Asset Allocation Outlook

Embracing a hybrid environment

12/01/2022

Jamie Kramer

Pulkit Sharma

If the past two years have taught us anything, it is that we have a great capacity to adapt in the face of dramatic change. Often, that adaptation requires us to embrace hybrids. We hybrid shop – increasing our online purchases but also rediscovering the fun of a trip to the mall. We hybrid work – enjoying office camaraderie while appreciating work-from-home efficiencies. We hybrid play – e-gaming and binge watching but also attending concerts and sporting events. We hybrid learn – children go to school on Zoom and in person. We hybrid drive – buying more and more hybrid and electric vehicles, especially as gas prices rise and climate change becomes an increasingly important consideration.

Just as we are growing accustomed to a new hybrid lifestyle, we need to embrace a hybrid model for investing in a changing market environment. Facing moderating economic growth, higher inflation and low but rising interest rates, investors will find it increasingly difficult to generate stable income-driven returns and alpha through the public markets alone. Alternatives can deliver on both fronts. That is especially true for hybrid-like alternatives – sectors and styles that exhibit equity-like and fixed income-like characteristics. Critically, they can provide public equity diversification, stable returns and the potential for alpha/growth. These hybrids are less well understood than traditional investments and generally less liquid. In the current environment, they are also relatively mispriced, which presents an attractive entry point for investors.

2022: Current cycle positioning, with an anchor in hybrid investments

Alternatives can play different roles in a portfolio, depending on the stage of the economic and market cycle. Given today’s low or negative real yields and inflationary pressures, investments that can generate positive real yields and grow cash flows over time are extremely important. Alternatives with explicit or implicit inflationary pass-through mechanisms, such as certain types of real assets, should be well positioned to deliver attractive risk-adjusted returns. Higher yielding private credit investments, particularly those with floating interest rates, can protect against rising interest rates. Finally, hedge funds and private equity can provide public equity diversification and/or alpha.

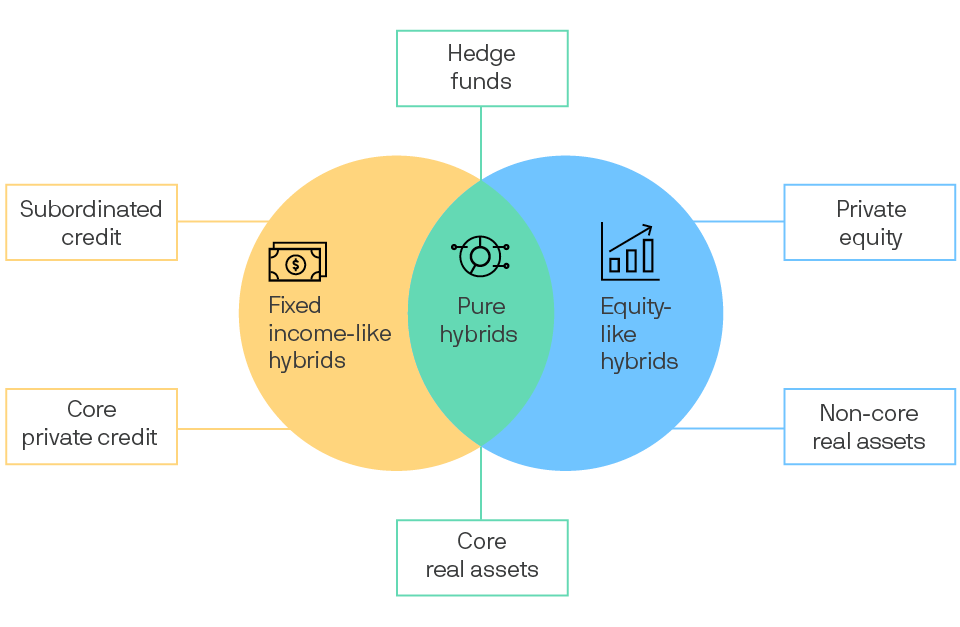

The opportunity set shows our emphasis on hybrid categories in the current market environment

Exhibit 1: Opportunities in which we have the highest conviction for 2022

Source: J.P. Morgan Asset Management—Alternatives Solutions Group; as of January 2022.

Adapting to a hybrid environment

Fixed income-like hybrids

Fixed income-like hybrids offer the potential for enhanced yields over core fixed income in the public markets, with hybrid features (e.g., mezzanine positions and floating interest rates). The group includes real estate mezzanine debt, infrastructure debt and various segments of private credit (e.g., middle market direct lending and consumer lending). Their hybrid attributes are particularly attractive for investors that can accept some illiquidity in exchange for enhanced yields. In addition to positive real yields, fixed income-like hybrids may also offer downside protection for public equity exposure, which is now less available from traditional fixed income securities.

Equity-like hybrids

Equity-like hybrids offer the potential for enhanced returns. For example, non-core real assets can draw on positive tailwinds in an economic recovery to uncover development opportunities, boosting cash flow and investment returns. In a market of growing demand, non-core real assets can be repositioned and re-leased, potentially transforming “ordinary” assets into “premium” assets. Certain environmental, social and governance (ESG)-integrated strategies can also generate alpha from structural changes driven by long-term sustainability trends (for example, the ongoing energy transition).

Within equity-like hybrids, the expanding opportunity set within private equity (PE) creates the potential for alpha. Digital transformation extending well beyond new economy sectors – in changing consumer preferences and ESG mandates, for example – is creating new opportunities for PE sponsors to generate incremental alpha. In an environment of still-low interest rates and above-trend economic growth, PE managers can use leverage to enhance returns. Investors may take the traditional approach, investing directly in primary PE funds. They can also uncover private equity opportunities by co-investing with PE sponsors and investing in secondaries (pre-existing commitments to PE funds). In this way, investors can find the potential for additional sources of alpha and faster capital deployment than investing in primary funds.

Pure hybrids

Pure hybrids exhibit characteristics of both fixed income and equity investments, which we think will serve them well in the current market environment. Pure hybrids can deliver enhanced yields, public equity diversification and/or the potential for capital appreciation. Notably, many of these assets can deliver yields at a meaningful premium to fixed income securities with similar counterparty risk.

Currently, we especially like core real assets (e.g., core real estate, infrastructure, transport and timberland) that stand to benefit from the continued reopening of economies. Core real assets offer stable yields with the potential for cash flow growth during periods of economic growth and rising inflation. Many of these assets feature some degree of explicit or implicit inflationary pass-through mechanisms. Lastly, core real assets can also deliver these attributes through ESG investments, whether through investments in more sustainable buildings, infrastructure investments in renewable power assets or liquefied natural gas-powered maritime vessels.

Hedge funds can be effective investments in generating alpha from market volatility. That’s especially useful when volatility picks up, as it has done in both public equity and fixed income markets. Looking ahead, discretionary macro strategies should be well positioned to take advantage of any volatility spikes arising from central bank moves toward policy normalization. Critically, too, hedge funds can act as a ballast and diversifier in portfolios, particularly in environments when fixed income and/or equity markets are challenged. Hedge funds have demonstrated this resilience by providing downside protection when indices for these markets have posted negative returns.

Conclusion

Much as we hybrid shop, work and drive, we can hybrid invest. A new market environment requires a new investing playbook. We encourage investors to consider, or reconsider, how hybrid alternatives (and alternatives more broadly) can help them achieve their investment goals in the new year. They may find that a new approach can deliver the outcomes they are looking for.