Emerging Market Investment Grade: Market Well Held

13/03/2020

Giles Bedford

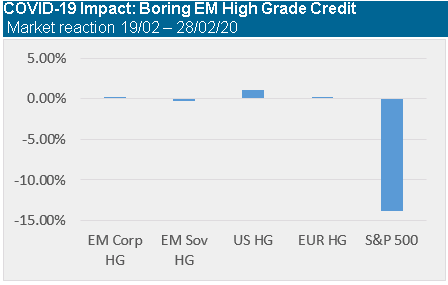

With markets down across the globe, we here on the emerging market debt team are not writing to provide comfort by claiming it is worse with us than you. Nor are we writing to gloat, because like everyone else, we’ve seen a tough couple of sessions after Monday’s oil move. But we are writing to tell you that EMD has not delivered a homogenous drawdown. Instead, there has been a resilience in our arena that is worthy of comment.

So far, EMD’s performance has divided between a more resilient investment grade and a less resilient high yield arena. For some, this outcome is doubtless disappointing, as there is always someone who wants the cheap veal after a good pounding. Sadly for them, the worst has occurred elsewhere. More and more, that looks like a pattern: emerging market investment grade has defied a broad market drawdown with resilience several times recently. If the third is the event that confirms a trend, then consider this one secure.

In the popular imagination, emerging market assets are not supposed to be boring in markets like these, so this feature is something new. For us old timers who have followed this asset class from the glory days of the 1990’s Brady Bonds and Tequila crises, this even feels like potentially dangerous territory. In the eyes of some, “Emerging Markets” has been nearly synonymous with “volatility” to such a degree that some institutional investors have managed to avoid engaging with the space for decades. In the not so distant past, we’ve even met counterparties who proposed that “investment grade emerging market debt” was a sort of bond market oxymoron, destined to end at least in downgrade and more probably in tears.

Source: JPMAM, Bloomberg, As at 28.02.2020

This view is far from dead. Flows into emerging markets have always targeted the higher yielding market segments; investment grade has rarely enjoyed podium finishes in the pursuit of higher income. Spend a few days meeting clients on an EMD roadshow and one will rapidly discover why: most fund selectors still look at EM as a single purpose vehicle that can only be used to add beta to a portfolio. Emerging Market portfolio managers are inevitably expected to be aggressive “risk on” types, for example the sort of person who might have paid their university tuition by ruthlessly fleecing their fellow students in late night card games. Contradict this received wisdom at your peril: “You get paid more in emerging markets because they are more risky”, a senior fund selector told me once, “and they are risky for good reason. I want my manager to embrace that risk, and get me paid properly for it.”

Yet again the oxymoron called EM Investment Grade has defied the street’s prevailing trend. We do not think it is an accident that investors dumped their higher yielding investments but left their IG mostly untouched. It might even be a trend.

So what is driving the resilience?

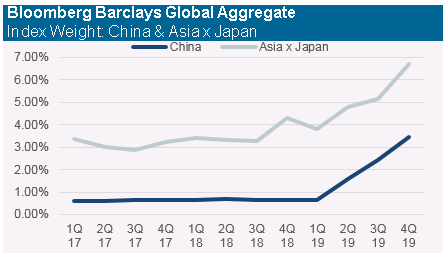

The first factor is relevance. Not so long ago, emerging markets represented less than 3% of the Bloomberg Barclays Global Aggregate. This relatively small weight meant that managers commonly demanded high rewards for allocation, or would cannibalise the space as a source of allocation elsewhere. To attract inflows, emerging markets had to present both a knock down valuation and robust fundamentals to justify any sort of investor engagement. The industry duly responded, offering many aggressive, risk intensive strategies as plays on an already risky marketplace. In turn, this elevated the myth of the risk-on EMD manager, in the shape of those who only ever said “buy” regardless of events, valuations or flows. With investors cheering them on through inflows, risk hungry managers found plenty of places to engage, producing varied results along the way. The market’s understanding of EM as a high risk asset class consolidated, leading to the prevalent conception we enjoy today.

Source: J.P. Morgan Chase & Co, February 2019

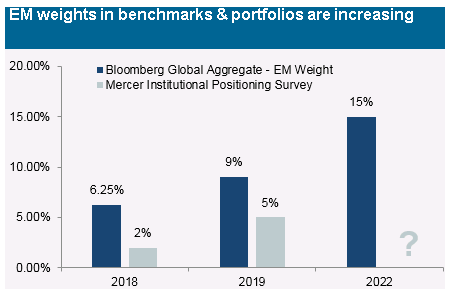

The space is now moving past that understanding. China’s inclusion in many leading bond indexes is delivering the next step in emerging market’s journey towards mainstream opportunity, helped by the global search for yield. At the end of 2019, emerging markets represented 9% of the Bloomberg Global Aggregate. And a few days ago, China joined the JPMorgan GBI – EM index family, on its way to a 10% weighting after a series of tranches. We expect similar news from FTSE Russell’s WGBI indexing team shortly.

The second point is market deepening. Fully half of the broad emerging markets universe is currently investment grade. As the space becomes more addressable to larger investors, emerging market issuers are not responding by flooding the market with bonds. Far from it: in the EM Corporate world, we think 2020 net issuance likely prints the lowest level we have seen since 2015. When we consider the impact on supply presented by financing through tenders, buybacks and calls, the total financing in the hard currency corporate space reduces to $4 billion. In the sovereign space, the market is looking for a similar pattern: $147 billion in gross issuance reduces to $25 billion after amortizations, buybacks and coupons. For reference, we expect $250-300 billion in passive inflows into the local currency space care of China’s inclusion into the Bloomberg Global Aggregate and the JPMorgan – GBI EM Global Diversified. Buyers may come to outnumber sellers.

The third point is maturity, and the diversity of approach it enables. The introduction of the world’s second largest bond market by issuance has raised emerging markets’ relevance to levels that in turn may foster further diversification of investor type and portfolio role. Investment grade already accounts for approximately half of the investable opportunity, so adding Chinese treasury and policy bank debt will only tilt it more towards high grade. Just as a good investor can use a marketplace in different ways to engineer different outcomes, then that larger space should attract more diverse approaches, horizons and timelines. A decade ago, larger institutional investors were rare in emerging markets, while not exactly common today, they are seen more frequently. The idea of a one dimensional, one-size-fits-all emerging markets “game” is at last giving way to a more sophisticated field of engagement. That’s broadly good news for most participants.

The final point is around the subsequent outcome: taken together, EMD’s sponsorship is changing in character. Passive inflows may act to protect downside in a market where net new issuance is limited. But what is ultimately much more interesting is how the institutional investment community chooses to engage with the change. Their exposure levels are low, but steadily rising. Many institutional investors prefer or require relatively higher quality exposure to emerging markets, meaning that the resilience we have seen in the space is consistent with their increasing exposure. Though new, we think this pattern continues from here.

Source: .Bloomberg, Mercer, December 2019