Over the last couple of months, we have received a lot of criticism for our economic forecast. In attempting to model what a recovery could look like following the pandemic, we were estimating that it would take about 10 years to close the output gap and return to something approximating full employment.

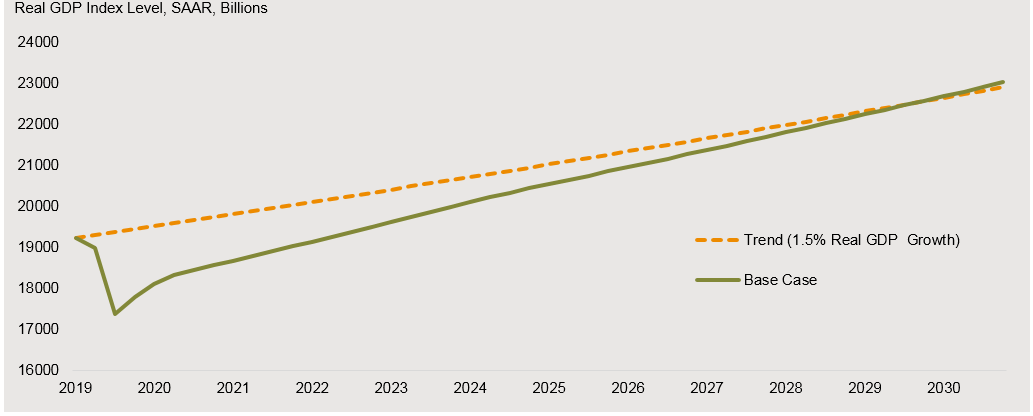

Real GDP GFICC Base Case Forecast verus Trend Growth starting Q4 2019

Source: J.P. Morgan Asset Management, BEA and Bloomberg as of 6/1/2020

Of course, the push back centered on the overwhelming fiscal and monetary policy response which has been a multiple of what was experienced during the Great Financial Crisis (GFC)…and deployed in weeks as opposed to years. It is true that if GDP is modeled on an annualized quarterly basis, the recovery will look like a ‘V’ with the bottom being put in 2020 Q2. This is what we saw during the GFC. But if GDP is modeled versus its long term potential, it will take about 10 years to return to that trend line. Hence, our view of a check mark shape recovery…..again, similar to what we saw after 2008 when it took about 8 ½ years to return to the economy’s long term potential.

This week, the Congressional Budget Office released a letter to Democratic Leader Charles Schumer effectively confirming our original analysis. https://www.cbo.gov/system/files/2020-06/56376-GDP.pdf

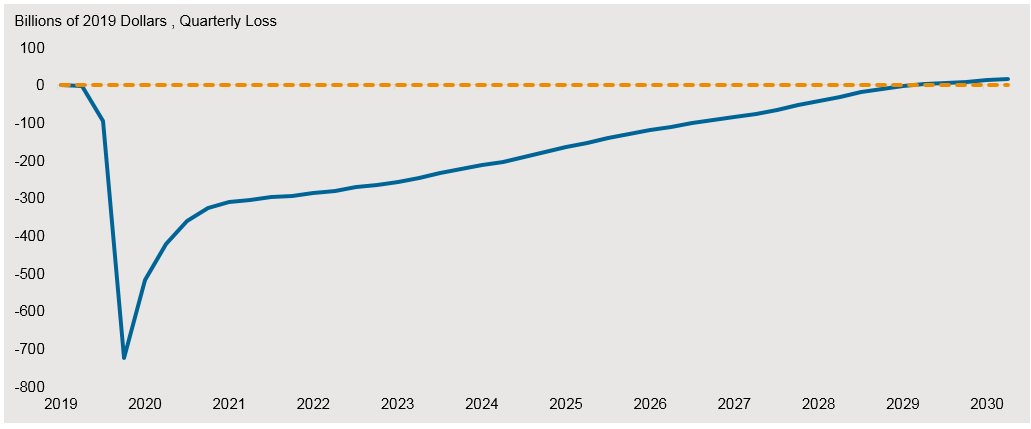

In a normal year, the CBO forecasts economic variables going out 10 years bi-annually. Following the coronavirus, their January 2020 forecast looked woefully out of date. In May, they took their first stab at projecting the new economic reality out to 2021 warning that unemployment could still be double digits for much of that time. Now, with some more time to gather information, the CBO is looking out to 2030 and has formally revised its growth estimates lower for every year until 2029. We should note that their original forecasts were already more rosy than ours (and they also use a higher trend growth rate) but this at least implies the output gap won’t be closed till at the earliest 2027 according to their new estimates.

Difference in Real Gross Domestic Product Between CBO’s May 2020 and January 2020 Projections

Source: CBO as of 6/1/2020

The importance of both our analyses is to highlight that the road to recovery will be long and challenging. Inflation will remain low and unemployment will be unacceptably high. This is an unfolding reality that policy makers (public and private) must accept and begin to deal with.

Like everyone, I am very disturbed by the events of the last week. I have worried for months that on June 5th, we might see an unemployment rate in the US print at over 20% just as the equity markets are rising back toward their highs. The pandemic is disproportionately taking a toll on our underserved and minority communities while the aggregate policy response seems to be inflating asset prices once again. Growing frustration was bound to erupt and the horrible death of George Floyd became the unfortunate catalyst. Like some others, I am worried - but hopeful - that there can be a path to recovery which is promising for all.

I do not blame the Federal Reserve or the other central banks for their policy response. They have done what was needed to help underwrite the amount of debt needed to fund a recovery. Trillions upon trillions upon trillions. What all policy makers should take away from the GFC is that austerity – a concentrated focus on deleveraging and paying down debt – is the wrong policy response for the foreseeable future. And by all policy makers, I mean central bankers, politicians and corporate CEOs. At a time when unemployment is high, policy makers should be looking for longer term solutions and investments.

Perhaps an infrastructure spend of $1T in the US spread out over 3-5 years instead of the 10 years mooted a few years ago would be a good use of public funds? It would create jobs, provide genuine stimulus in contrast to what we believe is currently aid and assistance, and encourage more durable consumption. And surely, the pandemic has highlighted deficiencies in our healthcare system which could be addressed at both the Federal and local levels of government. And this time, corporate CEOs need to be incented to invest in capex rather than to deleverage and then buy back stock or raise dividends. Certainly corporate investment and spending could be undertaken to catch up to the work-from-home/stay-at-home movement. I am sure that everyone has very good ideas of their own which could be added to this list.

I realize that all of this will exacerbate the debt burden. But the central banks are helping to make the cost affordable and the potential benefits are appealing. History has taught us that every crisis will present opportunities. Let’s hope this time the opportunity is broadly diverse and inclusive.