Global Real Estate Outlook

Changing demand patterns reshape the investment landscape

12/01/2022

David Chen

Tony Manno

Pete Reilly

Doug Schwartz

Alan Supple

Growth is back – and with it inflation. After a year of rapid economic expansion fueled by historic levels of fiscal stimulus and loose monetary policy, inflation is surging in developed markets. Global investors, alert to the threat of rising interest rates, are increasingly focused on real assets as alternative sources of yield and inflation protection.

In this shifting investment environment, real estate is experiencing a dramatic revival. Although not all industry sectors or geographic regions will benefit from the heady speed of the current economic recovery – office occupancy patterns in urban centers continue to experience pressure – demand for specific sectors is high and rising, creating shortages in some asset types and opportunities in others.

Quality is key. In 2022, we expect that many asset owners will have the flexibility to increase rents at or above the inflation rate in real estate sectors characterized by moderate supply and robust fundamentals. Conversely, sectors with high vacancy rates and excess supply pipelines (or even negative demand patterns) may see revenues fall below the inflation rate unless rents keep pace.

Pandemic-related exceptions, however, are becoming visible. The shift to hybrid home-and-office working patterns means that the link between aggregate market vacancy and the availability of grade A rental space has been weakened. In some markets, we expect to see high vacancy rates associated with surprisingly robust rental growth – and in these instances, maintaining a focus on quality is essential.

Strong fundamental analysis is also of paramount importance. Investors in global real estate need to parse risks carefully, whether they’re committing capital to the red-hot logistics sector or the resilient multi-family housing market. Well-informed sector selection is even more meaningful now that some assets – particularly retail, office and residential properties – risk sliding toward obsolescence under changing environmental and building standards.

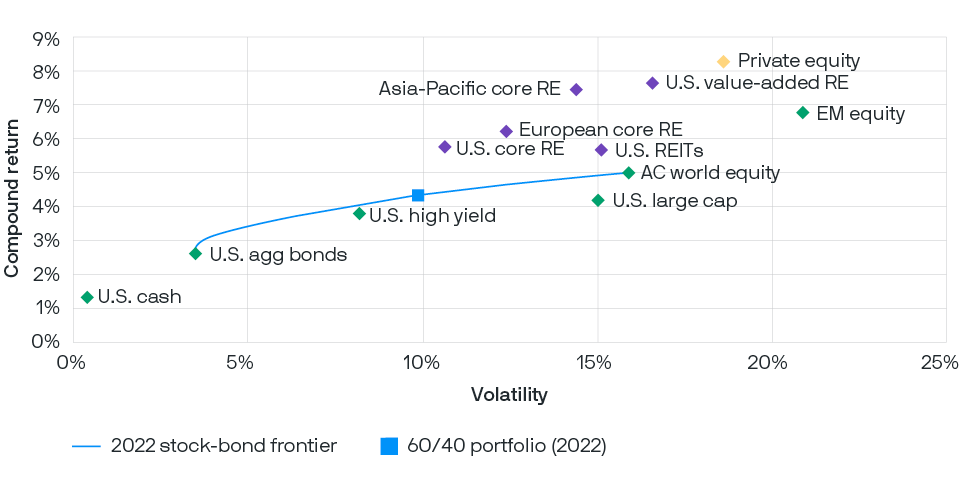

In the coming 12–18 months, we expect to see real estate continue to deliver strong risk-adjusted returns with meaningful inflation protection in a rising rate environment – as long as economic growth continues unabated (Exhibit 1). But new COVID-19 variants could disrupt that recovery. Stagflation is still a downside risk, and not all real estate markets are created equal: Identifying regional and sector-specific pockets of opportunity will be essential in the months ahead.

Over the long term, investors expect real estate allocations to outperform a traditional 60/40 stock and bond portfolio – and to deliver inflation protection in a rising rate environment

Exhibit 1: Expected volatility and long-term returns (>10 years) for real estate sectors (in USD) compared to the efficient frontier for a combined stock-and-bond portfolio

Source: J.P. Morgan Asset Management; data as of September 2021. All returns (in USD) based on projections for 10–15 years. Volatility measures include de-smoothing for private assets to ensure comparability with listed assets.

