Private Equity Outlook

Look past the feeding frenzy for opportunities in a competitive market

12/01/2022

Stephen Catherwood

Ashmi Mehrotra

Christopher Dawe

Osei Van Horne

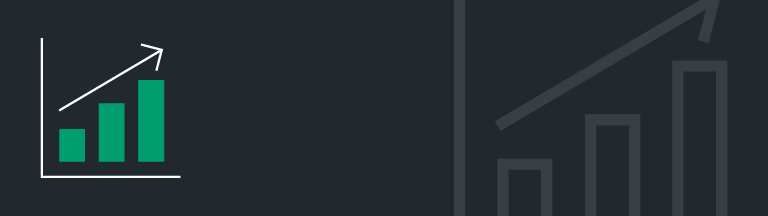

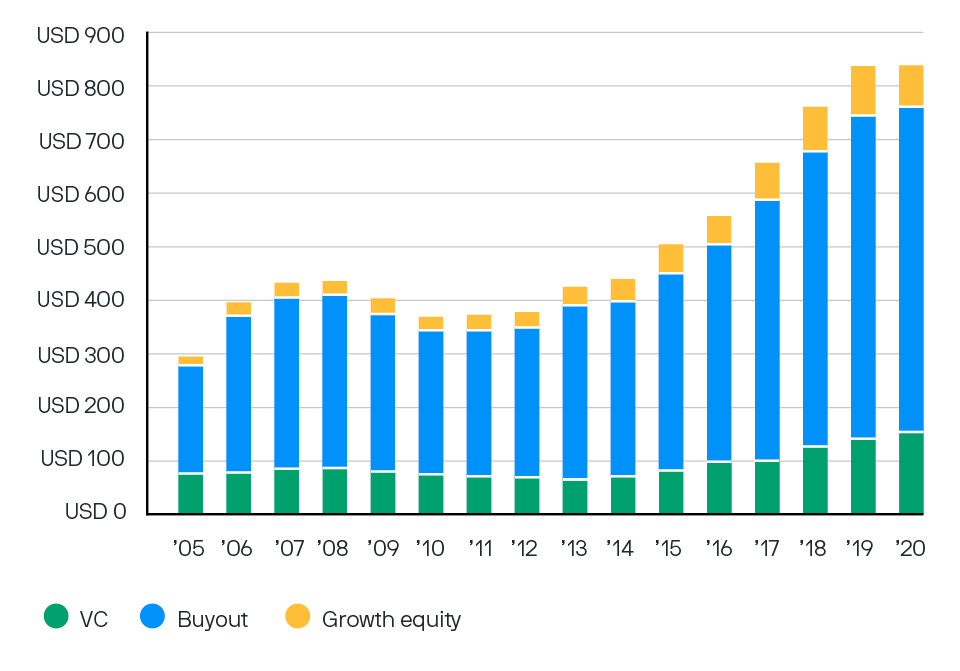

Private equity (PE) markets are experiencing a rapid pace of activity. Investor demand continues to be strong, and distribution volume remains high. Fundraising timelines are getting shorter and target fund sizes larger. Record levels of dry powder have kept pace with robust deal volume and velocity (Exhibit 1).

In a market that has not seen a prolonged pullback in over a decade, valuations are elevated and competition is intense. However, there continue to be ample and compelling investment opportunities for those managers with differentiated sourcing and value creation strategies. The core competitive advantage of private equity remains unchanged: highly skilled investors with the power to drive transformational change and growth in businesses.

Venture capital, growth equity and buyout fund dry powder are at or near record levels

EXHIBIT 1: Dry powder by strategy (USD, billions)

Source: PitchBook (Geography: U.S.), J.P. Morgan Asset Management; data as of December 31, 2020.

Strong investor demand

Among the strongest drivers of investor demand is the expectation of superior private (vs. public) market returns. A high volume of distributions is also adding to demand as investors rebalance back to target allocations. General partners (GPs) coming back to the market much faster and with larger funds have created a dilemma for some investors: how to allocate to their top-performing GPs when a healthy portion of their funds earmarked for private equity have already been committed. This is also challenging newer GPs competing for those same investor commitments.

