The case for leveraged loans

26/07/2018

Chad Engelbert

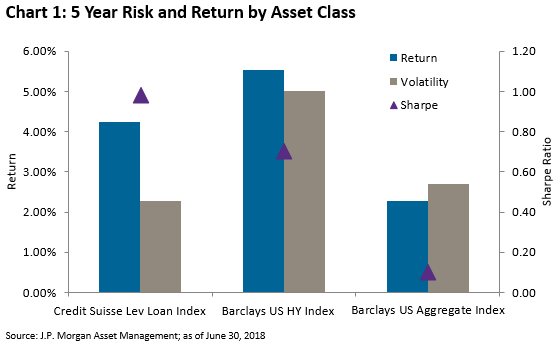

Leveraged loans (also known as bank loans) usually are the most senior debt obligations of non-investment grade corporate borrowers. Bank loans have two key distinctions versus most high yield corporate bonds: loans typically are secured by assets of the borrower, and they are floating-rate instruments that have interest rate resets every 1-3 months in accordance with changes in short-term rates, primarily LIBOR. As a result, bank loans mitigate the risk of rising rates and have historically had lower default rates, higher recovery rates and lower volatility relative to corporate high yield bonds. An additional benefit to investors is the historically low correlation of bank loan returns to corporate bonds and equities, as well as better risk-adjusted returns than other credit related investments as evidenced by higher Sharpe ratios (Chart 1).

Protection against rates

The past 35 years of declining U.S. interest rates have been very favorable to fixed income returns. However, with 3-month LIBOR up 64bps to 2.33%, and the 5-year U.S. Treasury yield up 60bps year-to-date and expectations that the Federal Reserve will continue normalizing monetary policy, bank loans should act as a hedge given their low duration due to their floating-rate coupon. Loans have provided positive returns in prior periods of rising rates when investment grade bonds generally had negative returns and high yield bonds had mixed returns.

Protection against credit risk

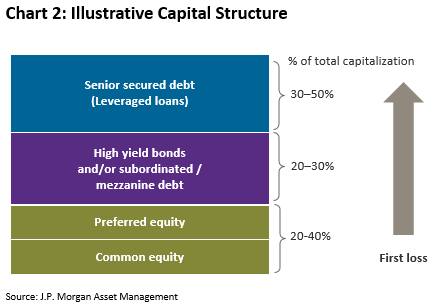

Bank loans are typically secured by the assets of the issuer. As a result, bank loan investors generally rank first in priority of payment in the capital structure, ahead of unsecured debt and equity, which has led to lower default rates and higher recoveries for bank loans in the event of default (Chart 2). According to J.P. Morgan, recovery rates on first lien bank loans over the past 20 years have averaged 66.5%, compared to a 25 year average of 39% for senior unsecured high yield bonds. Over the past 20 years, loans have had an average annual default rate of 3.1% and an average annual credit loss of approximately 1% over a period that included two recessions and the Great Financial Crisis.