U.S.: ECONOMIC GROWTH AND INFLATION CREATE 'SWEET SPOT' FOR CORE REAL ESTATE

In the U.S., the outlook for economic growth remains strong while the cost of capital is still cheap. Historically low interest rates and rising inflation are currently supportive of asset class valuations, creating a “sweet spot” for investment in core real estate. Investors need to take heed, however, because these favorable conditions may not last. Cash flow-generating assets are likely to become increasingly expensive in 2022 as the real estate market becomes more crowded.

Concurrent demand dynamics are actively reshaping the industry. Since the economic recovery began in late 2020, we have seen unprecedented fundraising by non-traded private real estate investment trusts (REITs) and an acceleration of institutional portfolio rebalancing, which always lags behind spikes in the value of equity and fixed income portfolios. As investors come under increasing pressure to find yield-producing assets, we expect to see capital flows into real estate increase sharply.

At the same time, long-term megatrends, such as the surging popularity of e-commerce transactions and, in the U.S., population migration to Sunbelt states, continue to drive demand for niche real estate assets. These structural transformations have accelerated precipitously in the wake of the global pandemic, creating distinct and regionally specific investment opportunities.

Parsing opportunities by sector and region

In the months ahead, we will be focusing on an array of sectors that are benefiting from high user demand: logistics properties (particularly infill logistics assets in the so-called last mile between urban storage facilities and consumers); suburban multi-family and single-family housing in Sunbelt states; campus-like clusters (or nodes) of amenity-rich offices for the technology sector; and industrial outdoor storage facilities (including truck terminals, parking and equipment storage) in key urban locations.

As we move deeper into 2022, contrarian investment opportunities in stressed corporate and retail subsectors may start to emerge. Leasing markets for offices are likely to recover slowly, potentially creating refinancing challenges for asset owners. If declines in asset values overshoot the intrinsic development costs associated with these properties, opportunistic investments in offices may become highly attractive.

Although contrarian plays are already apparent in retail, this sector is very different: Maintaining a focus on quality is essential. Our argument for highly selective retail investing has been validated, somewhat paradoxically, by the pandemic: Retail assets in top locations that have benefited from significant capital investment are thriving, while poor-quality assets are failing. The chasm between the two appears destined to grow wider in the months ahead.

EUROPE: IMPROVING ACCESS UNDERPINS INVESTMENT ACTIVITY

In Europe, the end of quantitative easing, rising inflation and improving GDP provide a potent backdrop for the potential outperformance of all real assets, including real estate. European real estate is also benefiting from attractive entry pricing as yield spreads over government bonds remain historically high. Investors, keenly aware of this developing dynamic, are putting more capital to work.

Real estate capital flows buoyed by accelerating sector rotation

Although the European Central Bank has indicated that it does not intend to raise rates until 2024, investors are already rotating out of fixed income into a range of diversifying alternatives – including real estate – that offer yield, inflation hedging and compelling returns. We expect current inflationary pressures to be reasonably short-lived, but investors’ anxiety may persist for much longer. The risk that a resurgent wave of COVID-19 infections could still derail the fragile economic recovery also introduces an element of uncertainty.

These broader macroeconomic concerns, however, are coincident with investors’ improved access to alternative asset classes across the region, which is clearly driving some of the recent search activity and capital flows. Seen in context, the shift toward real assets – and real estate in particular – is feeding into a dynamic, longer-term trend.

