019 that has delivered record +50 billion USD of positive inflows and +12% total return (EMBIG Diversified), high grade generating almost +15% (EMBIG Diversified IG). The recent spike of global protests share a common social unrest theme that might indicate that EM is returning to the days of the past and valuations stretched. Not so fast.

This isn’t your parents’ EM, nor is it 2008/2016’s EM.

The Hard Currency EM Sovereign universe has matured with the evolution of time & global growth dynamics. The EMBI Global Index is now a more diversified investment vehicle since the credit crisis covering the entire globe with the expansion from 32 countries to the current 73 countries. Fifteen years ago, the 10 largest countries represented 80% of the universe. Today, those same 10 countries represent only 40% of the universe.

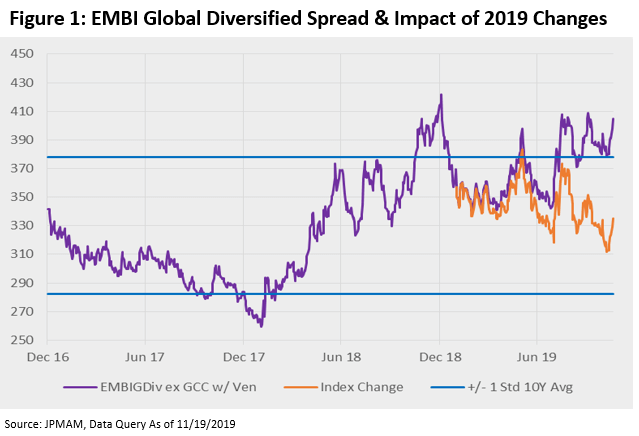

Adding further to the change in the index dynamics was the methodology construction changes. This resulted in the 10-month phased inclusion of 5 Gulf Cooperation Council (GCC) countries: Bahrain, Kuwait, Qatar, Saudi Arabia and United Arab Emirates. This started in January and finished in October. There was also a late summer decision to phase out over 5-months the “market value” impacts of OFAC sanctioned Venezuela. This has had an impact of roughly -25 bps from inclusion of higher rated GCC and an impact of roughly -45 bps from exclusion of defaulted Venezuela (Figure 1). What does this mean? It means the apples-to-apples comparison of the market displays credit spreads near the wider range of 2019 and above the 1 standard deviation average. Bottom-up credits are cheap from a valuation perspective, particularly in BB/B rated names.

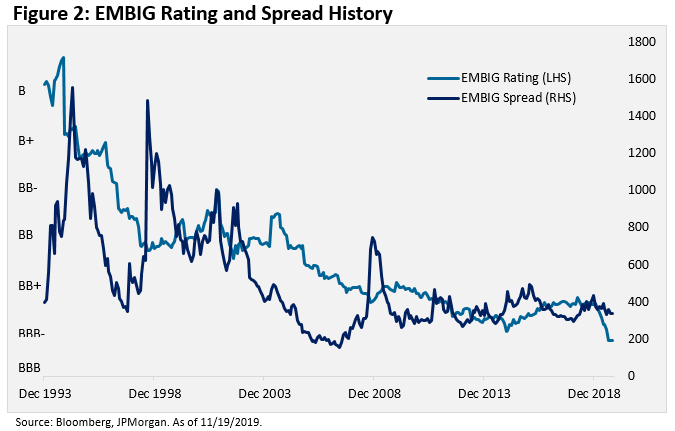

EM has never been better rated on a country-basis.

The EMBIG has never been better rated on a country-basis versus its history (Figure 2). It is true that the political and social unrest is visible in EM, but this underlying tension is also present in Developed Markets (DM) through Brexit, U.S. polarized politics and Hong Kong protests. Prior to 2008 many EM crises affected our markets, but since 2008 the major spread widening events are constrained to DM-led crises or global shocks. The stronger diversification mentioned above helps remove the idiosyncratic risks often associated with EM investing. The inclusion of high-rated GCC issuers improves the profile, yet in total there were 34 rating upgrades versus 18 rating downgrades across the 3 major rating agencies in 2019, and internally the investment grade upgrade candidates outnumber the fallen angel candidates. This isn’t an isolated event, rather it’s structural.

In our view, emerging markets debt deserves the positive attention it has been receiving in era of central bank interference and global hunt for yield. It remains critical to do the credit risk analysis to mitigate tail risk as the index still spans AA-rated to defaulted bonds; however, the flirtation with a BBB rating shows the strength and upside potential of the broader asset class on a long-term investment horizon.