How green are green bonds?

30/10/2020

Stephanie Dontas

Liam Moore

Why are we shining a light on green, social and sustainable bonds?

Green, social and sustainable bonds have proliferated this year, and the composition is broadening globally. Historically, such issuance has been skewed towards European corporates, but the recent trend has spread across the pond. In 2020, environmental, social and governance (ESG) related issuance in Europe and the US is comparable at EUR 47.5 billion and USD 41.3 billion, respectively[1]. This increase doesn’t just apply to developed markets either: sustainable bonds are increasingly coming to the emerging markets, spanning sovereigns and corporates. This week, we will focus on developed market investment grade (IG) credit.

Who is issuing these bonds?

A wide variety of companies have come to the market recently, led by utilities, banks, REITs, and technology. This confirms that companies are acknowledging the growing interest in sustainable investing and the trend is not confined to companies facing sustainability pressures. Some companies, particularly utilities, have gone further, stating that they are unlikely to ever issue another “non-green” bond since all of their financing will be linked to sustainable programs. Our European utility analyst, Rob Emes, recently highlighted that Enel’s (ENELIM) management team stated that all future issuance will be linked to Sustainable Development Goal (SDG) targets. We think this is not just a significant step forward for the company, but it could be a sign of what’s to come for other companies that have clearly aligned ESG and profitability goals.

What are the bonds being used for?

Companies have cited a host of reasons for issuing an ESG-related bond. For example, a utility could be financing a transition away from coal-fired power generation, towards renewables. A bank could use the proceeds to help fund construction, rehabilitation, and/or preservation of affordable housing for low-income populations. An auto company could issue a green bond to build, research and develop electric vehicles. The list goes on.

Who is buying them?

A lot of the evidence we have on this subject is still anecdotal. But we can say there is consistent and clear demand for ESG-linked new issue bonds, and at least a part of that demand has to be driven by their green or sustainable nature. The amount of ESG-linked AUM is also growing globally, which could offer more support for ESG-linked bonds going forward. A recent piece by JPMorgan showed that assets in ESG funds had grown to USD 565 billion globally by the end of September, which is an all-time high and a 43% increase year-to-date. We are also seeing more incentives for companies to come to market with ESG-linked bonds. For example, the ECB recently announced that environmental sustainably linked bonds would be eligible for its purchasing program going forward, which we feel could increase the potential for additional issuance in the space.

What happens if the sustainability part doesn’t work?

Some companies embed sustainability into bond covenants. For instance, Enel (ENELIM) has pledged a ‘coupon step’ program linked explicitly to their sustainability targets. With the latest new GBP 7-year SDG-linked bond, the coupon is linked to achieving a specific proportion of “Renewables Installed Capacity” at or above 60% by the end of 2022, with a +25 basis points (bps) coupon step if the target is not achieved by that date. Most utility companies are writing in similar language based on transition goals, and this provides clear accountability in the event of sustainability shortfalls. We feel that utilities are among the most reputable ESG-linked bond issuers, because ESG initiatives tend to clearly align with the overall objectives of the sector.

Are these bonds good value?

Active investors need to evaluate each bond on its own merit. To us, that means assessing the fundamentals, technicals and quantitative valuations. Many sustainable bonds tick the fundamental (e.g. appealing use of proceeds) and technical (e.g. market demand) boxes, but fall short on valuations. It is reasonable to expect a green or sustainable bond to yield slightly less than its “non-green” counterpart. But the challenge with index spreads being so tight, is that “slightly less” is a significant premium. With less room to compress, every basis point counts. We have observed a skew towards sustainable issuance from higher-quality names that already trade at the tighter end of their spread range.

Below are two examples of recently issued green bonds – one that we believe looks unattractive on a valuations basis while the other looks more appealing.