Complex sector-specific opportunities demand closer scrutiny

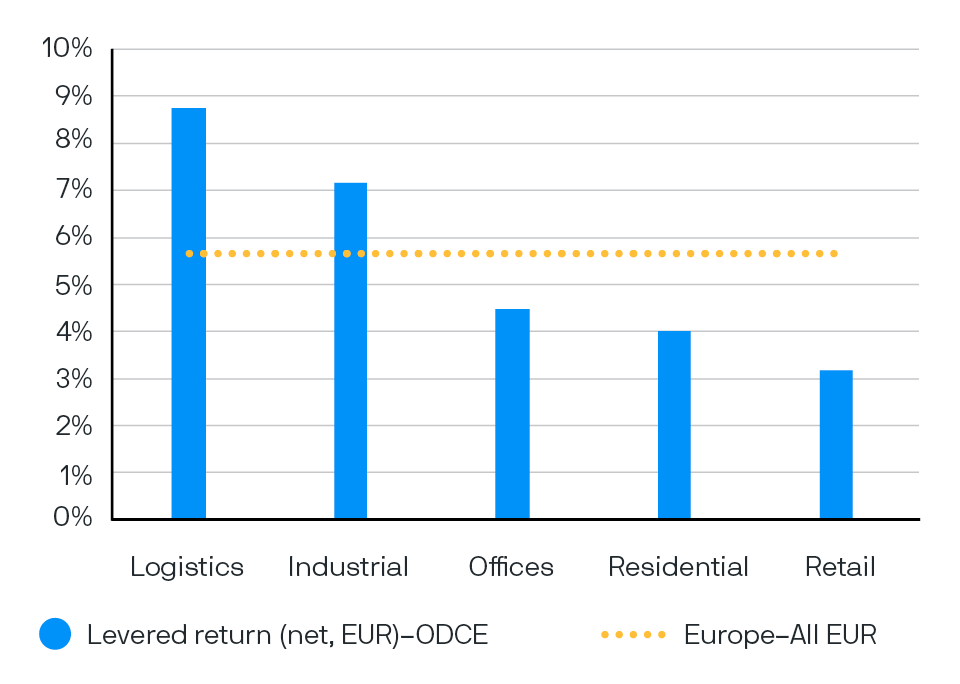

The investment opportunity set is decidedly mixed. Although some sectors offer compelling evidence of pandemic resilience, others – especially in the retail sector – are masking inherent and growing weakness. With these issues in mind, our European real estate experts have been conducting analysis of individual sectors (Exhibit 2). In logistics, for example, strong returns in recent years can be attributed primarily to yield compression; outside the "last-mile" submarket, rental growth has been subdued.

The differential resilience of European real estate sectors and projected long-term returns requires careful analysis

Exhibit 2: Long-term return forecasts for European core real estate (EUR)

Source: J.P. Morgan Asset Management; data as of November 2021. The Open-End Diversified Core Equity Index is known as the ODCE.

This dynamic is changing, however, as some sectors, such as the UK’s “big box” warehouse market, experience strong upward pressure on rental values. We expect this trend, which is being driven by robust demand and growing supply constraints, to spread to the wider European market, where rental growth should offset low current yields and continue to support logistics returns.

Structural supply shortages and affordability issues continue to drive the investment case for residential assets, which remain attractive. Although low current yields and restrictions on rent increases are likely to limit the upside, the sector’s improving liquidity and reliably stable returns suggest that investor demand will continue to be strong.

Retail still represents a major risk. Even in sectors that have experienced a correction in capital values, the ongoing shift from physical to online retail suggests a threat of continued obsolescence and further rental decline. Today's current high yields are unlikely to translate into attractive returns over the medium term.

Mispricings herald opportunity in beleaguered office sector

European office properties, in our view, now afford the greatest potential mispricing opportunities. Although we have noted a growing acceptance that offices will remain at the center of our working lives, the pandemic has accelerated the sector’s ongoing transformation. The importance of environmental, social and governance (ESG) considerations – as well as flexibility and connectivity – cannot be overstated. Going forward, asset owners will have to work harder to deliver space that meets occupier requirements and helps attract workers.

Inevitably, a new wave of obsolescence is sweeping across the sector. If investors are willing and able to navigate that phenomenon, they can take advantage of the risk premium attached to languishing office properties. As we’ve seen before in Europe, a lucrative arbitrage opportunity exists to revitalize some of these buildings and, once they have been refurbished and leased, sell them back into the core market at a profit.

ASIA-PACIFIC: SOCIAL MEGATRENDS SUPPORT MARKET GROWTH

Last year, economic recovery took hold in the Asia-Pacific (APAC) region as many countries moved with alacrity to implement high intensity COVID-19 infection control measures. Although resurgent infections have periodically impacted business activity, APAC’s real estate market has benefited from the overall recovery, with differentiated opportunities emerging by region, country and sector.

