Chinese property - a paradigm shift

19/11/2019

Sunny Tam, CFA

Over the past decade, Chinese property and related industries contributed ~15-20% of China’s GDP. Over the same period, the market value of the housing stock ballooned from 92% of GDP in 2009 to 178% of GDP in 2019. The Chinese government appears to be very determined to prevent further rapid growth in property prices and has further tightened credit availability to the sector this year. The operating environment could likely get more challenging in 2020, and we expect more divergence in developers’ performance going forward. Chinese property is one of the largest sectors in the Asia high yield bond universe, and is often considered as one of the “safer” sectors by investors, given limited default cases so far (only two defaults in the USD bond space in the past 10 years) and generally good asset coverage for most companies; however, the perception could change if defaults start to pick up. Some issuers may grow stronger as they consolidate the market, while the weaker ones get eliminated.

Policies now targeting demand side and financing side

Historically we have gone through many policy cycles for the Chinese property sector, but we think the key difference this time is that the government clearly stated that they will no longer use the property sector as a short term economic tool; and credit tightening is across the board, from construction loans, to bond issuance, and even mortgage loans. It is less likely that we would see policy easing anytime soon, and new regulations are virtually capping the total debt available to the sector. The operating environment has changed materially. Overall property sales appears to have reached its peak and is plateauing, if not gradually declining (volume growth is flat, price growth is being curbed).

Operational performance would likely diverge going forward

When markets perform well, developers can use higher growth to offset impacts of higher leverage or higher funding costs. As long as property sales do well, a lot of the weaker/smaller companies can still survive. However with the tighter mortgage loan availability, cash collection rate from property sales will likely be lower than before. As a result, the construction loans required to support the same scale will be higher yet at the same time construction loans are now harder to get. Also, with more stringent rules on bond issuances (basically only refinancing is allowed), developers would have less cash available to buy land too. Some developers may start to focus more on margins, and gradually deleverage during this period, yet others may struggle to survive. Current land bank quality and execution capability of management are also important factors determining how they would perform in the coming years, and this is not always fully captured in credit ratings.

Bond market gradually pricing in the diverging operating performances – more adjustments to come

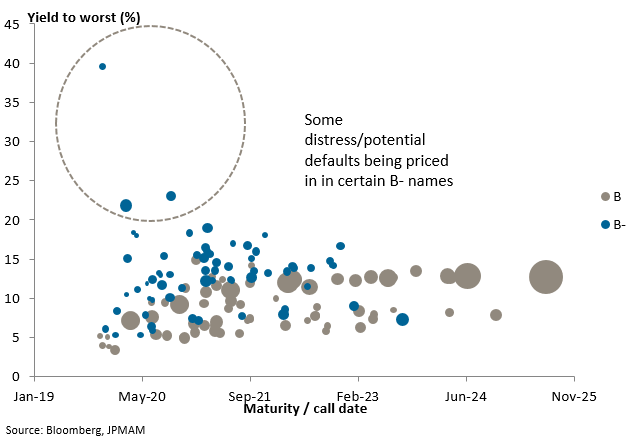

The bond market is already starting to price-in more differentiation between issuers, but this is possibly just the beginning. Some names are already trading at relatively distressed levels, yet if some of them actually default, it could still affect the overall sentiment towards the sector.

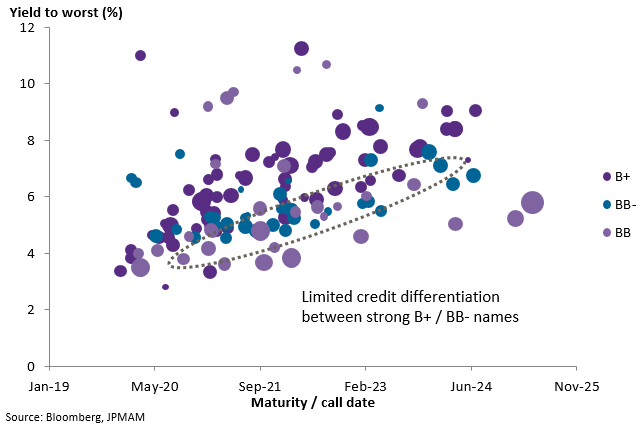

On the other hand there seems to be relatively less differentiation between some stronger B+ names vs BB- names, possibly due to the expectation that they would eventually improve their credit metrics and later get upgraded to BB-, yet it could also be due to complacency of investors on certain names, and valuations could adjust materially if their performances do not meet expectations.

All in all, there are still good investment opportunities within the sector; but we need to be vigilant in monitoring the company’s operational performances and make suitable credit rotations along the way, given that the competitive landscape is constantly evolving. The ability of issuers in adapting to the industry changes should play a much bigger role in credit selection going forward.

Yield charts for various issuers with different ratings