Key risk scenarios for bond portfolios in 2018

01/02/2018

Prashant Sharma

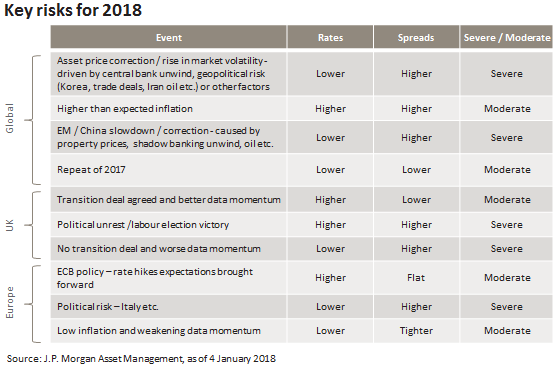

As Brexit talks continue amid a benign inflationary environment and tightening monetary policy globally, I have outlined below the key risk scenarios for bond portfolios in 2018.

GLOBAL RISKS

1. Asset price correction, market volatility (driven by central bank unwind), geopolitical risk

Central banks around the world are dialling down their accommodative policy mix and we are in the early stages of the end of one of the most extraordinary monetary policy experiments. The Federal Reserve and the European Central Bank have both started to unwind their bond purchase programmes and the Bank of Japan continues its stealth taper, while focusing on yield curve control. The approximate $1tn reduction in yearly G4 central bank purchases is a potential source of market volatility, especially as valuations of assets globally are stretched (e.g. corporate credit spreads are at or through their pre-financial crisis tights). Any flaring up of geopolitical risk could also cause a correction / risk-off environment in these stretched markets.

2. Higher than expected inflation

While global growth continues to be positive and synchronised (the strongest since the financial crisis), inflation remains stubbornly subdued. A number of global economies have or are about to reach full employment and have little, if any, spare capacity such as in the U.S. and Japan. While expectations are for inflation to start picking up steadily, a quicker than expected rise in inflation is definitely a key risk on the horizon. The question is around whether that might prompt central banks to increase their pace of monetary tightening and what impact would that have on asset prices that have been dependant on central bank support.

3. Slowdown in Emerging Markets and China, caused by property price weakness and the shadow banking sector

The outlook for China is optimistic, and it should be able to maintain 6.5%+ growth in 2018, supported by household consumption and ongoing industrial expansion. However, risks remain and our focus areas include the funding impact from the financial deleveraging directive, and the likely slowdown from the real estate sector. Any flaring up of these issues pose a severe risk to markets.

4. Repeat of 2017

Expectations are for economics and policy to look different in 2018 – a wind down of extremely accommodative policy and a pick-up in inflation. But what if that doesn’t happen and we get a repeat of 2017? Solid growth but without inflation picking up. Central banks continue to be broadly accommodative and we end 2018 with government bond yields at levels similar to or lower than current levels, and tighter spreads as risk assets continue to be supported.

UNITED KINGDOM RISKS

5. Transition deal agreed and better data momentum

It goes without saying that Brexit has been at the forefront of many investors’ and business’ minds. A transition deal that gives the market more visibility out to 2021 and better data momentum is definitely a risk for markets that are expecting continued political noise from Brexit and declining macro momentum as real wages continue to be squeezed.

6. Political unrest

Certainly another election in the UK at this point in the cycle would not only impact the bond, equity and currency markets, but could also have implications for the Brexit negotiations.

7. No transition deal and weakening economic data

If there were to be no transitional deal, and UK economic data weakened somewhat, it would be difficult to understand how Gilts will trade – traditional risk off reaction of lower yields or significantly higher yields as the market has concerns about the UK’s credit risk.

EUROPEAN RISKS

8. European Central Bank (ECB) policy – expectations of rate hikes brought forward

Growth across the Eurozone and economic fundamentals remain strong. The ECB has reduced the amount of bonds it purchases every month (down to €30bn from €60bn/month from the start of this year) and has also provided forward guidance on no rate hikes until 2019.

Most importantly, all eyes will be on the rhetoric of the European Central Bank at its meeting on 8 March, as continued macro strength may influence the market’s expectations on when the ECB will commence rate hikes. Stronger growth in the region may push the ECB to consider reducing asset purchases to zero, however, stubbornly low inflation in the region would be a reason for the bank to keep interest rates low. At this point, rates are not expected to increase in Europe until a period of time after QE has ended.

The market began to price in expectations of a potential rate hike from the ECB in the first few weeks of this year; however any further increase in rate hike expectations could cause volatility in markets.

9. Political risk – Italian elections

All eyes remain on the Italian elections, taking place 4 March. While market expectations of Italy exiting the Eurozone are low, the risk of an anti-euro election result is still possible, but not the most likely scenario given the recent polling data. If a populist party were to win the election, there is likely to be volatility in the markets with uncertainty around the expectations for reform and the future of fiscal policy.

10. Low inflation and weakening data momentum

A slowing of the strong data momentum along with inflation remaining low is not expected by the market.