EM central banks – the case for an asymmetrical beta to the fed

01/08/2019

Julien Allard

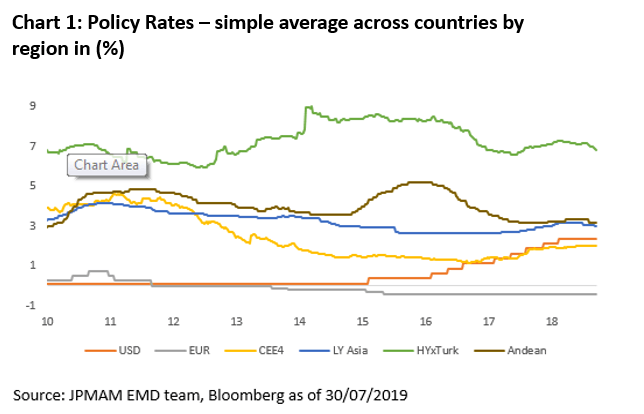

Since its first hike in December 2015 the Federal Reserve has delivered a 225bps hiking cycle. Over the same period the main Central Banks in Emerging Markets have hiked only 50bps on average, or they actually cut policy rate by -33bps when removing Turkey. We could infer from these numbers that EM CB don’t really include the Fed policy in their reaction function – or in other words that they exhibit a low beta to the Fed policy rates. We think that this would be incorrect and here is why.

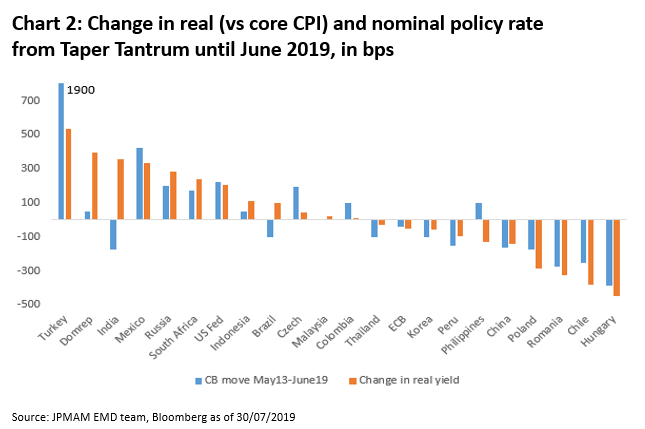

First, the above period of reference is misleading. The real turning point in the Fed tightening cycle is better captured by Taper Tantrum (May-June 2013) than by the first Fed hike (December 2015). The sharp rise in US real yield which occurred in the second half of 2013 led to tighter financial conditions across the board especially for at the time the so-called “fragile five” economies –Turkey, Brazil, South Africa, India, Indonesia – which shared the common feature of being particularly externally exposed. Between Taper Tantrum and the first Fed hike (December 2015) the Central Banks in the fragile five countries hiked between 75bps (Reserve Bank of India) and 675 bps (Bank Central of Brazil) in an effort to protect their currencies.

Second, disinflation in emerging markets has been an offset to the Fed hiking rates. With the exception of some idiosyncratic crises which led to currency depreciation and an inflation spike – such as in Turkey in the summer of 2019 or in Russia in 2015 – inflation has been moderating across most regions. Latin America and Asia overall have seen a very clear downward trend in YOY inflation prints driven by core and non core items. Central and Eastern Europe has been an exception to the rest of EM as the only region which has seen higher core inflation pressure fuelled by tight labour markets and strong wage growth. Emerging markets have been able to maintain elevated real yields relative to developed market not by hiking aggressively but by better anchoring inflation.

Third, looking at the average across the whole period masks a succession of three distinct regimes. The first period started from the Taper Tantrum and continued until 2016. In this period EM Central Banks had to adapt to the switch in the Fed stance and the more externally vulnerable countries were forced into hiking as mentioned above. During the second period – from 2016 to 2017 – the Fed hiked in a well telegraphed manner which did not destabilize the emerging market complex. Central Banks in a number of Emerging Markets were able to engage in deep cutting cycles for example Banrep (Colombia), BCB (Brazil) or NBR (Russia).The third period (2018) saw a resumption of hikes which were driven by a mix of better growth and the necessity for some EM Central Banks to compete with Libor in the 2-2.5% context. In 2018, we saw a number Central Banks hiking rates across the whole low yield-high yield spectrum and in particular Banxico (Mexico), BI (Indonesia), SARB (South Africa), CBRT (Turkey), BCCh (Chile) and CNB (Czech Republic).

Fourth, the sensitivity of EM Central Banks to the Fed varies highly across countries. Banxico stands out as one of the most sensitive Central Banks to the Fed policy as it targets a yield pick up over the Fed rates to compensate for political risk and attract investors. It hiked 425bps since Taper Tantrum. In general the most externally dependent tends to be more exposed to the Fed policy rate (CBRT, BI, RBI, SARB, Banrep) while the Central European Central Banks are less exposed to the Fed as the ECB dominates as a reference point. Mid yielder Central Banks – think BCR (Peru), BOT (Thailand), BNM (Malaysia)- fall somewhere in the middle.

In sum, EM Central Banks have in fact a relatively high beta to Fed policy rates. Going forward we therefore believe that EM Central Banks will deliver a significant cutting cycle across most countries and that they will at least match the Fed cutting cycle, which implies a beta of one or potentially even higher. In a number of countries, real policy rates have increased considerably over the last 5 years and there is room for cutting as activity is slowing down. In the last 13 weeks, 53% of the EM Central Banks have already delivered cuts. After the Fed cut we expect that close to 75% will have joined the party.