Taxable munis in 2020: Opportunity knocks

Margaret Byrne

Michelle Hallam

Municipal issuers are realizing savings by issuing taxable municipals to refund higher cost tax exempt debt. So what does that mean for the market? A spike in supply and more diversified issuance will be an opportunity to add high quality long duration at attractive spreads. We’ve already seen institutional investors taking advantage of the opportunity.

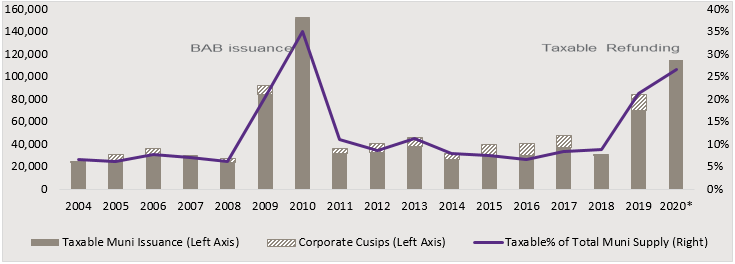

Of the $436bn of munis priced in 2019, $85bn was taxable. For 2020, we estimate that if rates remain stable, overall supply will again approach $435bn with over $100bn in taxable munis, almost a quarter of total supply. To put these numbers in perspective, prior to the uptick in supply last year, taxable muni supply from 2014 to 2018 averaged only $39bn.

Exhibit 1: Taxable issuance is expected to spike

Sources: Bond Buyer, Citi, JPMAM as of 01/15/2020

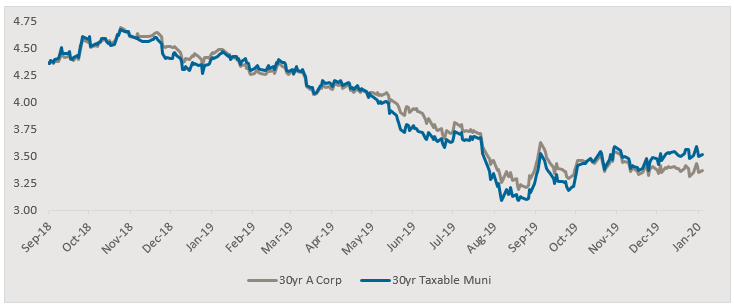

During the 2009 and 2010 Build America Bond (BAB) bubble, $85bn and $153bn respectively priced as part of the American Recovery and Reinvestment Act of 2009, which was created to reduce the cost of borrowing for new capital projects to spur economic growth. During that period, high quality taxable munis were priced cheaper than A-rated corporates due to a number of factors: 1) municipalities were under budgetary stress, 2) bond insurers were being downgraded by the rating agencies, and 3) many taxable investors were unfamiliar with muni credits. Since then, non-traditional municipal investors have gained familiarity with the market, which has kept spreads on A-rated munis vs. A- rated corporates from reaching the levels seen in 2009-2010, when that spread was almost 100bps.

Exhibit 2: Yields on Long Taxable A-rated Munis vs. Long A-rated Corporates

Source: BaML ICE and TM3 MMD as of 01/15/2020

Why The Surge

Municipalities lost an important tool used to lower interest cost on outstanding debt, the tax exempt advance refunding. Prior to the Tax Cuts and Jobs Act (TCJA), municipal issuers could advance refund higher cost debt by issuing a tax exempt refunding bond and use the proceeds to fund an escrow of government securities in an amount sufficient to pay the principal and interest on the outstanding debt.

Congress no longer permits muni advance refunding as it is considered double dipping because for a limited time, while both the refunding as well as the refunded bonds are outstanding, there are two sets of tax exempt bonds for any given project.

With interest rates at multi-decade lows, the refunding math again works for issuers – this time using taxable debt. The taxable advance refunding meets the requirement that only one tax exempt issuer per project is outstanding at any time.

So far, issuance has been fairly well received, but the uptick in supply has made valuations more attractive. In 2020, issuance should look less skewed toward healthcare and education because every municipality across the country, large and small, revenue and general obligation, lower rated and higher rated, may tap the market. This will create significant opportunities for managers who have expertise in the fragmented muni market – as both larger index-eligible and especially non-index eligible issues come to the market looking for buyers.

Continued low rates and significantly more taxable muni supply should create opportunities, especially for clients who want to take advantage of the high quality asset class to diversify portfolios heavily weighted in corporate credit.

More on the market

2019 saw a record breaking wave of demand for munis of nearly $100bn into funds that has surpassed the previous record flows during the recession when investors flocked to the safety and security of municipal bonds. Munis have become one of the last tax shelters. TCJA limited the deduction of income, property and in some states sales taxes to $10k. For many high net worth tax payers, that means the loss of significant deductions that run into the six figures

Taxable municipal deals are priced with both municipal as well as with corporate cusips. Issuing in the corporate market typically requires less rigorous disclosure and has a shorter time to market. The corporate market attracts a broader investor base given the typically larger issuance size, more recognizable credits, bulleted structure and make-whole calls. Issuance of taxable in the muni market can come with either make-whole calls or with optional ten year par calls, typical of most muni market issues.