Investors are increasingly committing to co-investments, allowing them to exercise discretion and invest alongside top managers in pre-identified opportunities. Objectives are shifting, too. Many investors are sharpening their focus on achieving environmental, social and governance (ESG) and diversity, equity and inclusion (DEI) goals, and are unwilling to sacrifice performance.

Expanding private equity opportunities

Technological innovation is among the most potent forces generating venture capital (VC), growth equity1 and buyout opportunities, not only among traditional tech companies but across almost every sector of the economy. The increasing speed of adoption of disruptive innovations, accelerated by the pandemic, is fortifying this trend (Exhibit 2). The private equity market, with almost 35% of its assets in the tech sector (vs. less than 14% for the public equity market), offers substantial opportunity for exposure to technological innovation.2

Technology adoption cycles have accelerated

EXHIBIT 2: Time to reach 50 million users

Source: Citi GPS: Global Perspectives & Solutions, Netflix, Walt Disney Company, J.P. Morgan Asset Management; data as of December 1, 2021.

Figures for radio and TV are from Citi GPS Technology at Work Series, “The Future of Innovation and Employment,” February 2015; Netflix figure represents time to reach 50 million subscribers of Netflix’s digital streaming service, based on analysis of Netflix earnings announcements (2007) and J.P. Morgan Securities LLC (2014); Disney+ figure is from Disney press release, 2020.

Top-tier managers can quickly assess valuation and growth potential and seize attractive opportunities. The most talented GPs can then bring deep, specialized sector knowledge and the specific skill sets needed by companies – from early start-ups to later-stage, fast-growing businesses – as they progress through the critical phases of their pre-IPO life cycles.

Diversity may be an advantage: Research suggests that the performance of private equity firms committed to DEI3 is comparable to that of their nondiverse counterparts.4 Yet these firms are not receiving a commensurate share of the PE capital raised. This points to an untapped opportunity for those private equity investors that can help support and guide early firm development while potentially securing preferred allocations in the future, both to funds and to co-investment opportunities.

Like investors, GPs are adapting to the increasingly competitive, frenzied pace of private markets. While some in the industry prefer a broad approach, we’re encouraged to see many experienced and disciplined managers becoming more specialized in the deals for which they compete. This narrower focus may enhance their ability to transform businesses and drive positive outcomes.

Insights and high conviction ideas

Intensified competition and elevated valuations exist across all sectors and stages of the market, from venture to growth equity to buyouts. Where are investors most likely to find opportunities with the growth potential to offset high starting valuations, and the risk-return profiles they seek?

Venture capital

Venture capital is clearly benefiting from the speed of technological innovation and adoption. The result: near-record fundraising, projected to exceed USD 110 billion in 2021,5 as well as a rapid rate of capital deployment. Increased fundraising by venture-backed companies has driven average deal size upward across all stages. Pre-seed and seed rounds have increased to the USD 2 million–USD 10 million range, Series A rounds to USD 20 million and Series B rounds to approximately USD 50 million, on average.6

Early-stage VC presents opportunities at the “idea” phase, when there are few customers and an as-yet-unproven product or business model. This stage can offer expansive upside potential but also significant downside risk.

Our Private Equity Group (PEG) continues to see substantial opportunity in primary funds focused on pre-seed, seed and Series A opportunities, where top-tier venture capitalists create differentiated sourcing through relationships with entrepreneurs and reputation in the market. Realizing the full potential of these early-stage investments requires experienced GPs that can attract the best deal flow and most promising entrepreneurs, take meaningful positions and apply specialized skills; ultimately, those skills can be even more important to return potential than pricing.