Residual risks persist, given the unknown trajectory of the pandemic. But the fundamentals of the recovery are currently supportive of the asset class. Demand for logistics assets in the industrial sector, for example, such as temperature-controlled warehouses, is surging thanks to the rise of e-commerce. This social megatrend, which we focused on last year in our Global Alternatives Outlook, will continue to impact the region’s real estate market in what is now a multi-year transformational process.

Residential subsectors vary in attractiveness across the region, but the resilient multi-family sector in Japan continues to benefit from consumer demand despite the country’s challenging demographics. Prices of multi-family rental properties in four key cities – Fukuoka, Nagoya, Osaka, and Tokyo – have remained stable throughout the pandemic. Looking ahead, investors stand to profit from the relative income yields available in the sector as demand from onshore and offshore investors strengthens.

Office occupancy across APAC remains high

With workers returning to their desks, office submarkets in APAC – particularly in Auckland, Beijing, Shanghai and Singapore – are already displaying different recovery patterns than assets in other parts of the world. This differentiation is practical as well as cultural: At the peak of the pandemic, local businesses struggled to accommodate remote working practices on short notice, and workers themselves were less inclined to press their employers for that flexibility.

Consequently, office utilization in APAC has been consistently higher than in Europe and North America. In Hong Kong, for example, office occupancy ranged from 50%–75% during 2021. Office values in many of these cities didn’t fall as far as those in London or New York, nor did they remain suppressed for as long. In Seoul, office prices have continued to grow in recent months, while those in Singapore and Brisbane have remained stable.

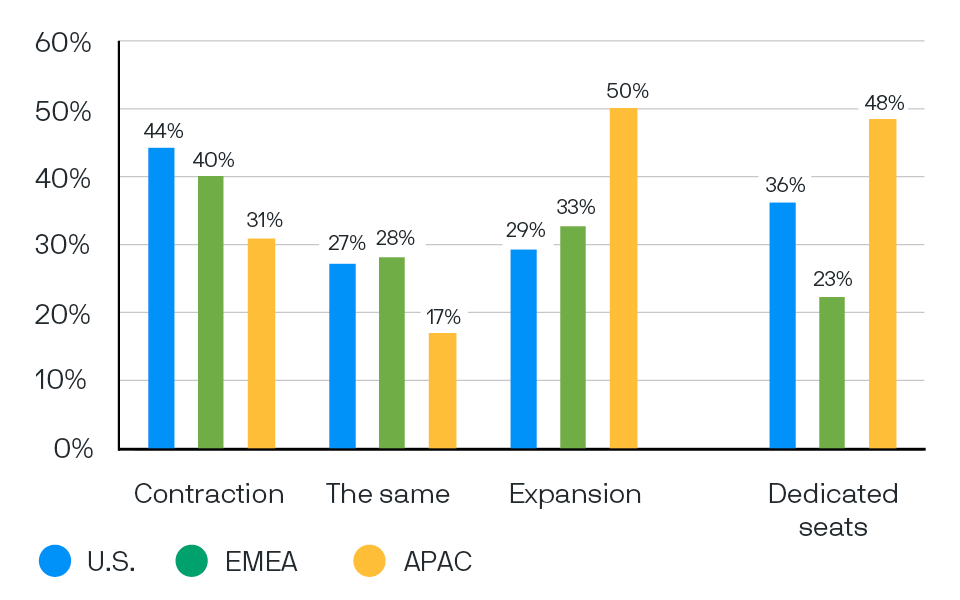

Based on a third-party global survey of corporate occupiers (Exhibit 3), demand for office space in APAC will be likely to expand in the medium term, and lessees clearly favor dedicated desk space.

With office occupancy holding steady in Asia-Pacific, demand for dedicated seat space is expected to rise in the months ahead

Exhibit 3: Survey of occupiers points toward potential net office demand expansion in APAC

Source: CBRE; data as April 2021.

