Treasury’s 20-20 vision

14/05/2020

Owen Hawkins

On May 20, 2020 the Treasury will issue $20bn of new 20-year bonds. Formally announced last week, this re-introduction of 20-year issuance was widely anticipated and will be followed by $17bn of monthly reopenings. The new 20-year will feature auctions in the refunding months (February, May, August, and November) and maturities aligned with existing 10 year and 30 year issuance. In justifying the new tenor, the Treasury cited primarily the need to manage their increased borrowing and the growing demand for long bonds by liability driven investors (“LDI”).

While the market had been expecting this announcement since January, the size of issuance nevertheless surprised given expectations for initial 20-year issuance were around $13bn. In order to make room and avoid meaningfully extending their maturity profile, the Treasury was expected to reduce 7-, 10- and 30-year issuance and/or issue more bills to balance the duration impact. However, as we now know, the COVID-19 crisis created unprecedented fiscal spending requirements and rendered both aforementioned concerns moot. Along with the $20bn 20-year, the Treasury upsized issuance across the curve and intends to maintain higher cash balances through bill issuance given the uncertainty of future spending needs.

On the demand side, the LDI flow, generally consisting of life insurers and corporate defined benefit pensions, will be significant buyers of 20-year bonds. This investor base has long dated liabilities that often require hedging with similarly long duration assets. Their liability profile also tends to feature significant exposure in the 15 to 25-year part of the curve. For LDI investors looking to match their curve exposure, there has historically been a limited offering between 10s and 30s, creating natural demand for 20-year issuance. We see this in the other markets with a large LDI investor base, such as Japan and the UK, where 20-year issuance is well absorbed.

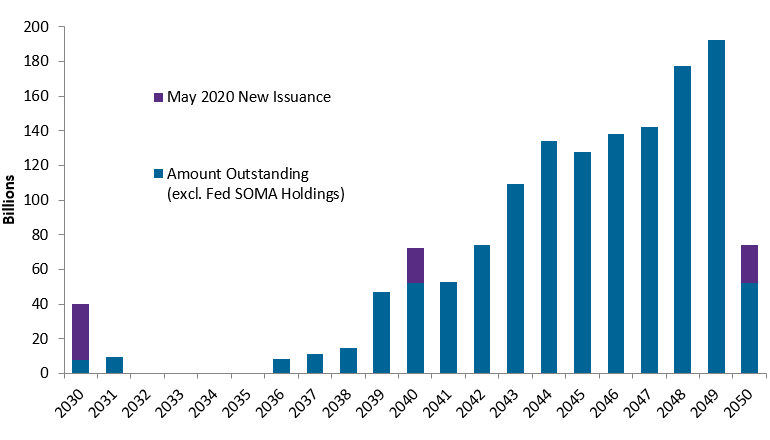

Despite the relative illiquidity of the 20-year sector at present, it has historically traded rich to fair value. This is due in part to the scarcity of available bonds (see chart). From 2001 to 2006, the Treasury ceased issuance of 30-year bonds which has created a gap in the current curve. On top of this, the Federal Reserve has purchased nearly their maximum 70% of outstanding issuance in the 2036 to 2041 maturity range via open market operations (both in 2020 as well as earlier quantitative easing).

Long Treasuries Outstanding by Maturity

Source: Bloomberg, US Treasury as of 5/12/2020

As the 20-year issuance builds over time, we’d expect the curve to cheapen given a better matching of supply and demand and more trading activity. We’ve witnessed much of this cheapening already following the October 2019 announcement recommending 20-year issuance, as well as after further detail was released in January and May 2020. The impact of Fed buying remains a significant unknown however, as they’ve essentially ceased purchases in the 20-year sector which likely contributes to the cheapening. The Fed will certainly be buyers of the new issuance though.

Beyond the first order implications for rates, the introduction of 20-year issuance will also impact other debt markets. For corporates, long bonds price off either the 10-year or 30-year Treasury, with the roll occurring around 15 years to maturity. With new on-the-run 20-year bonds, these will presumably be used for pricing corporates once a sufficient issue size is developed. This may help richen a part of the credit curve that has historically traded cheap due to the lack of a natural hedge. After the initial 20-year announcement in January, however, much of this trade may have already played out.

The other side of the coin is corporate supply. 20-year corporate issuance has picked up in recent years as companies termed out debt given the historically low rate environment and looked to diversify their maturity profile in the process (rather than having just a large block of 30-year debt outstanding). Now we may see an uptick in 20-year corporate issuance, though existing debt profile preferences and the cost of long debt are much more likely to drive issuance patterns.

So while there may be a handful of relative value opportunities yet to be priced out, meaningful changes to the shape of rates and credit curves via factors like LDI portfolio construction, futures contract deliverables and corporate bond hedges will likely play out over a longer horizon. Fortunately, the Treasury has signaled that 20-year issuance will be a consistent and sizable component of their borrowing in the years to come.