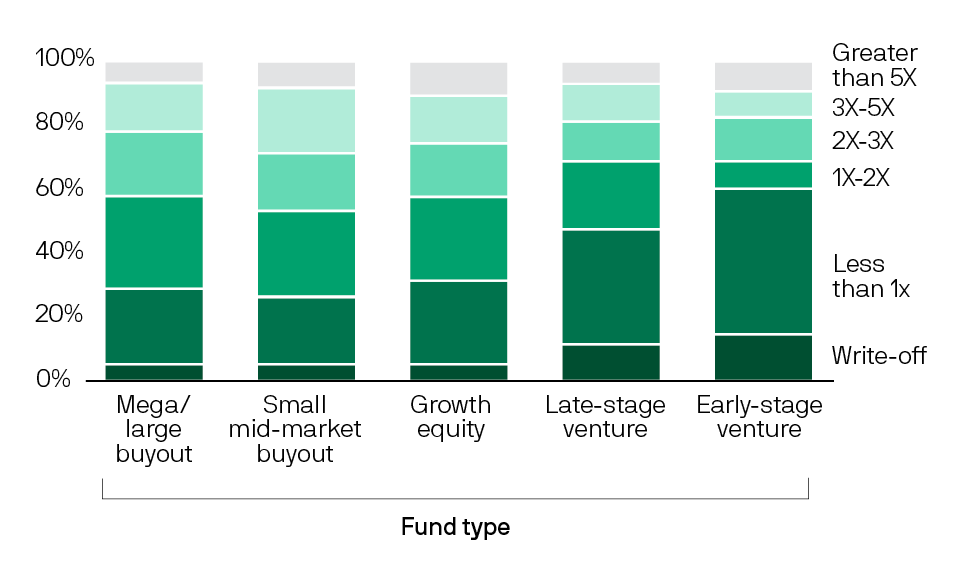

Late-stage venture capital and growth equity

Late-stage VC and growth equity companies (beginning as early as Series B and continuing through the pre-IPO stage) have a risk-return profile considerably different from and complementary to early-stage VC. While the most successful early-stage opportunities may offer higher return potential, late-stage VC and growth equity returns are more broadly distributed, with lower expected loss ratios (i.e., greater downside protection). This has allowed these asset classes as a whole to offer the more attractive range-bound distribution of returns associated with buyouts while maintaining some of the high growth and outsize return potential of venture capital (Exhibit 3).

Late-stage VC and growth equity return distributions are similar to those of buyouts

EXHIBIT 3: Distrubution of gross returns, by deal count

Source: State Street Global Exchange Private Equity Index; data as of June 30, 2018.

Analysis includes 28,000 fully realized deals invested globally; gross returns are returns before fees, expenses and carried interest.

J.P. Morgan Private Capital’s Growth Equity Partners (GEP) sees opportunity among young, thriving tech companies that have moved beyond the early VC stage. GEP focuses on companies that have an established product-market fit and sound unit economics,7 and appear to be on a path to near-term operating profitability. Generally on a steep, positive growth trajectory (frequently growing at rates exceeding 50% year-over-year), these companies need capital to keep expanding and to take their businesses to the next level.

Late-stage VC and growth equity portfolio companies are typically still scaling. They need not only capital but a trusted partner that understands their businesses, industries and customers, and has the skills, experience and networks to guide them through this critical growth phase. GEP’s high conviction areas of opportunity include:

- In the fintech space, technology to support B2B payments, ultimately facilitating the real-time automation of a company’s entire payment flows

- In enterprise software, technology to drive automation and digitization and increase a company’s productivity and efficiency

- In real estate, technology to drive digital transformation of historically human-driven processes such as mortgage origination, construction, etc.

- In consumer internet, technology that supports the continued consumer adoption of e-commerce and opportunities that persist across the e-commerce value chain

Climate technology, as viewed by J.P. Morgan Private Capital’s Sustainable Growth Equity (SGE) team, is another area with exceptional opportunities as companies, consumers, policymakers and investors respond to climate risks and the need to mitigate the impacts of climate change.

Mounting regulatory forces are accelerating private and public sector commitments to sustainability and climate action goals. These forces, along with shifting consumer preferences toward sustainable practices, have impacted all industries but are particularly acute in agriculture, real estate, transportation and industrials. These “heavy industries” collectively account for as much as 80% of global greenhouse gas (GHG) emissions.8 Companies operating in these heavy industries will require a wide variety of solutions to meet the new and looming state and federal regulatory sustainability standards.

SGE believes technology solutions, such as telematics, circular economy9 solutions, automation, the Internet of Things (IoT), biomaterials, carbon capture and the digitization of wasteful legacy operations, are well positioned to capture the total addressable market (TAM) opportunity for sustainability needs. As these markets continue to mature, we anticipate venture and growth equity capital allocators will be attracted to the large TAM, long-term demand drivers (fueled by the impacts of climate change) and double-bottom line value propositions (the potential for both environmental and financial returns).

