Key macro risks for bond portfolios in 2020

21/02/2020

Merveille Paja

Markets will always be vulnerable to the “unknown unknowns,” the risks we don’t know we are unaware of. There are also the “known unknowns”—risks to which we can apply judgement and analysis in assessing the likelihood of particular outcomes and their ramifications. Last year, the main macro concerns for fixed income markets were intensifying trade wars, a hard Brexit, and an EU economic growth slowdown, some of which materialized. Below is an outline of some of the known unknowns we believe fixed income investors should be focusing on this year.

Slowdown in emerging markets and China: Coronavirus and trade war

Although concerns around emerging markets were related to the escalation of trade wars last year, the coronavirus is now at the forefront of investors’ minds. Its impact on China’s growth through 2020 could be significant. Some analysts are forecasting zero or even negative growth for the first quarter and the timing and speed of a growth rebound in subsequent quarters remains uncertain. Data availability adds to the uncertainty around the scale of the issues and therefore the inability to evaluate the virus’s repercussions. The risk of a trade war reescalation should also not be ignored, despite this year’s U.S. presidential election and the implementation of the so-called “Phase 1” trade deal.

Global recession

The impact of China’s slowdown on the global economy will likely be larger than that of the SARS epidemic of 2003, given China’s growing share of global GDP (currently about 20%, based on purchasing power parity[1]. Globally, the world is still in a slow growth, low inflation environment and the green shoots of growth seen toward the end of 2019 remain fragile and survey-based. Any reescalation of trade tensions between the U.S. and China or the U.S. and Europe could push global growth toward a sharp slowdown. If such risks were to materialize, major central banks would have little ammunition to ease—particularly the ECB, which has already pushed rates into deep negative territory.

Higher-than-expected inflation

While global growth continues to be slow, we see signs of inflation picking up in some emerging markets. We have seen an increase in inflation in China, India and Poland, mainly driven by an increase in food prices. Market participants don’t consider developed market inflation to be a material risk partly due to other items, such as global recession, growth slow down etc., and given historically low breakeven inflation (The EU five-year breakeven inflation rate is currently at 1.21%, a historical low). However any increase could easily surprise the market and make an inflation shock a reality.

U.S. presidential elections: Market-unfriendly results?

One of the biggest risks that could catalyze a correction would be if a corporate-unfriendly candidate gains momentum. We will be watching the results of Super Tuesday on March 3. So far, after the Iowa caucus and New Hampshire primary, Democratic presidential hopefuls Bernie Sanders and Pete Buttigieg are pretty close. We expect a risk-on scenario if the most market friendly candidate wins while we expect a risk-off scenario in the event that a non-market friendly candidate wins.

Hard Brexit

Despite the UK’s departure from the EU at the end of January 2020, there is still no certainty on a transition deal that would give the market more visibility out to 2021. It is difficult to forecast how Gilts would trade in the event that no UK-EU transitional trade deals were reached and if UK economic data weakened. Would there be a traditional risk off reaction, with lower yields in the short term—or would concerns about UK credit risks drive yields significantly higher for the medium term?

Political unrest

It is reasonable to assume that political risk will be a market issue again this year. Instability in Iran and the Middle East remains a risk as do North Korea’s potential nuclear capabilities. Social unrest in Latin America, particularly in Chile and Ecuador, remains a tail risk that could put pressure on oil prices and the bond market. Political rebellion and social unrest can also be seen in political upheaval in the Catalonia region of Spain and more recently in Hong Kong.

Significant fiscal policy

Momentum is toward more fiscal easing globally; over time this could drive yields higher, given greater bond supply and support for growth. We expect to see moderate fiscal easing in the eurozone, especially in Germany, with increased investment in the green sector. We could also see more fiscal spending in other areas of the EU, though it is currently uncoordinated and tentative. In the U.S., if the next president wins on a strong mandate with a majority in both houses of Congress, we could see another fiscal package implemented in 2021 that would likely give a boost to the U.S. economy. We also anticipate stronger fiscal support for growth in China, especially in the form of medical investment to contain the coronavirus epidemic.

EU political risk

Following the UK’s exit from the EU, the risk is that any other EU country could decide to take the same path; that raises the question of the likelihood of a potential eurozone breakup. In addition, market participants should closely monitor the risk that spreads on bonds of countries on Europe’s periphery could widen.

Climate risk

How to understand and measure climate risks on fixed income portfolios is evolving, but risks can be split broadly into physical and transition risks—meaning impacts on companies’ assets from adverse climate events—and risks from policy and consumer responses to climate change. For investors, factoring climate risks into fundamental credit analysis of various industrial sectors is critical. In 2020, it will be important to monitor closely any sectoral impacts from the European Green Deal set out in December 2019 and the subsequent European Climate Law expected to be passed in March.

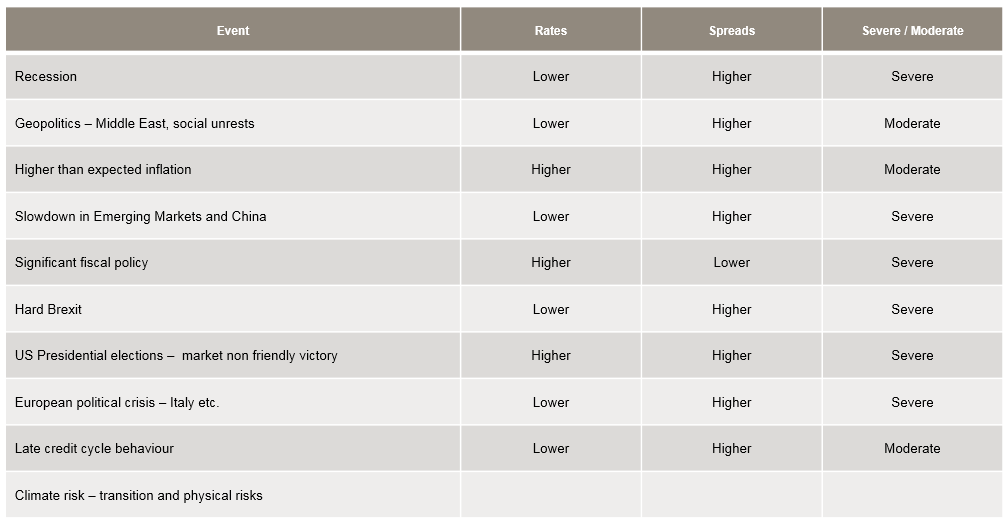

In evolving markets, it is important that client portfolios are stress-tested for a variety of outcomes and scenarios. We’ve highlighted some of the “known unknowns” that we are focusing on. There will be many views about their likelihood and impact. The table below shows our view of possible market reactions.

What is likely to be more challenging are the unknown unknowns. Should they come, we will be vigilant and ready to respond.

[1]https://www.imf.org/external/datamapper/PPPSH@WEO/OEMDC/ADVEC/WEOWORLD/CHN