Where will the cash go?

16/04/2020

Frederick Bourgoin

This year is not comparable to any other year in history in more ways than one.

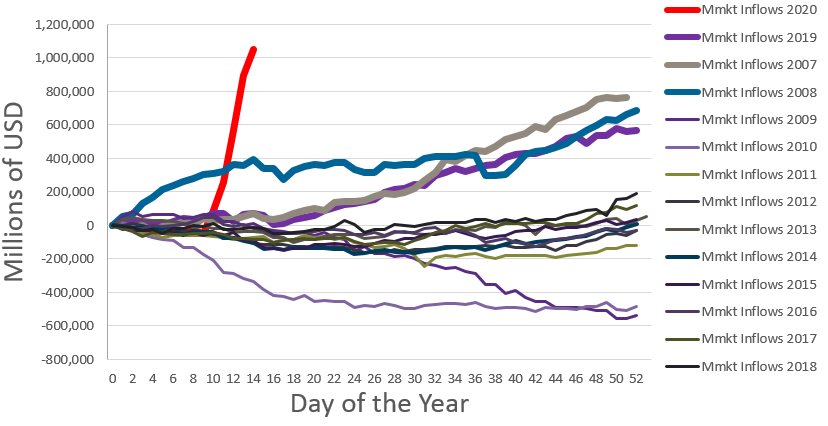

With the appearance of COVID-19 and the extreme market sell-off in risky assets, in the space of 3 months investors have aggressively been buying money market funds, for approximately a $1tn according to our calculation.

This amounts to more than each of the entire calendar year of 2007, 2008, 2019 individually, the biggest years in money market flows of recent history.

Cumulative Inflows into Money Market Funds every year since 2007

Source: ICI, Bloomberg, JPMAM calculations as of 08-Apr-20

In this new environment, we think it is a key indicator to track going forward.

Are these flows getting re-deployed back to riskier asset classes like equities or emerging market debt?

So far, it is not the case.