The pandemic and the recovery

U.S. economic outlook

Dr. David Kelly

Earlier this year, as the pandemic led to a widespread shutdown in economic activity, it seemed that the most likely shape of the U.S. recession and recovery would be a plunge, a bounce, a crawl and a surge. The logic behind this was that while a good chunk of economic activity could recover even in a pandemic environment, a large swath would have to await the distribution of a vaccine. However, once that vaccine was distributed, economic activity could be expected to boom as America and the world rushed to enjoy all the activities that had been suspended by the pandemic.

As this year draws to an end, this pattern appears even more likely to play out. The economy has already seen a plunge and a bounce, with real GDP falling by 5% annualized in the first quarter and 31.4% annualized in the second before vaulting by 33.1% in the third. Unfortunately, with the pandemic rapidly worsening, we expect growth to average just 3.5% annualized in the fourth quarter of 2020 and the first half of 2021.

However, with early trial results showing remarkable effectiveness, the distribution of these vaccines should conclusively end the pandemic later in 2021. Clearly, a key question is how quickly the population can be inoculated. In our forecasts, we assume that this is largely achieved by the end of the summer. As a practical matter, this should allow the pace of social activity to pick up over the summer and then return to normal levels by the fall. Moreover, a pent-up demand for vacations, family get-togethers, live sports and other recreational activities as well as medical and dental visits could lead to above-normal levels of consumption in these areas in late 2021 and early 2022.

These activities could also be supplemented by the impact of fiscal stimulus and, potentially, an infrastructure bill in 2021, depending on the ability of the incoming administration to get its policy priorities through Congress. It should, however, be noted that even divided government in Washington would likely result in very significant budget deficits in 2021 and 2022.

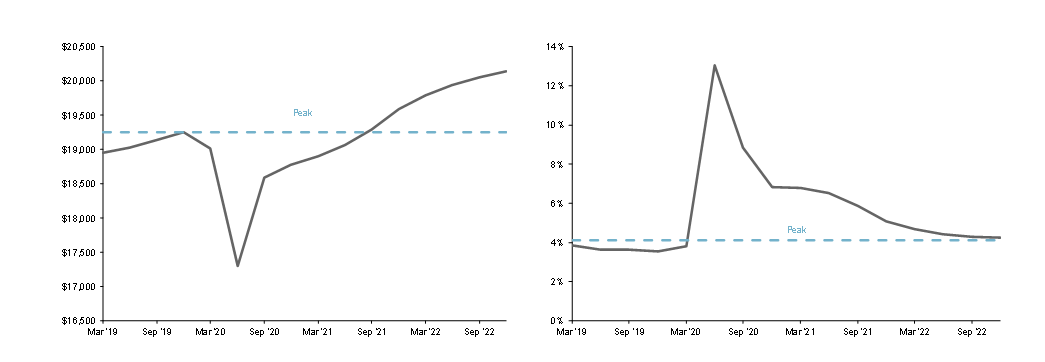

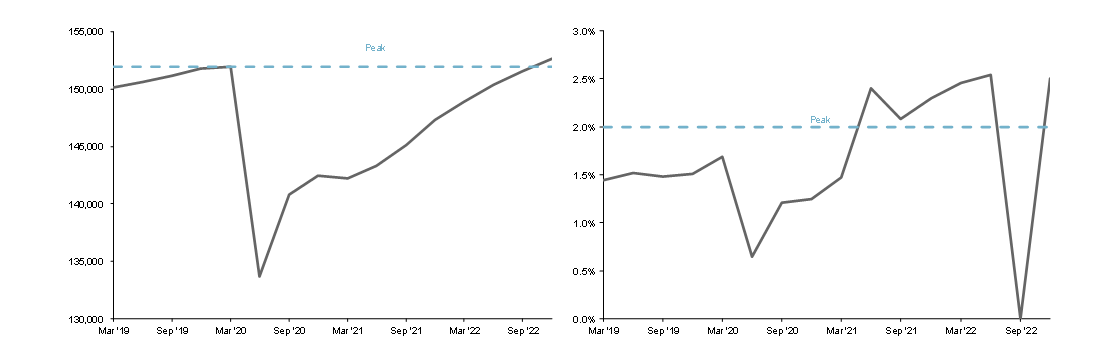

Employment should generally follow the pattern of GDP, with small job gains over the next six months and then accelerating payroll increases in the most affected industries over the rest of 2021 (Exhibit 1a). We expect that total payroll employment will regain its pre-pandemic peak by the third quarter of 2022 (Exhibit 1b). Very low net migration combined with baby-boom retirements should slow the rebound in the labor force, and we expect the unemployment rate to fall below 5% by early 2022 and to the Fed’s long-run projection of 4.1% by early in 2023 (Exhibit 1c).

The pace of the recovery should differ across GDP growth, jobs and inflation.

Source: Bureau of Labor Statistics, J.P. Morgan Asset Management. 4Q20-4Q22 are J.P. Morgan Asset Management forecasts. Data are as of November 30, 2020.

Source: Bureau of Labor Statistics, J.P. Morgan Asset Management. 4Q20-4Q22 are J.P. Morgan Asset Management forecasts. Data are as of November 30, 2020.

Inflation should also recover in line with the economy. Wage growth should be slow over the next few months but then accelerate in the second half of 2022. This, combined with a shortage of airline seats, hotel beds, restaurant tables and, eventually, apartments to rent, could push inflation (as measured by the consumption deflator) above 2% in the second half of 2021 and keep it there in 2022 (Exhibit 1d).

After a post-pandemic services consumption surge, economic growth should, once again, slow later in 2022, and economic conditions may well begin to look remarkably similar to those that prevailed in 2019: slow growth, relatively low inflation and low interest rates. A key question is, at that point, whether Washington policy makers will be satisfied with such an outcome or whether, by pursuing additional efforts to stimulate demand in an economy with structural supply issues, they finally achieve their desired higher inflation rate. It should be noted, however, that while such an outcome would have been a blessing in a recessionary economy, it could be a curse in an economy close to full employment. Higher inflation, and the higher interest rates that would follow in its wake, could make it very difficult to service the enormous debt accumulated during the pandemic or support the more elevated asset prices that prevail today.