A Road to Recovery

24/07/2020

Jason Davis

In response to Europe’s biggest growth shock in a generation, the European Union (EU) council agreed on the outline of the “Recovery Fund”[1] to help cushion the EU’s economic fallout from the coronavirus pandemic.

After four days of negotiations, marking the second longest European Union (EU) summit to date, the EU Council finally agreed on the outline of the Recovery Fund. The Recovery Fund itself is EUR 750 billion which equates to 5.5% of 2019 EU GDP. Grants have been reduced from the initial proposal of EUR 500 billion to EUR 390 billion, however, this was mostly at the pan-European level, while grants within the core Recovery & Resilience Fund were actually increased. At the same time, loans have been increased from EUR 250 billion to EUR 360 billion and will only go to sovereigns where it would actually reduce funding costs.

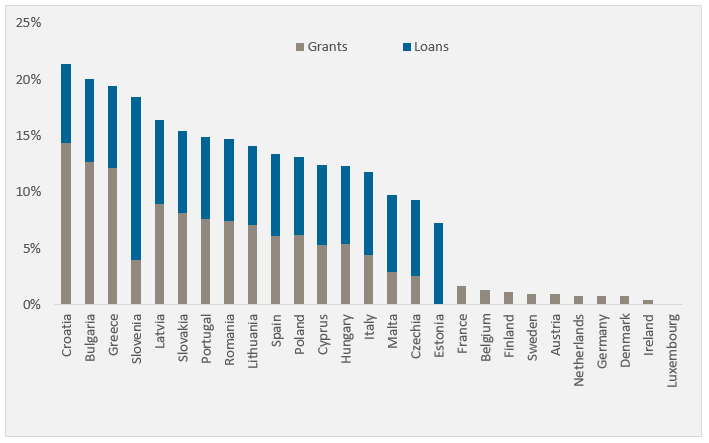

The main beneficiaries are therefore peripheral and Eastern Europe. In fact, over four years, we can expect Italy to receive up to 12% of GDP in loans and grants, greatly helping reduce the funding needs resulting from the pandemic.

Percent of GDP over four years

Source: ECB, Bloomberg, JPMAM as of July 2020

This episode is particularly impressive. Although a fiscal union is a long way off, the combination of joint issuance, joint taxation and net transfers from the stronger to weaker sovereigns is a powerful response, and certainly a step in that direction.

Political risks will remain in the Eurozone and may flare up again as countries haggle over their recovery plans or argue over when to re-impose some form of fiscal prudence. That said, at the very least, this agreement removes the tail risks of a Eurozone break up and should make Euro assets structurally more attractive. If the Eurozone can find a way through the COVID-recession, then surely it can handle anything thrown its way. The Eurozone has gone from being as vulnerable as its weakest member, towards becoming as strong as its aggregate balance sheet.

Of course there were some concessions to get a deal over the line. Importantly, rebates were increased to keep the frugal Northern European countries happy. Over 7 years, these sum to approximately EUR 54 billion. This reduces the net transfers within the Eurozone, but not by much:

Percent of GDP (grants minus GDP weight)

Source: ECB, Bloomberg, JPMAM as of July 2020

Combined with an ECB that is buying EUR 1.2 trillion of bonds this year alone, the first implication for portfolios is that Eurozone spread risk has a very powerful backstop. We remain structurally positive periphery in portfolios with room to add further on any cheapening as the supply returns after the summer.

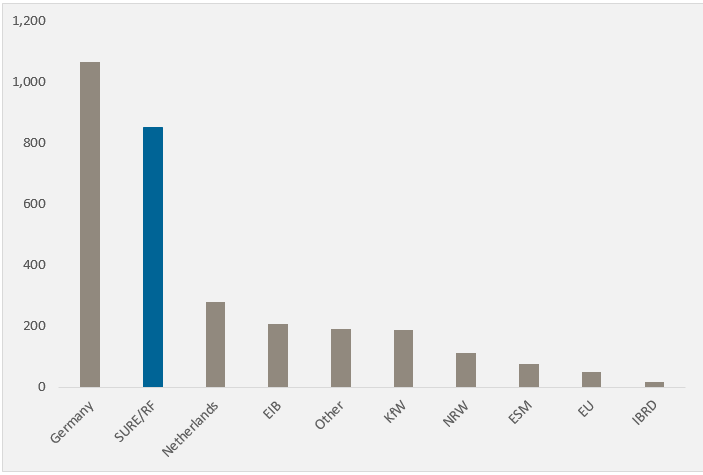

The second implication is that a lot of supply will be coming to the market in the next few years. The EU needs to issue EUR 850 billion, which represents 40% of the current AAA stock of bonds outstanding. All else equal, this should lead to an underperformance of European core duration relative to higher yielding countries with steeper curves.

AAA Debt Outstanding (nominal, fixed)

Source: ECB, Bloomberg, JPMAM as of July 2020

Despite some watering down of the plan, the details are still very positive and represent a big moment for EU solidarity. There have been ample opportunities over the past two decades for the Eurozone project to fail, and each time, Europe’s leaders have found a way to end the impasse.

[1] Note the EU has not passed the Recovery Fund but agreed on the fund in principle. It still needs to be passed by all parliaments.