IOER – does the latest fed move have any practical implications for cash investors?

12/07/2018

John Tobin

Aidan Shevlin

The Federal Reserve’s (Fed) interest on excess reserves (IOER) shot to prominence last month following an unprecedented adjustment by the central bank. What was the rationale for the change and what, if any, are the implications for markets and investors?

The evolution of Fed monetary policy

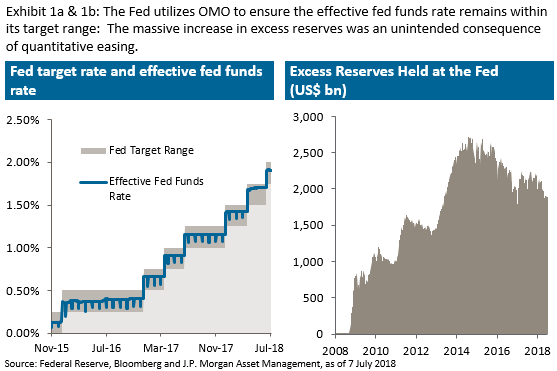

Depositary institutions hold required and excess reserves on deposit at the Fed. They are allowed to borrow and lend their excess reserves to ensure they meet their required reserve obligations. The effective fed funds rate (EFFR) is the volume-weighted, daily traded rate of all this activity (Exhibit 1a). It is actually a market driven rate, but influenced by the Fed to ensure it remains close to the fed funds target rate (FFTR).

Historically the Fed regulated interest rates by controlling the money supply via its open market operations (OMO) – either selling treasuries to drain market liquidity and pushed interest rates up, or buying treasuries to inject market liquidity and pushed interest rates down. However, during the global financial crisis, the Fed’s quantitative easing program injected a massive amount of liquidity into the banking system, effectively removing the structural short in fed funds and boosting excess reserves (Exhibit 1b). The need for banks to trade fed funds declined sharply and the effectiveness of OMO was significantly reduced.

In response to substantially lower fed fund trading activity, the Fed introduced two new monetary policy tools, interest on excess reserves (IOER) and the overnight reverse repo program (ON-RRP); the former acting as a ceiling – banks will not invest elsewhere at a lower rate, while the latter acts as a floor – banks must pay at least this rate to attract deposits. Since the Fed began raising rates in December 2015, it has increased its target rate, IOER and RRP in tandem and by the same amounts.

The Fed’s interest rate challenge:

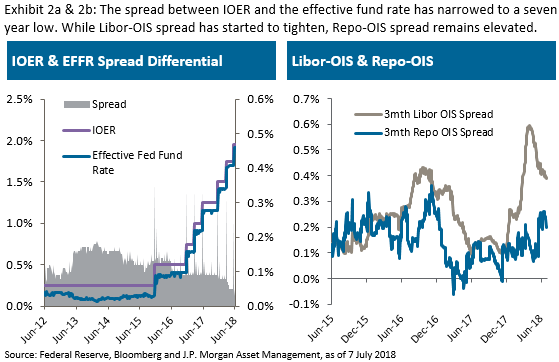

Recently the Fed’s monetary policy model has shown signs of stress as the EFFR moved towards the top of the Fed’s target trading range and the EFFR/IOER spread narrowed to post-global financial crisis lows (Exhibit 2a). During his latest testimony, Chairman Powell expressed uncertainty about the reasons for the EFFR movement; exacerbating market concerns about rising funding costs, tighter liquidity conditions (Exhibit 2b) and the impact of the Fed’s balance sheet reduction.

Nevertheless, to ensure that EFFR continues to trade within its target range, the Fed took the creative and expedient step of raising the IOER by 20bps while raising other rates by the customary 25bps at the Fed open market committee meeting in June. This unusual adjustment provides a strong signal of the Fed’s intention to prevent the EFFR breaching the IOER ceiling.

IOER – much ado about nothing?

In reality, EFFR breaching IOER or the Fed target range should have no major technical or operational implications; however, many market participants would view such an event negatively and question the Fed’s ability to control a historically important benchmark rate.

For now, it appears that the Fed’s “technical” IOER adjustment has achieved its goal of moving the EFFR back towards the mid-point of the target range. However, the continued challenges of increased Treasury bill issuance, tax repatriation and the Fed’s balance sheet reduction suggests the problem may re-emerge, and with the Fed’s credibility on the line, it is now important for investors to monitor EFFR movements. Any further erratic deviations will trigger additional Fed actions – which could range from another adjustment of the IOER to something potentially more drastic, such as an early end to the Fed’s balance sheet reduction program (which would have major market implications).

For US$ cash investors, a hawkish Fed and tighter funding are significant positives, pushing interest rates higher and boosting returns on cash investments. With real rates (Fed Funds Target Rate – Core CPI) approaching their highest level in almost a decade and commercial paper offering significant yield pickup over treasuries, cash investments have re-emerged as an important asset allocation choice.