Some of you may be familiar with the children’s book titled “If You Give a Mouse a Cookie”, written by Laura Numeroff. For those of you that haven’t read it, it reads something like this; if you give a mouse a cookie, he will probably ask for a glass of milk. Once you give him a glass of milk, he will ask for a straw. Once you give him a straw, he will ask for a napkin. And by then, he probably wants another cookie!

The Federal Reserve (Fed) surprised the market on Tuesday, March 3rd by cutting rates by 50 basis points (bps) to a target range of 1.00% – 1.25%. In doing so, Chair Jerome Powell lit a fire under investors all over the world yearning for easy monetary policy.

While the Fed’s action occurred following an emergency G-7 call regarding threats to the global economy associated with the coronavirus disease, once the immediate shock of the action passed, the focus turned towards questions such as: Will the Fed would cut rates again? How soon before they get back to zero? Why didn’t other major central banks join in? Will other senior monetary policy makers follow suit?

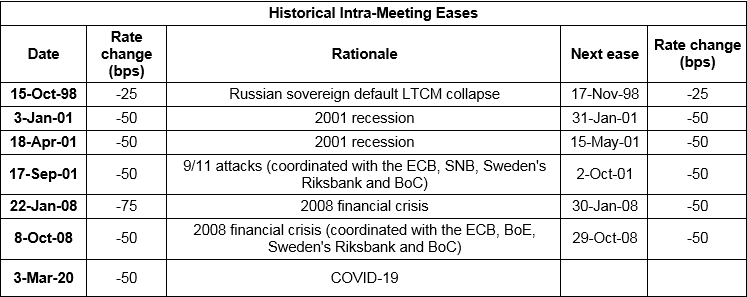

The Fed’s next scheduled Federal Open Market Committee meeting is March 18th. Prior to the surprise cut, the futures market was already expecting a 50 bps reduction at the upcoming meeting. Despite the Fed delivering the expected (just two weeks early), the market is now pricing in another 25 bps cut in just another 2 weeks’ time. At that point, the Fed funds range would be 0.75% – 1% – dangerously close to the zero-lower bound. The market is not off base to expect additional policy action. Historically, when the Fed has acted intra-meeting, they’ve continued cutting rates aggressively within the next month.

The Fed’s emergency cut significantly increased the odds of returning to the zero-lower bound in 2020. We have yet to see the economic data deteriorate in the U.S. When the data does ultimately weaken, the markets will force the Fed to continue to ease rates despite their attempt this week to cut proactively.

Using the analogy of the cookie story, when the Fed gives the market a rate cut, they ask for another rate cut. When the rates cuts are exhausted, they ask for Quantitative Easing (QE), where the central banks purchase large-scale government assets to help ignite the economy. Once QE has restarted, they look for negative interest rates!