State of the market

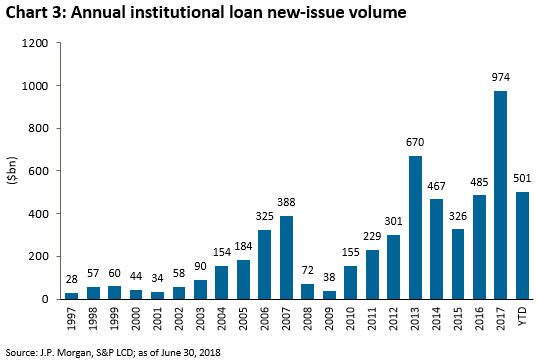

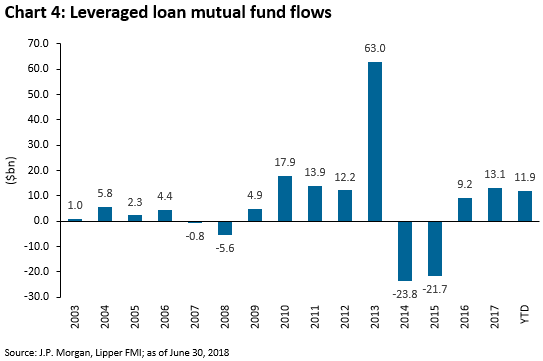

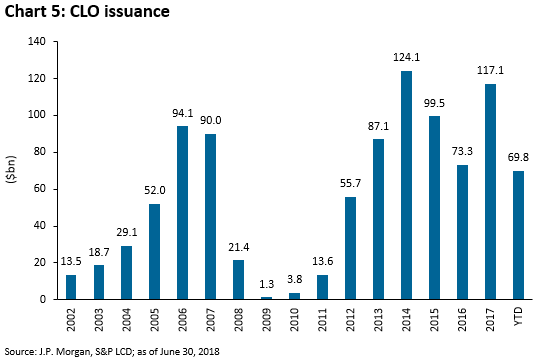

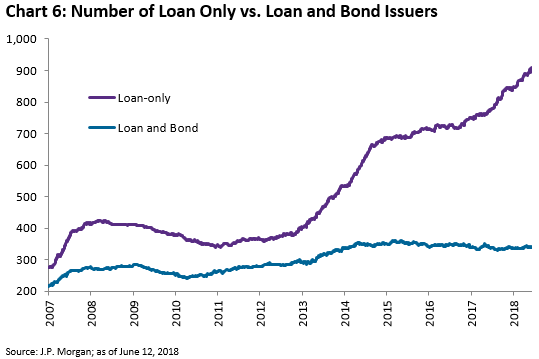

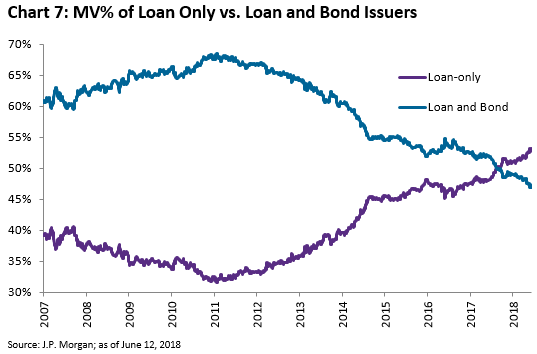

Since 2010, the loan market has grown from $500bn to more than $1tn today. The growth has come as a result of increasing supply from mid-cap leverage buyout (“LBO”) issuers and increasing demand from investors (Charts 3-5), primarily through collateralized loan obligations (CLOs) and to a lesser extent through retail funds. There has been a steady trend of LBO issuance in the term loan market, with loan-only structures now accounting for roughly 70% of the issuers in the market and 55% of the market value (Charts 6-7). In terms of ratings, single B rated loans have led the growth in recent years, with BB and split-rated BB/B loans declining from 60% of the market in 2006 to 44% today. Most loans are pre-payable at any time, typically without any premium after a 6 month soft call window at 101% of par value. This optionality is a major reason why issuers have preferred loan to bond financing – they can prepay a loan when it is advantageous to the issuer whether it be to re-price to a lower spread over LIBOR, a sale of the business or any other corporate activity. At the same time, the investor demand has grown driven by CLOs and retail demand.

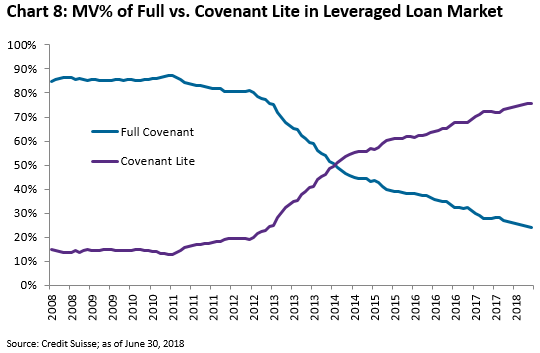

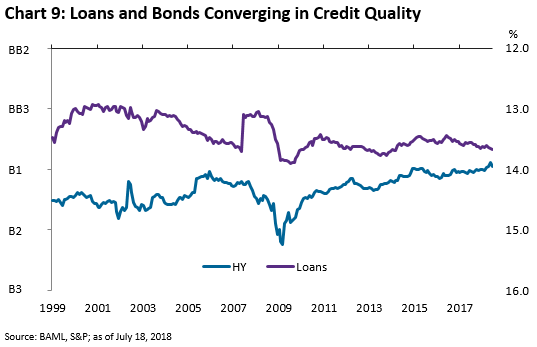

A concern that remains for loan investors is the loosening of loan covenants. A common question from loan investors centers around the growth in the issuance of covenant lite deals in the loan market, which has now reached 75%+ of the total Credit Suisse Leveraged Loan Index (Chart 8). A covenant lite loan is typically defined as a loan lacking covenants that require that the issuer maintain certain financial ratios related to maximum leverage, minimum interest coverage and total debt limits. It is important to note that the covenant lite universe tends to be of better quality than the full covenant universe, although the marginal advantage is eroding over time. Another cause for investor concern is the deterioration in other restrictive covenants, such as debt incurrence, permitted investments and restricted payment capacity as a result of increased LBO issuance. A weakening of these protections can dilute the claim and thus the recovery for a secured creditor in the event of a default. This growth of LBO issuance with weak covenant protections has resulted in the high yield bond and loan asset classes converging in credit quality (Chart 9).

While economic conditions generally look constructive for credit in the near term, we are concerned about increasing leverage in the lower tier of the loan market. The lower tier segment of the loan market is currently levered at 4.8x first-lien debt/EBITDA compared to 4.1x for the higher tier segment of the market. It is our sense that the lower tier segment leverage numbers are understated because this is where most of the new issuance to finance LBOs is taking place and these deals tend to be marketed on heavily adjusted pro forma EBITDA numbers, which is generally not the case for higher-rated public issuers. Furthermore, the lower tier segment has less junior debt cushion beneath the first lien loan to absorb credit losses in a default scenario as both segments are currently levered at 5.1x total debt/EBITDA. Finally, the lower tier segment of the market is where the preponderance of the LBO issuance with weak covenants is being issued. These trends require careful review and a selected approach to lower quality loans.

On the other hand, higher quality loans are benefitting from strong economic conditions with growing revenues and cash flows. In addition, higher quality loans have not experienced the same kind of increasing leverage and aggressive covenant structure seen in the LBO loans that are driving the growth of the lower tier segment of the loan market. We believe high quality loans will continue to deliver the low defaults and high recoveries that loans have delivered historically.

It is difficult for investors to predict when and how quickly rates will rise or when the next bear market will emerge, but the embedded benefits of higher quality leveraged loans may make a compelling case for a strategic allocation. The positive attributes of the asset class such as high current yields, low duration, credit protection, lower correlation to other fixed income investments, as well as lower volatility with higher Sharpe ratios can provide important benefits, particularly in a rising rate environment.