Although APAC’s retail subsector has underperformed other major commercial real estate sectors, the pace of rental correction appears to be stabilizing. Significant regional differences persist, but these differences are not likely to be erased by the recovery. Headwinds in the retail sector continue to bring unique assets onto the market – assets that do not trade often, creating opportunities for investors with strong active management capabilities.

REITs: DELIVERING LIQUID, FLEXIBLE ACCESS TO GROWTH AND INCOME

As more investors seek refuge from rising inflation, the REIT market is attracting renewed attention for its liquidity, transparency and ease of access. Although investing in listed REITs comes with some additional price volatility, the structural advantages can be meaningful in periods of heightened macroeconomic stress: Investors are able to diversify their real estate portfolios quickly, modifying asset allocations and capitalizing on changing market trends.

This flexibility may be particularly advantageous for investors in the coming year if inflation becomes more embedded and the economic recovery falters – for better or worse, heightened market risk is now a given. So where should investors focus their attention?

Key themes for global listed real estate

Our REIT team has identified three key themes for 2022: the importance of pricing power, the changing definition of “quality” and the growing significance of ESG. Although these themes are not exclusive to REITs – they also support valuations in private real estate – they hold the potential to drive differential growth and income.

Paradoxically, the return of inflation may benefit investors in certain sought-after assets (public or private) if rent hikes outpace financing and labor costs, resulting in greater top-line revenue that filters down to bottom-line cash flow. For this dynamic to hold true, investors need exposure to in-demand, fast-growing sectors, such as distribution warehouses, data centers, life science facilities and single-family rentals.

These specialty sectors are likely to exhibit significant pricing power, which will give them an attractive growth profile relative to some of the more traditional sectors, such as office and retail, even as interest rates rise. A meaningful proportion of U.S. and global REIT indices – 42% and 29%, respectively – already consist of companies focused on nontraditional sectors, although not all are high growth.

Inflation hedging with a plus: Income

In comparison with fixed income, REITs hold an advantage with respect to income generation. The current dividend yield for the Wilshire US Real Estate Securities Index (WILRESI), for example, is approximately 2.6% (and does not include potential price appreciation of the underlying assets). The effect can be significant: U.S. REIT total returns for the WILRESI have averaged 11.5% for the past 10 years. Investing in REITs also carries a structural advantage, as they offer access to specialty sectors that use only modest leverage and can be considered akin to conservative core investments (unlike value-add or opportunistic private vehicles, which are typically more highly levered).