Historically, most sustainability investments focused on increasing renewable energy supply, often in the form of project financings. More recently, there has emerged a particularly compelling opportunity set for investments in technologies enabling efficient utilization of both energy and raw materials, as well as business operation efficiencies that enable downstream benefits of reduced GHG emissions. SGE focuses on such opportunities. The team believes that corporations will need to invest in and scale these innovations to meet their sustainability commitments, decarbonize industries and supply chains, and adapt to climate change, among other goals.

Private equity buyouts

Buyout activity has been fast, furious and competitive, with global M&A topping USD 1 trillion in 3Q 2021 for the fifth consecutive quarter.10 Adding to PE buyout opportunities, elevated valuations and demand are bringing high quality companies to market. Private equity, corporate and strategic buyers have all contributed to the volume and pace, and there has been an ample supply of debt capital to support these transactions.

Our Private Equity Group sees some of the most attractive opportunities in primary funds and co-investments in lower middle market buyouts, with specialized GPs that have a focused strategy, whether defined by geography, deep sector specialization or where and how they source opportunities. In this smaller end of the buyout market, highly skilled managers can find opportunities to be among the first to inject outside capital into family- or founder-owned businesses, at lower multiples, using less leverage than at the larger end, while driving operational improvements. PEG also views buy-and-build strategies – whereby managers acquire a core business and execute a number of add-on acquisitions to enhance size, scale and capabilities – as a powerful approach to value creation in this sector.

Additionally, the team believes that co-investments in buyouts can potentially offer significant benefits, particularly for experienced investors that have long-standing relationships with GPs and a differentiated ability to conduct due diligence and participate in quickly moving, complex processes. In these competitive, fast-paced markets, those characteristics are creating select opportunities for sophisticated investors to negotiate co-investments with attractive economics.

Conclusion

Our outlook for private equity remains positive. A rapidly evolving world is driving disruptive, innovative solutions that are being adopted at an accelerating pace. The private equity industry is well positioned to support such transformational change. Disciplined investors who recognize the need to look beyond traditional markets to meet return objectives have the potential to benefit.

Of course, an overall market sell-off could negatively impact interim valuations for deployed funds, but it would likely result in an opportunity for those with available dry powder, across venture capital, growth equity and buyouts. Diversifying investment pacing across vintage years can help to mitigate this risk.

Working with experienced managers that have been through sustained downturns is a plus at this stage in the cycle. As always, partnering with those that have the skills to drive transformational change will be critical to generating positive outcomes.

1 While there is no hard-and-fast definition, we refer to growth equity as the phases of a private company’s life cycle between late-stage venture and initial public offering (IPO).

2 J.P. Morgan Guide to Alternatives, November 2021: 37.

3 While there is no industry standard, our Private Equity Group (PEG) categorizes a firm or opportunity as diverse if individuals who are women, Black, Hispanic, Latino, Native American, Asian & Pacific Islanders, LGBT+, military veterans and people with disabilities compose at least 30% of its key persons or if 30% or more of its economics (carried interest) is held by members of these groups. A host of qualitative factors are also part of the evaluation.

4 Knight Diversity of Asset Managers Research Series: Industry, “A study of ownership diversity and performance in the asset management industry,” Knight Foundation and Bella Private Markets, 2021.

5 Bob Blee, Andrew Pardo, Calvin Otis and Eli Oftedal, “State of the Markets: Inside Views on the Health and Productivity of the Innovation Economy,” Silicon Valley Bank, Q3 2021. USD 110 billion includes traditional venture capital only.

6 Ibid. These statistics on size of fundraising rounds include U.S. venture capital investments only.

7 Sound unit economics implies profitability on a per-unit basis.

8 Climate Watch, World Resources Institute (based on 2016 emissions). Sector emissions values include direct emissions and emissions from energy use in specific sectors: industrials (24% energy, 5% direct); food and agriculture (2% energy, 18% direct); real estate (18% energy); transportation and logistics (16% energy).

9 A circular economy is a model of production and consumption that advocates reusing, repairing, leasing and recycling materials and products.

10 Global M&A Report Q3 2021, PitchBook, October 28, 2021: 8.