Singapore Dollar – no longer defying gravity

20/02/2020

Aidan Shevlin

Weak growth, elevated currency

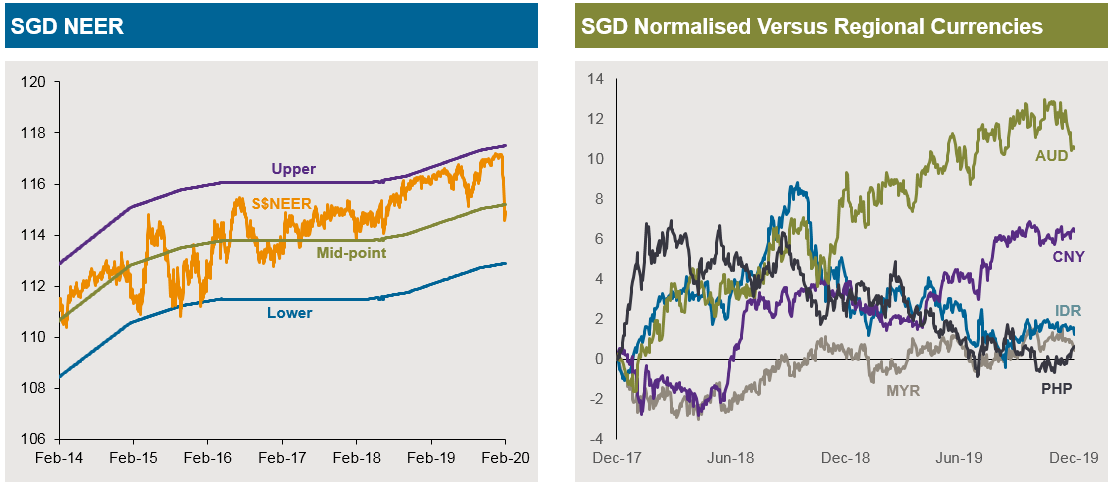

For the majority of 2019, the Singapore nominal effective exchange rate (S$NEER) defied economic gravity, tightly adhering to the top end of its trading range (Fig 1a), while the SGD outperformed many regional currencies (Fig 1b).

However, the potentially large negative impact of the of the Covid-19 virus has prompted a reappraisal of weaker economic data and muted inflation – triggering a notable dovish shift by the Monetary Authority of Singapore (MAS) with significant implications for the SGD and short term interest rates.

Fig 1: The MAS controls the S$NEER; SGD has outperformed regional peers in 2018 & 2019

Source: Citibank, Bloomberg & J.P. Morgan Asset Management. Data as at 12th February 2020

Trade tensions encourage a MAS pivot

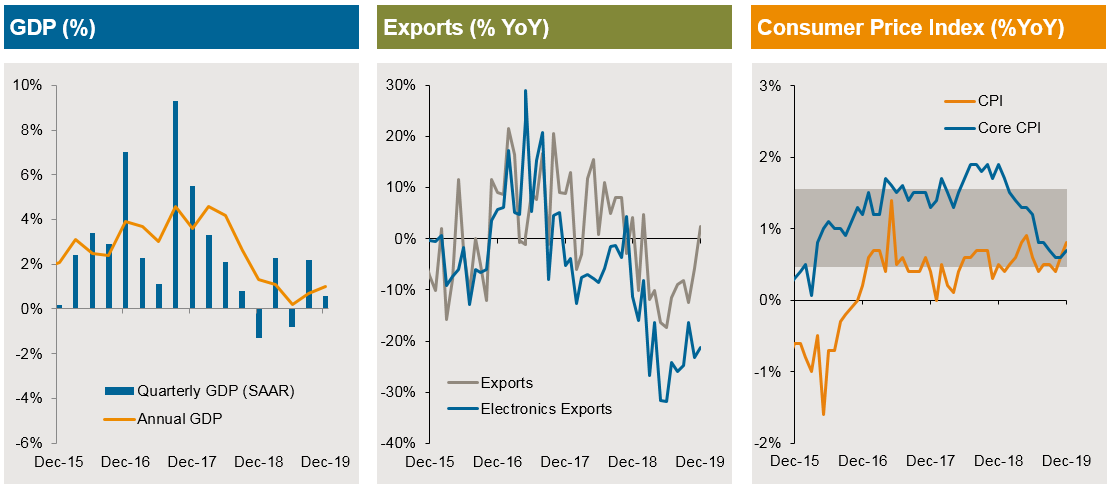

The Singapore economy faced multiple headwinds in 2019 from weaker domestic growth, anemic price pressures and a heightened exposure to global trade tensions (Fig 2). At its April 2019 monetary policy meeting the MAS ended its hawkish hiking cycle, leaving rates unchanged and downgrading its GDP and core inflation targets. Subsequently, weaker than expected growth and further downward revisions to its key targets nudged the central bank to cut the slope of its S$NEER at its October policy meeting, the first easing in over 3.5 years.

