What are financial conditions and why do they matter?

05/11/2015

Brandon Merrill

There are generally four components to financial conditions analysis:

- The US Dollar

- Corporate bond spreads

- Equity market levels

- The level of interest rates at different maturities

Changes in each of these components in isolation influence the economy in different ways. In general, a stronger dollar acts to restrain growth via reduced demand for exports. Higher corporate bond spreads restrain lending growth and corporate investment. Lower equity prices suppress growth in consumer spending through the wealth effect, and finally, the overall level of interest rates is a key component of mortgage rates and corporate borrowing rates. It is through this lens of financial conditions, broadly defined, that we should view current Fed policy.

When the Fed raises the short rate, their goal is to suppress latent inflation pressure, and tighter financial conditions are the transmission mechanism through which this occurs. The short rate, by itself, does not influence the economy at large.In reality, Fed policy changes act to influence the factors discussed above, which in turn influence the broader economy. And to complicate matters, an incremental change in the short rate does not always have the same incremental effect on financial conditions, i.e., the transmission mechanism of monetary policy is not constant. For this reason, it’s critical to watch not only what the Fed says (and ultimately does), but how the markets react. A disproportionate reaction in the markets to a given action by the Fed is likely to be met with resistance in the opposite direction.

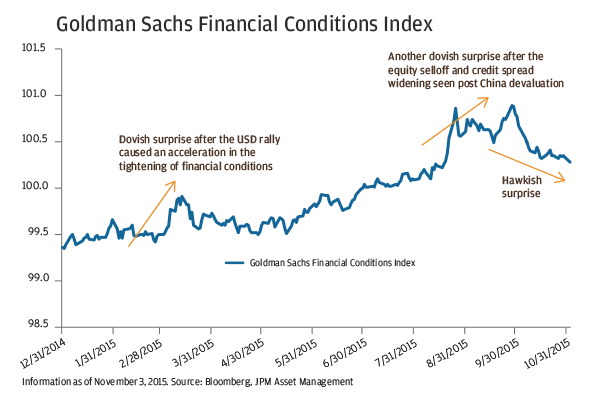

Three times this year, the market has been caught off guard by the Federal Reserve statement. Twice the Fed acted more dovishly than expected (March and September), and most recently at its October meeting the Fed shifted more hawkishly than expected. Interestingly, each of these three meetings saw large changes in the rate of change of financial conditions in the weeks leading up to their meeting (see chart below). Is this a coincidence, or is it possible that perceived changes in financial conditions play a larger role in the Fed’s policy framework than they have previously indicated?

Interestingly, one of the early adopters of the financial conditions framework was the Fed’s own Bill Dudley. He is now the president of the NY Fed and is considered part of Janet Yellen’s inner circle, but earlier in his career as an economist in the private sector, he worked to develop the financial conditions index that is the industry standard today. As one of its original authors, it is natural to believe that he would still be a large proponent of the index today. In fact, he has said as much in recent speeches.*

As we look toward the December meeting, it seems that the rate of change of the financial conditions index will be a key determinant of whether or not the Fed hikes rates. Meaning, unless the current trend reverses, the Fed will likely hike rates in December. For that to happen, equities need to stay around current levels or higher, and the dollar cannot strengthen too much, even though the Fed wouldn’t spell it out just like this.

*http://www.newyorkfed.org/newsevents/speeches/2014/dud141201.html