Japanese equities have stood out compared with global equities in the first half of 2023, due largely to multiple structural and cyclical tailwinds. It appears that Japan’s economic recovery and structural transformation present quality growth opportunities. This Q&A presents insights on the outlook of Japanese equities.

Q: What are the macro drivers that support the resurgence in Japanese equities?

Fuelled by consumer spending and manufacturing, Japan’s gross domestic product (GDP) growth in 1Q 2023 was better than market expected, and the economy grew at the fastest pace in three quarters4. The Japanese government also upgraded its economic assessment and forecast a moderate recovery. It is believed that Japan's economic growth appears to be more resilient than other developed markets and the risk of recession is comparatively lower as the economy is supported by domestic demand after a relatively lagged reopening.

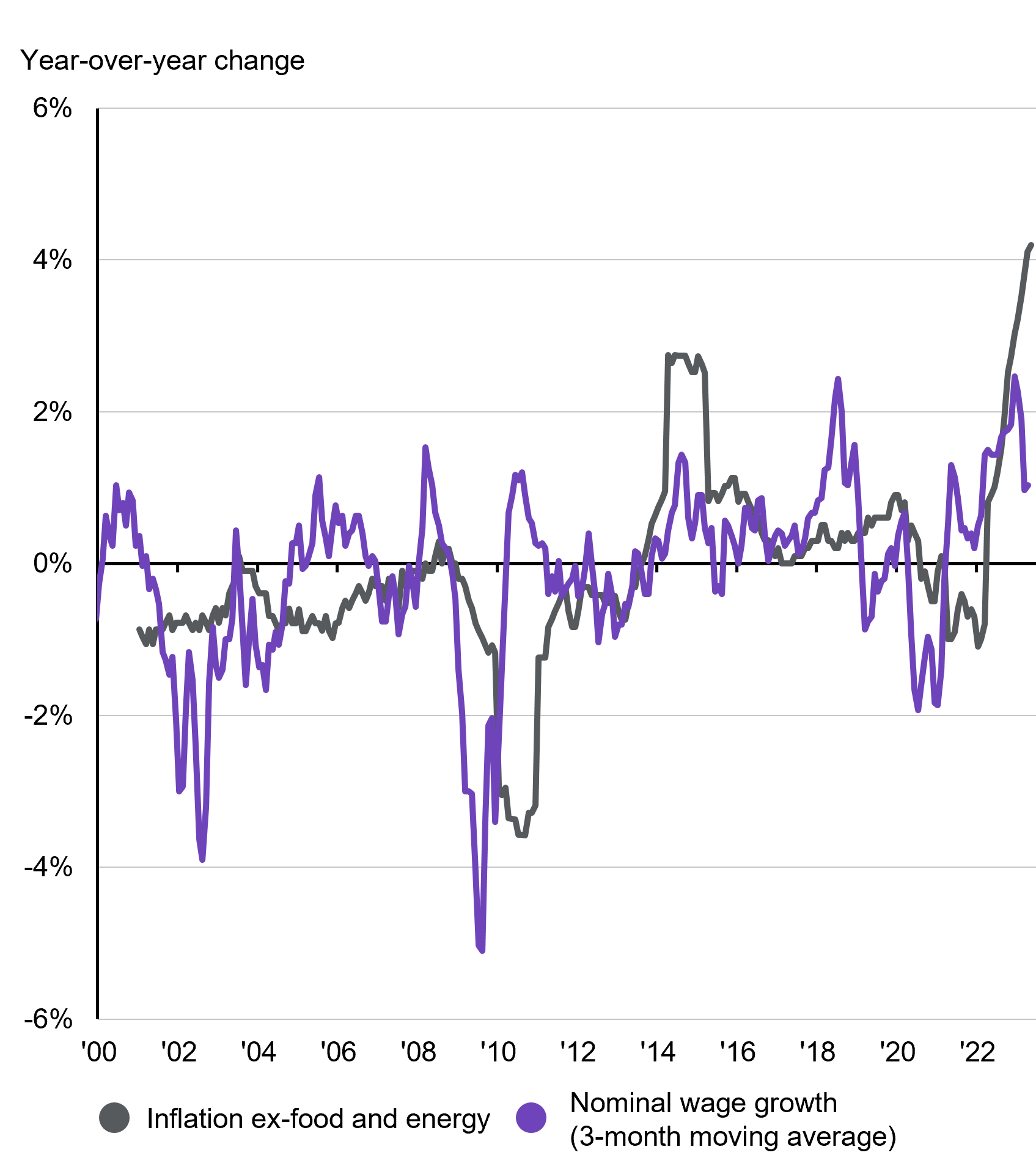

Historically, wage growth and inflation in Japan have been very low and below the Bank of Japan's (BoJ's) target, as illustrated5. Even in 2015, when there was a momentary spike up in inflation, wage growth remained anchored. However, that dynamic has started to change.

After decades of deflation, Japan is now experiencing inflation, primarily due to a tight labour market and employers' willingness to raise wages5. The inflationary trend is expected to boost GDP levels further and accelerate earnings growth for Japanese companies. The improving economic backdrop presents both value and growth opportunities.

Japan core inflation and wage growth

5. Source: FactSet, Japan Ministry of Health, Labour and Welfare, Japan Ministry of Internal Affairs and Communications. Data as of 09.06.2023.

Still, the uncertain global economic outlook and evolving monetary stance of global central banks could change the pace of Japan’s economic recovery and inflationary trend. Fortunately, the structural change in Japanese market and secular growth opportunities across sectors could potentially offset some of the external shocks.