The MAS’s modest monetary policy adjustments stood in stark contrast with more aggressive rate cuts by global and regional peers – leaving the S$NEER at the top of its trading range and SGD stronger relative to other Asia-Pacific currencies

Fig 2: Singapore monetary policy depends on trade and inflation

Source: Bloomberg & J.P. Morgan Asset Management. Data as at 15th February 2020

SAAR = seasonally adjusted annualized rate

Despite the policy pivot, Singapore’s economic growth hit a decade low of 1.0%y/y in 2019 as escalating global trade tensions weighted on the Lion city’s open, export dependent economy. Fortunately, lower global interest rates and record tourist arrivals and spending supported a moderate stabilization while the phase 1 US/China trade truce in early January raised the potential of an economic recovery in 2020.

Evolving uncertainty

The unexpected Covid-19 outbreak, with its negative implications for international trade, domestic productivity and tourism has triggered significant uncertainty and concern - especially after Singapore raised its disease outbreak response condition level.

The imposition of travel restrictions on Chinese visitors – the largest source of spending in 2019 - has already dramatically impacted tourism, with significant ramifications for the aviation, hospitality and consumption sectors. In addition, the delayed return of many Chinese workers will impact the construction sector, while manufacturing and export sectors will be negatively affected by China’s delayed re-opening following Chinese New Year holidays. Acknowledging the downside risks, the government downgraded its 2020 growth forecast by 1% to a range of -0.5% to 1.5%.[1]

Rapid fiscal and monetary support

Responding to media queries, on 4th February 2020, the MAS commented[2] that “there is sufficient room within the policy band to accommodate an easing of the S$NEER in line with the weakening of economic conditions as a result of the 2019-nCov”. Such inter-meeting statements are rare and highlight the central banks concern. The de-facto easing triggered an instant market response, with the S$NEER declining sharply below the mid-point of its trading range for the first time since 2017 while the SGD weakened considerably versus the USD.

The MAS confirmed its next policy meeting would occur on schedule in April – allaying concerns of an inter-meeting cut. Given the S$NEER band still has a mild appreciation bias, most economists expect the central bank to either flatten the S$NEER slope or lower the S$NEER trading band.

Implications for cash investors

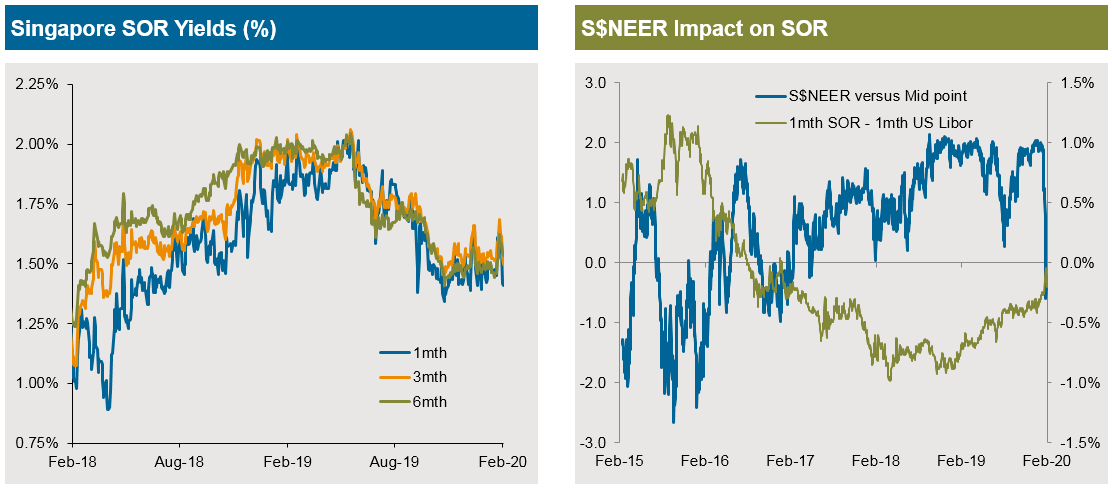

In 2019, Singapore Swap Offer rate (SOR) yields declined (Fig 3a) as the US Federal Reserve (Fed) switched to a dovish policy stance with three rate cuts. However, even as yield curves flattened, SOR yields outperformed their US Libor equivalents, with the spread between the two short term interest rates contracting to a 3.5-year point tight.

Fig 3: Singapore SOR yields are impacted by movements in S$NEER

Source: Citibank, Bloomberg & JPMorgan Asset Management as at 12th February 2020

Historically, SOR yields tend to increase when the S$NEER weakens – especially as it declines below the mid-point of its trading range (Fig 3b). With the Fed on-hold for the foreseeable future and the MAS expected to ease S$NEER policy at its April meeting, it is likely SOR yields could climb further, creating attractive investment opportunities for cash investors who are able to lock in longer tenor securities.

[1] https://www.mti.gov.sg/Newsroom/Press-Releases/2020/02/MTI-Downgrades-2020-GDP-Growth-Forecast-to--0_5-to-1_5-Per-Cent

[2] https://www.mas.gov.sg/news/media-releases/2020/comments-by-mas-on-the-monetary-policy-stance