Week in review

- RBA holds cash rate at 3.6%

- FOMC cuts fed funds rate to 3.50-3.75%

- Australia unemployment rate steady at 4.3%

Week ahead

- U.S. CPI inflation

- ECB and BoE policy rate decisions

- U.S. nonfarm payrolls

Thought of the week

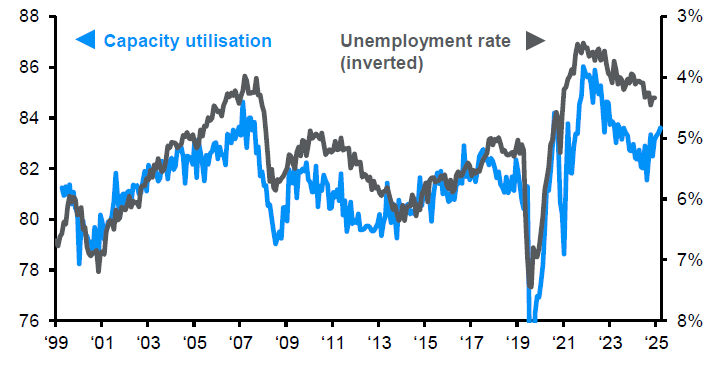

Messaging from both the RBA and the U.S. Fed was hawkish last week, even as they both met market expectations for a pause and a cut, respectively. In both economies, inflation is likely to remain stickier than desired, prompting a more cautious stance. However, the real key to the rates outlook is the labour market. In Australia, the unemployment rate remains low, and the RBA noted that rising capacity utilisation could lead to further inflation. We expect the RBA to hold rates steady in 2026, but a tighter labour market could bring rate hikes forward. Meanwhile, in the U.S., the Fed entered its December meeting without official labour market data and is increasingly concerned about fading labour demand, prompting another 25bps insurance cut. With the dot plot showing only one cut in 2026 it’s well below market expectations, but the wide range of views suggests the rates outlook far from certain.

Capacity utilisation is moving higher suggesting tighter labour market ahead

Capacity utilisation advanced three months

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 12/12/25.

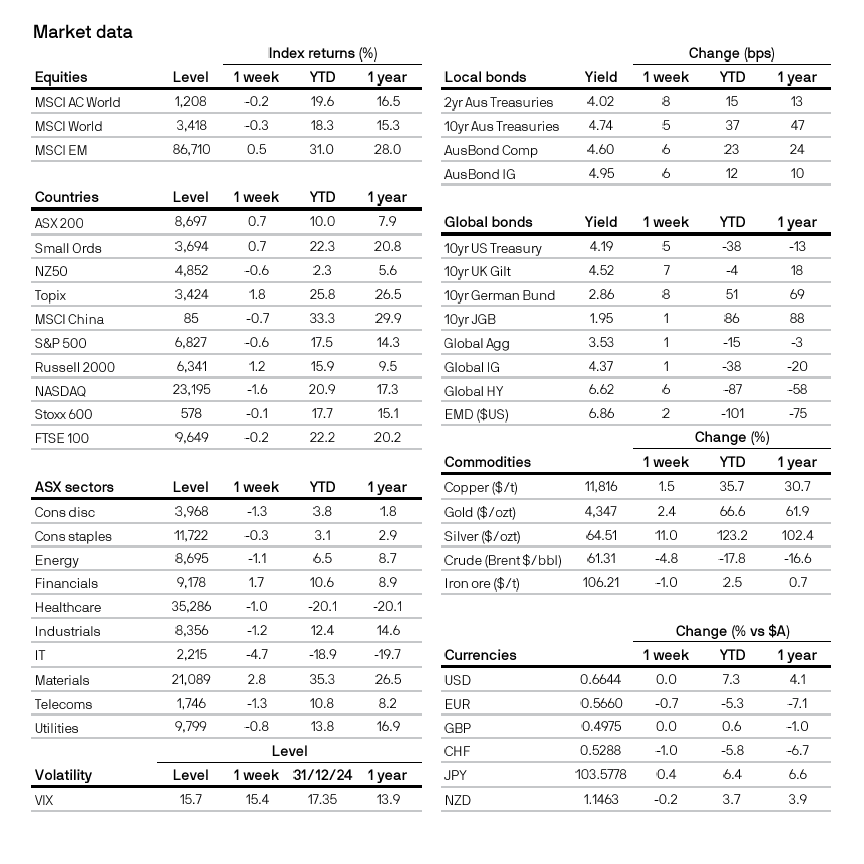

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

Material ID: 0903c02a82467ab5