- Telecoms company A. This company came to the USD new issue market with a 10-year green bond in September 2020. The deal was announced with initial price thoughts of 110 bps and secondary bonds were trading around 90-95bps at the time. For context, it had priced a non-green 10-year bond in March, during the height of COVID-19 volatility, at 225 bps. The September green deal priced at 83 bps: not only below its existing bond with a similar maturity, but importantly, offering limited upside given outright spread levels.

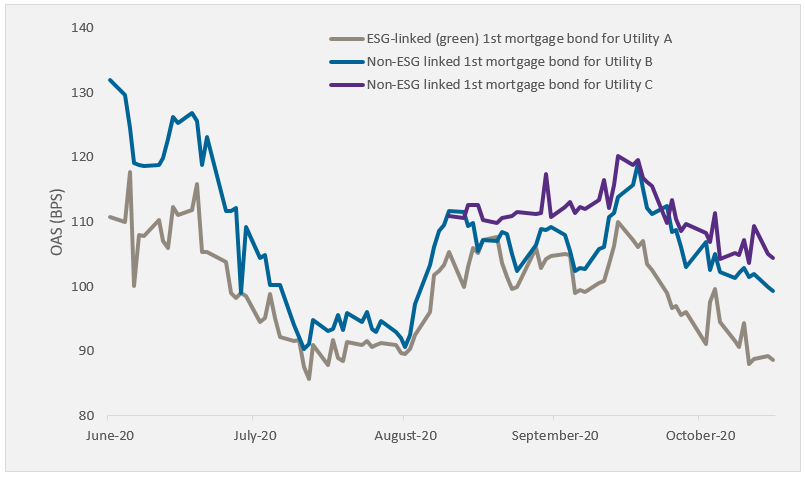

- Utility company B. We believe this utility has a solid fundamental outlook. It came to market in June 2020 with a green bond priced at 105 bps. The company tends to score very positively from an ESG perspective due to their commitment to transition towards renewables. In the most recent market rally, the 30 year bond (1st mortgage green bond deal) outperformed similar quality non-green 1st mortgage bonds of peers (Utility companies B and C).

Source: Bloomberg as of October 27, 2020

In this low-yielding environment, we need to be more discerning than ever when it comes to valuations. ESG-linked bonds can present opportunities for outperformance depending on the bond, but investors need to consider whether they really offer value before investing.

What are the next steps in the evolution of IG green bond issuance and what are the current risks?

As mentioned previously, ESG-linked bond issuance is still a relatively new dynamic in the IG market, and as green and sustainable bond issuance becomes a growing percentage of overall supply, we believe that should come with more oversight. As an example, utilities that have issued ESG-linked bonds have tended to cite specific ESG-related goals over a certain timeframe, with “penalties” to the issuer in the form of coupon steps if these goals aren’t reached. But, ESG-linked bonds issued out of other sectors have language tied to direct use of proceeds or specific goals, without much of a “check and balance” to ensure goals are being met. We believe that the next stage of development for ESG-linked bonds will be more independent oversight, similar to that of a rating agency, to ensure companies are held accountable.

The bottom line: are sustainable bonds going to outperform?

March’s volatility prompted widespread reporting that explicitly sustainable mutual funds had performed better over the short-term than their “traditional” counterparts, offering some reduced volatility. Given the nascent stage of the sustainable bond market, it remains to be seen whether such bonds individually offer significant volatility reduction in a risk off market. What seems clear is the trend toward further future sustainable issuance, whether spurred on by central bank policies or broader demand trends. The increasing focus on ESG and the prospect of additional regulation could mean that demand for sustainable bonds remains robust. As active investors, we need to look beyond the jargon, understand the use of proceeds and determine whether there is real value in these deals.

Investing on the basis of sustainability/ESG criteria involves qualitative and subjective analysis. There is no guarantee that the determinations made by the adviser will align with the beliefs or values of a particular investor. Companies identified by an ESG policy may not operate as expected, and adhering to an ESG policy may result in missed opportunities.

[1] Goldman Sachs Research