Macroeconomic Outlook

Growth with a side of inflation

12/01/2022

David Lebovitz

If 2020 was the year of the pandemic, 2021 was the year of the recovery. But this recovery has occurred in fits and starts, and at times has felt quite uneven. What‘s more, the recent emergence of the Omicron variant reminds us that the pandemic is not over. At the same time, simmering geopolitical tensions and elevated levels of inflation signal that there will be new challenges if and when the virus fades into the background.

A healthy consumer suggests that the developed world can continue to grow at an above-trend pace in 2022, and we expect that manufacturing economies in the emerging world will see growth improve as vaccination rates rise. Against this backdrop, policy will likely become less accommodative but not outright restrictive. This should provide support for risk assets while leaving investors still searching for income in what will remain a very low interest rate world.

Solid economic growth, healthy consumer

The global economy seems to have finished 2021 with solid momentum. While we believe the pace of economic growth will gradually decelerate over the course of the year, we expect it will remain above trend. Driving this solid economic activity will be three distinct forces: the consumer, inventories and business investment.

The consumer is in good financial shape. That’s partly because the fiscal policy response to COVID-19 lined the pockets of individuals with cash, particularly in the developed world. With checking account balances still well above their long-run average and debt-to-income ratios near their lowest levels on record, it seems reasonable to expect consumption will be a key driver of growth this year. While mobility has come under modest pressure as Omicron spreads rapidly, we believe the broader expansion is intact and anticipate any economic disruption will be contained to the first quarter. That is a testament to how populations globally have adjusted to the continued presence of the virus. Further, we believe that additional tightening in the labor market will support the consumer going forward.

In addition to solid consumption, inventory growth looks set to support above-trend economic activity. Supply chain disruptions — most people have experienced some sort of delay when trying to get something from point A to point B — are beginning to resolve. We began to see an inventory build as we came into the fourth quarter, and it seems to have continued through the end of 2021. Looking ahead, we believe that inventory growth will provide an additional tailwind for economic growth in 2022.