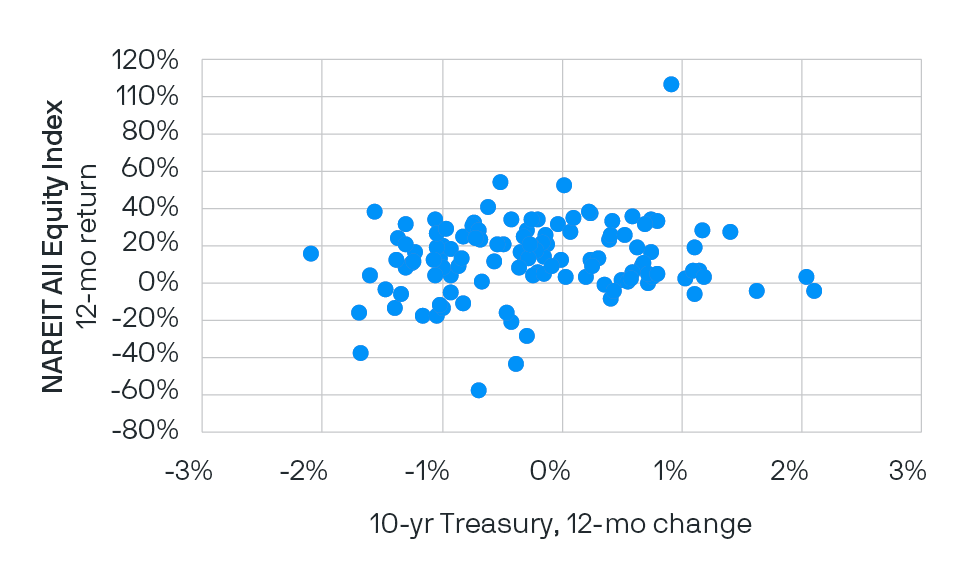

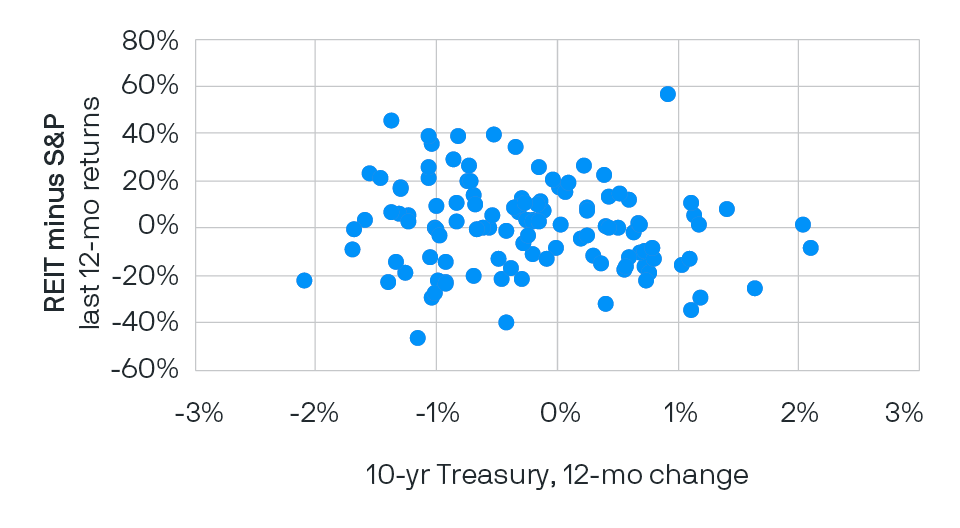

Historical performance supports the argument for using REITs for their inflation-hedging and income-generating qualities. In 83% of the rising rate periods between 1992 and 2020, U.S. REITs delivered positive total returns; in 50% of those periods, U.S. REITs also outperformed the S&P 500 (Exhibits 4A and 4B). The current expansion of specialty property types linked to the fastest-growing segments of the global economy could bolster this effect, especially if supply remains constrained.

REITs deliver positive performance and often outperform stock markets during periods of rising rates

Exhibit 4A: REIT total returns and interest rate changes (1992–3Q 2021)

Exhibit 4B: REIT vs. S&P 500 total returns and rate changes (1992–3Q 2021)

Source: NARIET, J.P Morgan Asset Management; data as of September 30, 2021.

Location, quality – and the new ‘green’ premium

Given recent demographic trends, we expect migration to U.S. cities with fast-growing technology companies and comparative lifestyle advantages – cities like Atlanta, Austin, Boston and Raleigh – to accelerate. In an effort to retain talent, employers are now actively upgrading their traditional office spaces to deliver a state-of-the-art employee experience.

The movement of workers and the shift to e-commerce are driving increasing demand for real estate capacity. In response, rents for associated property types, such as single-family homes, apartments, storage facilities and industrial units – all of which are represented in the liquid REIT universe – are rising. In a new twist, however, environmental standards are increasingly linked to building quality, and REITs that offer “green” space are likely to achieve higher occupancy and rent growth. A recent study by Knight Frank suggests environmentally friendly offices in London already command rents 12% higher than the market average.

Globally, Australian, British and European companies are further ahead in implementing ESG considerations than their U.S. peers, but a number of U.S. REITs have begun to differentiate themselves by mitigating the carbon footprint of the construction process. Typically, these larger listed companies are quicker to adopt best practices and achieve greater market differentiation, which should lead to higher rents and occupancy in the years ahead.

CONCLUSION

Although strong fundamental research is required to differentiate among assets and across real estate sectors in the current environment, investors still have a range of options. As long as the supply-demand dynamic remains healthy – and the economic rebound is not derailed by the emergence of new coronavirus variants or undermined by poorly controlled inflation in the coming 12 to 18 months – real estate should provide investors with a consistent source of alpha, income and diversification.