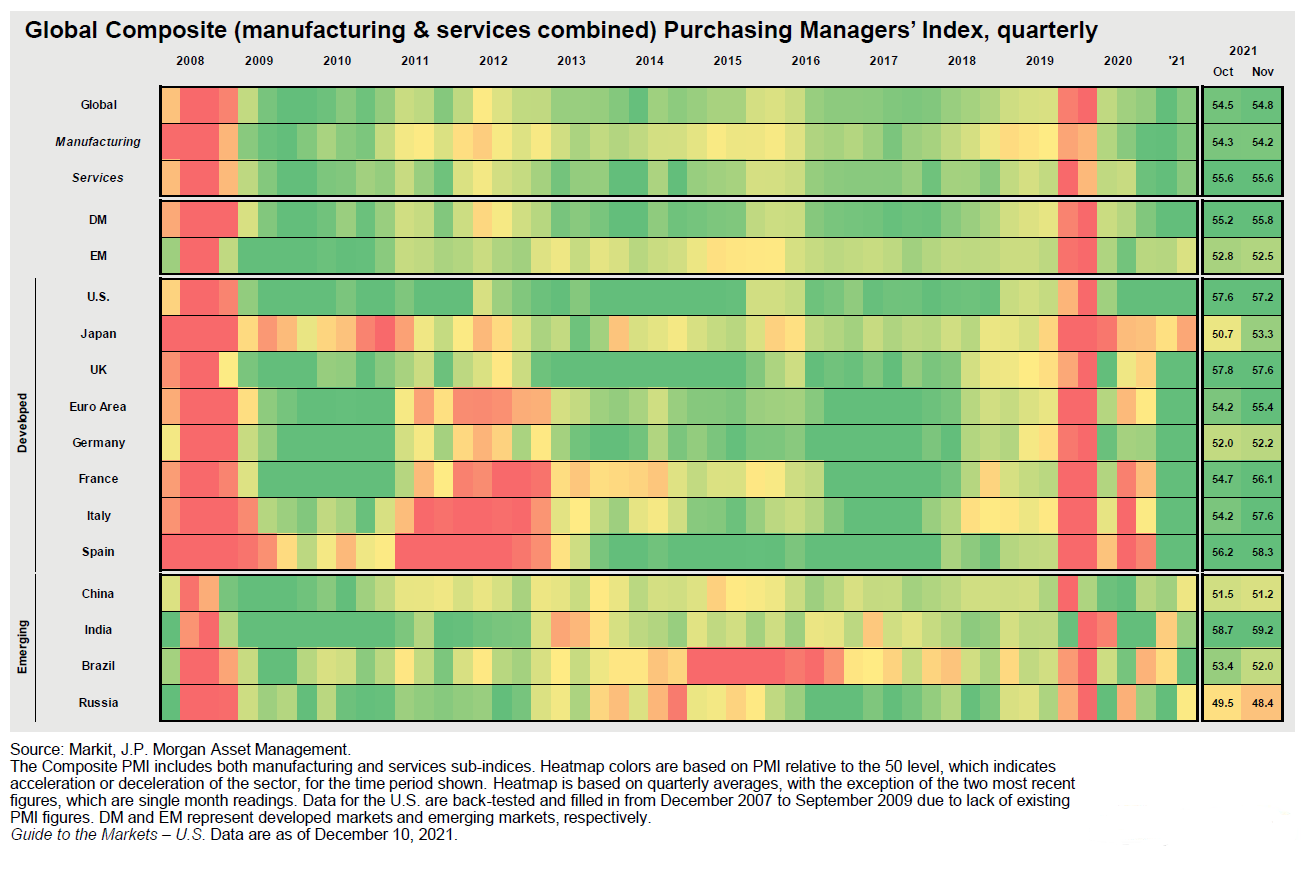

Finally, investment spending looks set to accelerate. First, there has historically been a tight relationship between earnings growth and nonresidential investment spending 12 months later; 2021 was a fantastic year for profits, and we expect that will translate into stronger capital spending. Second, it is nearly impossible to read the news without seeing headlines about rising raw material prices, higher wages and an increase in transportation costs. Management teams have stated openly that they plan to defend margins against these rising input prices in two ways, by passing along these higher costs to the consumer and, where possible, focusing on automation and efficiency. The latter requires investment, which we believe will increase in 2022. This should benefit manufacturing economies broadly, but particularly those in the business of manufacturing technology and other productivity-enhancing products (Exhibit 1).

Elevated inflation, but drifting down

We are constructive on the economic growth outlook for this year. Still, we recognize that above-trend growth will be served with a side of inflation. In 2021, it became clear that inflation was not as transitory as many investors and policymakers had assumed. While we do not believe that inflation will evolve into a structural issue, we do believe that it will be elevated relative to the Federal Reserve’s (Fed’s) target over the coming year. Contributing to this stickier inflation are the significant increase in home prices over the past year, supply chain disruptions and a tight labor market characterized by the fastest wage growth since the early 1980s.

Over the course of the year, inflation should decelerate – remember, inflation measures the rate of change rather than the level. Many of the reasons inflation is elevated today stem from issues on the supply side of the economy. However, as supply chains gradually normalize, the labor supply increases and the housing market cools, inflation should begin to drift lower. Structural forces such as globalization, technological adoption, demographic changes and income inequality have weighed on inflation for the better part of the past 40 years. As long as these factors remain in place, it is difficult to see inflation remaining elevated over the longer term.

The challenge of monetary policy

This macroeconomic backdrop has created significant questions around the appropriate trajectory of monetary policy in 2022. At its December meeting, the Federal Open Market Committee (FOMC) announced that it would accelerate the pace of asset purchase reduction (i.e., “tapering”) and aim to hike the federal funds rate three times in 2022. It seems perfectly reasonable for tapering to be accelerated, as the financial plumbing of the economy looks fine. However, tapering is very different from tightening, and it will likely be more difficult for the Fed to hike rates faster than it currently expects. Further complicating this dynamic will be the midterm U.S. elections in November. We see room for the Fed to begin hiking in 2022, but would not be surprised to see it move more slowly than market pricing and its own forecasts suggest. Meanwhile, the Bank of England (BoE) will lead the tightening charge in 2022, whereas the European Central Bank (ECB) and the Bank of Japan (BoJ) seem poised to move more slowly. The bottom line? Monetary policy should become less easy, but we do not believe it will become tight.

Elevated volatility, muted expected returns: The case for embracing alternatives Although we take a constructive view of the economy, we recognize that investment returns may be more difficult to come by. Public markets have delivered remarkable performance over the past two years, but we expect that returns will be lower and volatility higher going forward. Further, while interest rates should rise, they will likely do so only gradually. At the end of the day, it will be essential for investors to embrace alternatives as they navigate a world characterized by muted expected returns, historically low interest rates and elevated volatility.

A likely increase in business investment in 2022 should benefit economies that manufacture technology and other productivity-enhancing products

Exhibit 1: Global composite (manufacturing and services combined) purchasing managers’ index, quarterly

Source: Markit, J.P. Morgan Management. The composite PMI includes both manufacturing and services subindices. Heat map colors are based on PMI relative to the 50 level, which indicates acceleration or deceleration of the sector, for the time period shown. Heat map is based on quarterly averages, with the exception of the most recent figures, which are single months’ readings. Data for the U.S. are backtested and filled in from December 2017 to September 2009 due to a lack of existing PMI figures. DM and EM represent developed markets and emerging markets, respectively. Guide to the Markets–U.S.; Data as of December 10, 2021.

Source: Markit, J.P. Morgan Management. The composite PMI includes both manufacturing and services subindices. Heat map colors are based on PMI relative to the 50 level, which indicates acceleration or deceleration of the sector, for the time period shown. Heat map is based on quarterly averages, with the exception of the most recent figures, which are single months’ readings. Data for the U.S. are backtested and filled in from December 2017 to September 2009 due to a lack of existing PMI figures. DM and EM represent developed markets and emerging markets, respectively. Guide to the Markets–U.S.; Data as of December 10, 2021.